Singapore Airlines 2014 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2014 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

129

ANNUAL REPORT FY2013/14

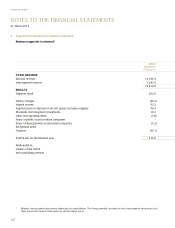

2 Summary of Significant Accounting Policies (continued)

(aj) Segmentreporting(continued)

(ii) Geographical segment

The analysis of revenue by area of original sale from airline operations is derived by allocating revenue to the area

in which the sale was made. Revenue from other operations, which consist principally of engineering services and

cargo operations, is derived in East Asia and therefore, is not shown.

Assets, which consist principally of flight and ground equipment, support the entire worldwide transportation

system, and are mainly located in Singapore. An analysis of assets and capital expenditure of the Group by

geographical distribution has therefore not been included.

(ak) Exceptional items

Exceptional items are separate items of income and expense of such size, nature or incidence that their separate

disclosure is relevant to explain the performance of the Group for the year.

3 Significant Accounting Judgments and Estimates

Estimates and assumptions concerning the future are made in the preparation of the financial statements. They affect the

application of the Group’s accounting policies, reported amounts of assets, liabilities, income and expenses, and disclosures

made. They are assessed on an ongoing basis and are based on experience and relevant factors, including expectations of

future events that are believed to be reasonable under the circumstances.

(a) Judgments made in applying accounting policies

(i) Determination of control over investees

As at 31 March 2014, the Group owns 20.8% of equity in Virgin Australia Holdings Limited (“Virgin Australia”). It has

been assessed that the Group does not have the ability to exercise significant influence over Virgin Australia due to

the composition of other shareholdings and lack of representation on the Board. Consequently, this investment in

Virgin Australia is treated as a long-term investment, as opposed to an investment in an associated company.

As at 31 March 2014, the Group owns 40.0% of equity in Tiger Airways Holdings Limited (“Tiger Airways”), as

well as an interest in perpetual convertible capital securities acquired during the year that are currently convertible

into a further 12.1% interest in Tiger Airways. It has been assessed that the currently exercisable potential voting

rights are not substantive. The Directors consider that the Group does not have ability to exercise control as it does

not have majority substantive voting rights, does not control the Board, nor any other arrangement which gives it

ability to control. Consequently, this investment in Tiger Airways is treated as an associated company, as opposed

to being a subsidiary company.

(b) Key sources of estimation uncertainty

The key assumptions concerning the future and other key sources of estimation uncertainty at the end of the reporting

period that have a significant risk of causing a material adjustment to the carrying amounts of assets and liabilities

within the next financial year are discussed below.