Suzuki 2000 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2000 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

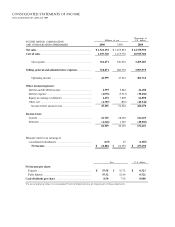

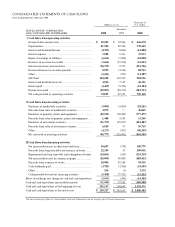

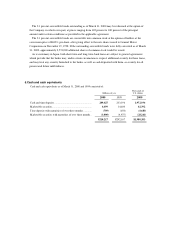

CONSOLIDATED STATEMENTS OF CASH FLOWS

Years ended March 31, 2000 and 1999

Thousands of

Millions of yen U.S. dollars

SUZUKI MOTOR CORPORATION (Unaudited)

AND CONSOLIDATED SUBSIDIARIES 2000 1999 2000

ⅠCash flows from operating activities

Income before income taxes ............................................... ¥ 45,291 ¥ 54,546 $ 426,670

Depreciation ....................................................................... 81,784 82,546 770,463

Interest and dividend Income ............................................. (4,395) (5,846) (41,408)

Interest expense .................................................................. 3,988 5,411 37,573

Equity in earnings of affiliates ........................................... (6,676) (7,808) (62,898)

(Increase) in accounts receivable ......................................... (3,664) (15,316) (34,523)

Decrease(increase) in inventories....................................... (18,759) 2,272 (176,726)

Increase(decrease) in accounts payable .............................. 8,992 (3,314) 84,712

Other ................................................................................... (2,261) (255) (21,307)

Sub Total 104,298 112,235 982,556

Interest and dividend received............................................ 4,924 7,165 46,391

Interest paid ........................................................................ (4,469) (5,336) (42,104)

Income taxes paid ............................................................... (29,903) (26,910) (281,713)

Net cash provided by operating activities 74,849 87,153 705,129

ⅡCash flows from investing activities

Purchases of marketable securities ..................................... (3,000) (5,000) (28,261)

Proceeds from sales of marketable securities ..................... 4,975 ─ 46,867

Purchases of property, plants and equipment ..................... (82,529) (98,383) (777,477)

Proceeds from sales of property, plants and equipment ..... 1,408 2,554 13,269

Purchases of investment securities ..................................... (21,379) (25,247) (201,407)

Proceeds from sales of investment securities ..................... 6,020 97 56,719

Other ................................................................................... (4,273) (902) (40,259)

Net cash used in investing activities (98,777) (126,881) (930,549)

ⅢCash flows from financing activities

Net increase(decrease) in short term bank loan.................. 10,697 (578) 100,779

Proceeds from long term debt and issuance of bonds ........ 22,249 59 209,602

Repayment from long term debt and redemption of bonds (24,862) (632) (234,219)

Net increase(decrease) in commercial paper ...................... (20,000) 40,000 (188,412)

Proceeds from issuance of stocks ....................................... 10,005 42,268 94,255

Cash dividends paid............................................................ (3,785) (3,380) (35,659)

Other ................................................................................... 236 (5) 2,232

Cash provided by(used in) financing activities (5,458) 77,730 (51,422)

Effect of exchange rate change on cash and cash equivalents (2,563) (441) (24,145)

Cash and cash equivalents increased(decreased) (31,949) 37,561 (300,988)

Cash and cash equivalents at the beginning of year 242,167 204,605 2,281,371

Cash and cash equivalents at the end of year ¥ 210,217 ¥ 242,167 $ 1,980,383

The accompanying Notes to Consolidated Financial Statements are an integral part of these statements.