Telus 2009 Annual Report Download - page 23

Download and view the complete annual report

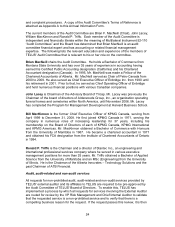

Please find page 23 of the 2009 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.any issuer which, while that person was acting in that capacity, or within a year of that

person ceasing to act in that capacity, became bankrupt or made a proposal under any

legislation relating to bankruptcy or insolvency or was subject to or instituted any

proceedings, arrangement or compromise with creditors or had a receiver, receiver manager

or trustee appointed to hold its assets. In March 2006, John Lacey was appointed to the

board of directors of Stelco Inc. (Stelco) as a nominee of Tricap Management Limited

(Tricap). Stelco had filed for bankruptcy protection under the CCAA in January 2004. Mr.

Lacey’s appointment as a director was part of a court supervised restructuring, from which

Stelco emerged on March 31, 2006 and pursuant to which Tricap had the right to appoint

four of Stelco’s nine directors. Charles Baillie was formerly a director of Dana Corporation,

which filed for bankruptcy in March 2006 under Chapter 11 of the U.S. Bankruptcy Code.

He ceased to be director when the company emerged from bankruptcy on February 1, 2008.

Robert G. McFarlane was a director of Ascalade Communications Inc. (Ascalade) until his

resignation in February 2008. In March 2008, Ascalade filed for bankruptcy protection under

the CCAA.

Other than as disclosed, for the 10 years ended March 10, 2010, TELUS is not aware

that any current director or executive officer of TELUS had been a director, chief

executive officer or chief financial officer of any issuer which was the subject of a cease

trade or similar order while that person was acting in that capacity, or was subject to

such an order issued after the director or executive officer ceased to be a director, chief

executive officer or chief financial officer and resulted from an event that occurred while

that person was acting in that capacity, or any order which denied such company access

to any exemption under securities legislation for a period of more than 30 consecutive

days. On June 14, 2006, and at the request of Cognos Incorporated (Cognos), the

Ontario Securities Commission (OSC) issued a cease trade order against all directors of

Cognos, including Pierre Ducros, in connection with a delay in filing its annual report with

Canadian regulators. The delay was related to a review by the United States Securities

and Exchange Commission (SEC) of the way Cognos allocated revenue between post-

contract customer support and licence fees. The OSC lifted the cease trade order on

August 3, 2006 after the SEC concluded that it did not object to Cognos’ revenue

recognition policy. Mr. Ducros ceased to be a director of Cognos in February 2008 after

its acquisition by IBM.

INTERESTS OF EXPERTS

Deloitte & Touche LLP, Chartered Accountants, are the auditors of the Company and

are independent within the meaning of the Rules of Professional Conduct of the Institute

of Chartered Accountants of British Columbia.

AUDIT COMMITTEE

The Audit Committee of the Company supports the Board in fulfilling its oversight

responsibilities regarding the integrity of the Company’s accounting and financial

reporting, internal controls and disclosure controls, legal and regulatory compliance,

ethics policy and timeliness of filings with regulatory authorities, the independence and

performance of the Company’s external and internal auditors, the management of the

Company’s risk, credit worthiness, treasury plans and financial policy and whistleblower

23