Suzuki 2000 Annual Report Download - page 24

Download and view the complete annual report

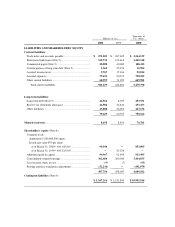

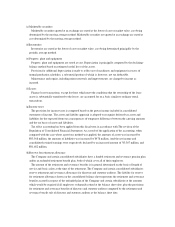

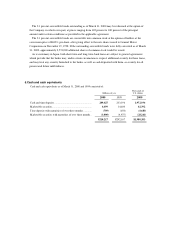

Please find page 24 of the 2000 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(c)Marketable securities

Marketable securities quoted at an exchange are stated at the lower of cost or market value, cost being

determined by the moving average method. Marketable securities not quoted at an exchange are stated at

cost determined by the moving average method.

(d)Inventories

Inventories are stated at the lower of cost or market value, cost being determined principally by the

periodic average method.

(e)Property, plant and equipment

Property, plant and equipment are stated at cost. Depreciation is principally computed by the declining-

balance method based on estimated useful lives of the assets.

Provision for additional depreciation is made to reflect use of machinery and equipment in excess of

normal production schedules, a substantial portion of which is, however, not tax deductible.

Maintenance and repairs, including minor renewals and improvements, are charged to income as

incurred.

(f)Leases

Finance lease transactions, except for those which meet the conditions that the ownership of the lease

assets is substantially transferred to the lessee, are accounted for on a basis similar to ordinary rental

transactions.

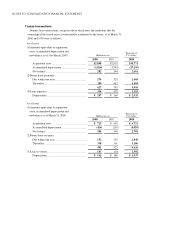

(g)Income taxes

The provision for income taxes is computed based on the pretax income included in consolidated

statements of income. The assets and liability approach is adopted to recognize deferred tax assets and

liabilities for the expected future tax consequences of temporary differences between the carrying amounts

and the tax bases of assets and liabilities.

Tax effect accounting has been applied from this fiscal term in accordance with The revision of the

Regulation of Consolidated Financial Statements. As a result of the application of the accounting, when

compared with the case where a previous method was applied, the amounts of assets was increased by

¥83,568 million, the amounts of liabilities was increased by ¥478 million. And the net income and

consolidated retained earnings were respectively declared by an increased amount of ¥3,307 million, and

¥81,682 million.

(h)Reserve for retirement allowance

The Company and certain consolidated subsidiaries have a funded retirement and severance pension plan

and/or an unfunded retirement benefit plan, both of which cover all of their employees.

The amount of the retirement and severance benefits is in general determined on the basis of length of

service and basic salary at the time of the retirement. The Company and certain consolidated subsidiaries

reserve retirement and severance allowances for directors and statutory auditors. The liability for reserve

for retirement allowance shown on the consolidated balance sheet represents the retirement and severance

benefits accrued in respect of the unfunded plan of the Company and certain subsidiaries at the amounts

which would be required if all employees voluntarily retired at the balance sheet date, plus the provisions

for retirement and severance benefits of directors and statutory auditors computed by the retirement and

severance benefit rule of directors and statutory auditors at the balance sheet date.