Quest Diagnostics 2004 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2004 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.•Be competitive in design and potential to attract and retain talented executives who have

the skills and experience required to achieve our strategic intent;

•Incent executives to balance appropriately the interests of our employees, customers and

stockholders in accordance with our satisfaction model;

•Pay for performance, with above-market pay opportunity only for performance that exceeds

targets and delivers significant value to stockholders;

•Be flexible to adjust for changing business conditions as well as the growth and

diversification of the Company;

•Be fiscally responsible and aligned with the Company’s budget; and

•Create long-term value for the Company and its stockholders.

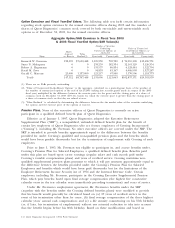

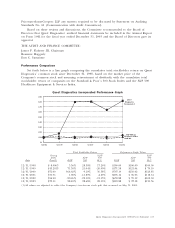

The key elements of executive compensation are base salary, annual incentive awards, and

equity participation. Each year the Committee evaluates Quest Diagnostics’ performance and

executive target and actual compensation levels compared to an executive compensation peer

group. The peer group represents the same companies in the Standard & Poors 500 Healthcare

Equipment & Services Index used for total stockholder return comparison purposes in the

Performance Graph shown on page 21.

Base Salary

Quest Diagnostics sets salaries for most executive officers to approximate median levels in its

executive compensation peer group. Base salary adjustments are determined following an

assessment of each executive officer’s position, performance, potential, and current salary level in

relation to market data for similar positions with comparable scope of responsibilities. For critical

positions and high-performance and high-potential executives, salary levels may be set above

median competitive levels.

Annual Incentive

The Company’s Senior Management Incentive Plan is designed to reward executives for the

achievement of objectives linked to the Company’s critical success factors. Individual incentive

targets are established for plan participants based on competitive levels in the compensation peer

group of companies. Incentive target levels are set within the limitations of the plan so as to result

in annual cash compensation in the range of 50th to 75th percentile of competitive practice,

depending on an executive’s responsibilities, future potential, individual performance, and Quest

Diagnostics’ performance. The Senior Management Incentive Plan is described below under

“Variable Compensation.’’

Long-Term Incentives

Long-term incentive compensation is based on annual grants of stock options under the terms

of the Employee Equity Participation Program. The Committee believes that these grants directly

align stockholder and executive officer interests.

Stock option grant levels and terms are established to deliver executive total compensation

ranging from 50th to 90th percentile competitive levels, depending upon an executive’s

responsibilities, future potential, individual performance, and Company performance.

Compensation of the Chairman of the Board and Chief Executive Officer

In February 2003, Mr. Freeman entered into a new employment agreement with the

Company that is described under “Employment Agreements’’. The employment agreement has a

term ending on the earlier of (a) December 31, 2005 or (b) one year following the date (if

any) that Mr. Freeman relinquishes, with the consent of the Board, the position of Chief

Executive Officer. In accordance with the terms of his employment agreement, Mr. Freeman

received a grant of 700,000 stock options and 100,000 restricted shares.

18 ?Quest Diagnostics Incorporated ?2004 Proxy Statement