Quest Diagnostics 2004 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2004 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

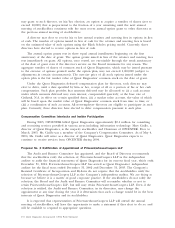

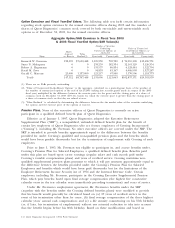

Option Grants. The following table sets forth certain information regarding options granted in

2003 to the named executive officers pursuant to stock option plans. No stock appreciation rights

(SARs) were granted in 2003.

Option/SAR Grants in 2003

Potential Realizable Value at

Assumed Annual Rates of Stock

Individual Grants Price Appreciation for Option Term

% of

Total

Number of Options

Securities Granted to

Underlying All Employees Gain Gain Gain

Options in Fiscal Exercise Expiration at at at

Executive Granted Year Price Date 0% 5% 10%

Kenneth W. Freeman 700,000(1) 22.8% $49.52 12/31/12 $0 $21,800,003 $55,245,489

Surya N. Mohapatra 100,000(2) 3.3% $49.52 2/13/13 0 3,114,286 7,892,213

Surya N. Mohapatra 76,000(3) 2.5% $71.07 2/27/12 0 1,413,355 4,956,673

Surya N. Mohapatra 5,618(3) 0.2% $93.79 1/13/08 0 0 0

Surya N. Mohapatra 2,975(3) 0.1% $64.07 2/3/09 0 39,828 114,201

Robert A. Hagemann 50,000(2) 1.6% $49.52 2/13/13 0 1,557,143 3,946,106

Robert A. Hagemann 34,000(3) 1.1% $71.07 2/27/12 0 632,290 2,217,459

Robert A. Hagemann 2,516(3) 0.1% $89.24 7/30/08 0 0 9,680

Robert A. Hagemann 2,078(3) 0.1% $69.58 1/13/08 0 8,715 48,859

Robert A. Hagemann 1,797(3) 0.1% $69.58 1/20/07 0 1,224 27,045

David M. Zewe 40,000(2) 1.3% $49.52 2/13/13 0 1,245,714 3,156,885

David M. Zewe 38,000(3) 1.2% $71.07 2/27/12 0 706,677 2,478,336

Gerald C. Marrone 32,000(2) 1.0% $49.52 2/13/13 0 996,572 2,525,508

Gerald C. Marrone 28,000(3) 0.9% $71.07 2/27/12 0 520,710 1,826,143

Gerald C. Marrone 1,713(3) 0.1% $93.79 1/13/08 0 0 0

Gerald C. Marrone 1,783(3) 0.1% $93.79 11/10/07 0 0 0

Gerald C. Marrone 2,507(3) 0.1% $64.07 1/13/08 0 24,316 72,747

Gerald C. Marrone 5,614(3) 0.2% $58.65 8/16/09 0 111,980 254,045

All Employees 3,068,720(4) 100%

(1) The option provides for monthly vesting over a three-year period beginning January 1, 2003 and vests immediately in

full if Mr. Freeman’s employment is terminated by reason of death. Upon Mr. Freeman relinquishing his position as

Chief Executive Officer, there will be no further monthly vesting from the relinquishment date except that Mr.

Freeman will vest in an additional 12/36 of the option if he remains as Chairman of the Board until the first

anniversary of the relinquishment date or if prior to such date his employment is terminated by the Company without

“cause’’ or by Mr. Freeman for “good reason’’ (provided that the option will vest in full if such termination by the

Company without “cause’’ or by Mr. Freeman for “good reason’’ occurs within six months of the date he ceases to be

Chief Executive Officer). The term “good reason’’ is defined below under “Employment Agreement of Mr. Freeman’’.

However, the option is not exercisable prior to December 31, 2006, unless Mr. Freeman’s employment is terminated by

the Company without “cause’’ or by Mr. Freeman for “good reason’’, in which case the option is not exercisable until

the first anniversary of such termination.

(2) The option vests in three equal annual installments beginning February 13, 2004 and vests immediately upon a change

of control (as defined below under “Severance Arrangements’’) or termination of employment by reason of death or

disability. In addition, on a termination of employment prior to February 13, 2007 (other than for cause), the

executive will vest in an additional percentage of the option as if the option had vested on a monthly basis. The shares

acquired upon exercise of the option may not be sold prior to February 13, 2007.

(3) The grant involved the replacement of an existing option. The replacement option was issued in order to fully ensure

that the Company would be entitled to available tax deductions upon the exercise of the option. The executive officer

realized no benefits, financial or otherwise, as a result of the replacement of the option. Each replacement option has

the same exercise price (which was above the market price at the time of issuance), the same vesting terms and the

same expiration date as the option that it replaces.

(4) Excludes 292,255 shares of the Company’s common stock reserved for outstanding stock options of Unilab Corporation

which were converted upon the completion of the Unilab acquisition into options to acquire shares of the Company’s

common stock.

Quest Diagnostics Incorporated ?2004 Proxy Statement ?13