Sprouts Farmers Market 2013 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2013 Sprouts Farmers Market annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

What Makes Us Different

We believe the following competitive strengths position Sprouts to capitalize on two powerful, long-term consumer trends—a

growing interest in health and wellness and a focus on value:

Comprehensive natural and organic product offering at great value. To capitalize on the growing interest in health and

wellness and the resulting consumer demand for healthy products, we feature an expansive offering of high

-quality natural and

organic products. On average, our stores carry approximately 16,500 SKUs across produce, bulk foods, vitamins and supplements,

grocery, meat and seafood, bakery, dairy, frozen foods, beer and wine, body care and natural household departments. We believe,

based on our industry experience, that our prices provide consumers a compelling relative value and appeal to a broader

demographic than other natural and organic food retailers. In particular, we position Sprouts to be a value leader in fresh produce in

order to drive trial visits to our stores by new customers. We believe our produce allows us to engage more consumers and

successfully convert many of these trial customers into loyal, lifestyle customers shopping with greater frequency and in more

departments across the store. We believe this approach and our full product offering enables us to grow our share of customers’

“food retail wallet” as they increasingly shop our stores for a significant portion of their everyday grocery, vitamin and supplement

and body care purchases.

Resilient business model with strong financial performance . We achieved positive, pro forma comparable store sales growth

of 2.6%, 2.3%, 5.1%, 9.7% and 10.7% in fiscal 2009, 2010, 2011, 2012 and 2013, respectively. We believe the consistency of our

performance over time, even through the recent economic downturn from 2008 to 2010, and across geographies and vintages is

the result of a number of factors, including our distinctive value positioning, innovative products and merchandising strategies, and

a well-trained staff focused on customer education and service. In addition, we believe our high volume and low-cost store model

enhance our ability to consistently offer competitive prices on high-quality natural and organic products while maintaining our

operating margins and strong cash flow generation.

Proven and replicable economic store model.

We believe our store model, combined with our rigorous store selection process

and a growing interest in health and wellness, contribute to our consistent and attractive new store returns on investment. Smaller

than conventional supermarkets, we target store sizes of approximately 25,000 to 28,000 square feet, which allows for greater

flexibility in identifying and securing new locations, often in second generation store sites. Our typical store requires an average

new store cash investment of approximately $2.8 million, including store buildout (net of contributions from landlords), inventory (net

of payables) and cash pre-opening expenses. On average, our stores reach a mature sales growth rate within three or four years

after opening, with net sales increasing 20-30% during this time period. Based on our historical performance, we target pre-tax

cash-on-cash returns of 35-40% within three to four years after opening. We believe the consistent performance of our store

portfolio across geographies and vintages supports the portability of the Sprouts brand and store model into a wide range of

markets.

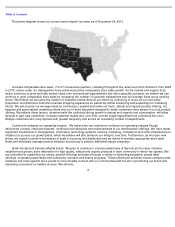

Significant new store growth opportunity supported by broad demographic appeal. We believe, based on our experience, that

our broad product offering and value proposition appeals to a wider demographic than other leading competitors, including higher-

priced health food and gourmet food retailers. Sprouts has been successful across a variety of geographies, from California to

Oklahoma, underscoring the heightened interest in eating healthy across markets. Based on research conducted for us, we believe

that the U.S. market can support approximately 1,200 Sprouts Farmers Market stores operating under our current format, including

300 in states in which we currently operate. We intend to achieve 12% or more annual new store growth over at least the next five

years, balanced among existing, adjacent and new markets.

3