Quest Diagnostics 2004 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2004 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

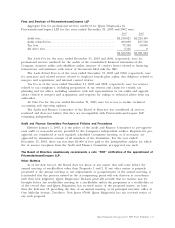

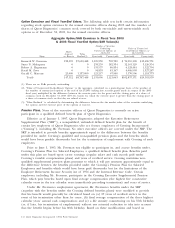

Option Exercises and Fiscal Year-End Values. The following table sets forth certain information

regarding stock option exercises by the named executive officers during 2003 and the number of

shares of Quest Diagnostics’ common stock covered by both exercisable and unexercisable stock

options as of December 31, 2003, for the named executive officers.

Aggregate Option/SAR Exercises in Fiscal Year 2003

& 2003 Fiscal Year-End Option/SAR Values(1)

Number of Securities

Underlying Value of Unexercised

Unexercised Options at In-the-Money Options at

Shares 12/31/03 12/31/03(2)

Acquired Value

Name on Exercise Realized(3) Exercisable Unexercisable Exercisable Unexercisable

Kenneth W. Freeman 122,512 $7,610,448 1,525,230 702,780 $ 74,910,198 $13,486,731

Surya N. Mohapatra 0 0 258,259 182,334 12,161,120 3,126,354

Robert A. Hagemann 0 0 131,557 86,834 6,128,444 1,522,794

David M. Zewe 0 0 94,833 81,167 4,086,903 1,327,287

Gerald C. Marrone 25,000 1,137,000 121,217 67,948 5,570,506 1,118,773

Totals 147,512 $8,747,448 2,131,096 1,121,063 $102,857,171 $20,581,939

(1) There are no SARs presently outstanding.

(2) “Value of Unexercised In-the-Money Options’’ is the aggregate, calculated on a grant-by-grant basis, of the product of

the number of unexercised options at the end of fiscal 2003 (taking into account grants made in respect of the 2003

fiscal year) multiplied by the difference between the exercise price for the grant and the closing price of a share of

common stock on December 31, 2003 ($73.11). Grants for which the exercise price is greater than the closing price of

a share of common stock on that day are valued at zero.

(3) “Value Realized’’ is calculated by determining the difference between the fair market value of the securities underlying

the options and the exercise price of the options at exercise.

Pension Plans. None of the executive officers of Quest Diagnostics is currently an active

participant in a qualified defined benefit plan of Quest Diagnostics.

Effective as of January 1, 1997, Quest Diagnostics adopted the Executive Retirement

Supplemental Plan (“SRP’’), a nonqualified, unfunded defined benefit plan for the benefit of

certain key employees of Quest Diagnostics who are former employees of Corning Incorporated

(“Corning’’), including Mr. Freeman. No other executive officers are covered under the SRP. The

SRP is intended to provide benefits approximately equal to the difference between the benefits

provided for under Corning’s qualified and non-qualified pension plans and the benefits which

would have been payable thereunder but for the termination of employment with Corning of such

employees.

Prior to June 1, 1995, Mr. Freeman was eligible to participate in, and accrue benefits under,

Corning’s Pension Plan for Salaried Employees, a qualified defined benefit plan. Benefits paid

under this plan are based upon career earnings (regular salary and cash awards paid under

Corning’s variable compensation plans) and years of credited service. Corning maintains non-

qualified supplemental pension plans pursuant to which it will pay amounts approximately equal to

the difference between the benefits provided under the Corning’s Pension Plan for Salaried

Employees and benefits which would have been paid thereunder but for the limitations of the

Employee Retirement Income Security Act of 1974 and the Internal Revenue Code. Certain

employees, including Mr. Freeman, participate in the Corning Executive Supplemental Pension

Plan, which pays benefits based upon final average compensation (the highest five consecutive

calendar years in the ten calendar years immediately preceding termination) and years of service.

Under Mr. Freeman’s employment agreement, Mr. Freeman’s benefits under the SRP

(together with the benefits under the Corning defined benefits plans) were modified to provide

that his benefit would generally be calculated based on (a) 37 years of credited service in the

event of his termination other than for cause, (b) final average compensation of the three highest

calendar years’ annual cash compensation; and (c) a life annuity commencing on his 55th birthday

(or, if later, his termination of employment) without any actuarial reduction to take into account

that the benefit begins before his 60th birthday. Based on these modifications and based on

14 ?Quest Diagnostics Incorporated ?2004 Proxy Statement