Suzuki 2001 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2001 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(f)Leases

Finance lease transactions, except for those which meet the conditions that the ownership of the lease

assets is substantially transferred to the lessee, are accounted for on a basis similar to ordinary rental

transactions.

(g)Income taxes

The provision for income taxes is computed based on the pretax income included in consolidated

statements of income. The assets and liability approach is adopted to recognize deferred tax assets and

liabilities for the expected future tax consequences of temporary differences between the carrying amounts

and the tax bases of assets and liabilities.

(h)Reserve for retirement allowance

Effective from the year ended March 31, 2001, the Company and its subsidiaries adopted the new Japanese

accounting standard for retirement benefits, which is effective for periods beginning on or after April 1, 2000.

In accordance with the new standard, the reserve for retirement benefits as of March 31, 2001 represents the

estimated present value of projected benefit obligations in excess of the fair value of the plan assets except

that, as permitted under the new standard, the unrecognized transition amount arising from adopting the new

standard of 53,896 million yen at April 1, 2000 (the beginning of year) is amortized on a straight-line basis

over 5 years, and unrecognized actuarial differences are amortized on a straight-line basis over the

employees' average remaining service years from the next year in which they arise. As a result of the

application of the new accounting standard, when compared with the case where a previous standard was

applied, retirement benefits expenses was increased by 11,704 million Yen, ordinary income was decreased

by 911 million Yen, and income before income taxes was decreased by 11,691 million Yen.

(i)Revenue recognition

Sales of products are generally recognized in the accounts as delivery is made.

(j)Amounts per share

Primary net income per share is computed based on the weighted average number of shares issued during

the respective years.

Fully diluted net income per share is computed assuming that all convertible bonds at the beginning of the

year were converted into common stock, with an applicable adjustment for related interest expense and net of

tax.

Cash dividends per share are the amounts applicable to the respective periods including dividends to be

paid after the end of the period.

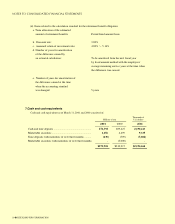

(k)Cash and cash equivalents

All highly liquid investments with original maturities of three months or less when purchased are

considered cash and cash equivalents.

(l)Reclassification

Certain reclassifications of previously reported amounts have been made to conform with current

classifications.

24 ●SUZUKI MOTOR CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

*ANNUAL REPORT2001/14のコピー 2