Suzuki 2001 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2001 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

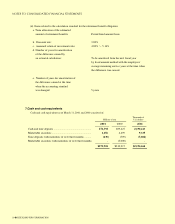

≠Hedge accounting

Gains or losses arising from changes in fair value of the derivatives designated as "hedging instruments"

are deferred as an asset or liability and included in net profit or loss in the same period during which the

gains and losses on the hedged items or transactions are recognized.

The derivatives designated as hedging instruments by the Company are principally interest swaps and

forward exchange contracts. The related hedged items are trade accounts receivable and investments in

securities.

The Company has a policy to utilize the above hedging instruments in order to reduce the Company's

exposure to the risk of interest rate and foreign exchange fluctuation. Thus, the Company's purchases of

the hedging instruments are limited to, at maximum, the amounts of the hedged items. The Company

evaluates effectiveness of its hedging activities by reference to the accumulated gains or losses on the

hedging instruments and the related hedged items from the commencement of the hedges.

(c)Foreign currency translation

Effective from the year ended March 31, 2001, the Company and its subsidiaries adopted the new Japanese

accounting standard for foreign currency translation, which is effective for periods beginning on or after

April 1, 2000. Under the new standard, all monetary assets and liabilities denominated in foreign currencies,

whether long-term or short-term are translated into Japanese yen at the exchange rates prevailing at the

balance sheet date. Resulting gains and losses are included in net profit or loss for the period. The adoption

of the new method had no material impact on the accompanying consolidated financial statements.

Under this standard, assets and liabilities of the foreign subsidiaries and affiliates are translated into

Japanese yen at the exchange rates prevailing at the balance sheet date. The shareholders' equity at beginning

of the year is translated into Japanese yen at the historical rates. Profit and loss accounts for the year are

translated into Japanese yen using the average exchange rate during the year or, alternatively, using the

exchange rates prevailing at the balance sheet date. Differences in yen amounts arising from the use of

different rates are presented as "foreign currency translation adjustments" in the shareholders' equity.

The effect of adopting the new accounting standard on the accompanying consolidated

financial statements was immaterial.

(d)Inventories

Inventories are stated at the lower of cost or market value, cost being determined principally by the

periodic average method.

(e)Property, plant and equipment

Property, plant and equipment are stated at cost. Depreciation is principally computed by the declining-

balance method based on estimated useful lives of the assets.

Provision for additional depreciation is made to reflect use of machinery and equipment in excess of

normal production schedules, a substantial portion of which is, however, not tax deductible.

Maintenance and repairs, including minor renewals and improvements, are charged to income as incurred.

SUZUKI MOTOR CORPORATION● 23

*ANNUAL REPORT2001/14のコピー 2