Quest Diagnostics 2004 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2004 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

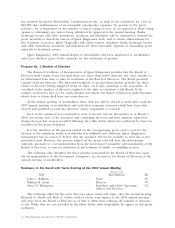

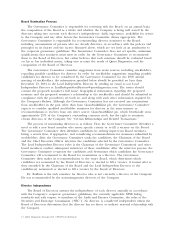

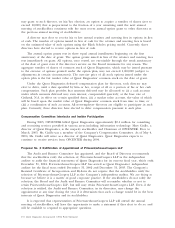

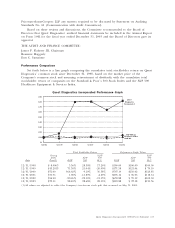

Executive Compensation

Summary Compensation Table. The following table shows the compensation for the past three

years of the Chief Executive Officer and each of Quest Diagnostics’ other four most highly

compensated executive officers (the “named executive officers’’).

Summary Compensation Table

Annual Compensation Long-Term Compensation

Awards

Other Restricted Securities All

Name and Annual Stock Underlying LTIP Other

Principal Position Year Salary Bonus Comp.(1) Awards(2) Options Payouts Comp.(3)

Kenneth W. Freeman 2003 $1,091,525 $1,243,901 $ 0 $4,890,000 700,000 $0 $ 82,853

Chairman & CEO 2002 785,200 1,356,512 228,237 0 200,000 0 101,915

2001 784,523 1,158,600 230,870 0 200,000 0 154,399

Surya N. Mohapatra 2003 $ 597,846 $ 586,647 $ 36,913 $ 0 184,593 $0 $ 97,226

President and 2002 520,000 513,344 36,913 0 81,618 0 91,893

Chief Operating 2001 519,615 438,500 38,704 0 78,975 0 101,825

Officer

Robert A. Hagemann 2003 $ 379,554 $ 292,165 $ 0 $ 0 90,391 $0 $ 28,885

Senior Vice 2002 312,000 289,140 0 0 36,516 0 24,590

President and 2001 311,769 197,300 0 0 37,875 0 27,265

Chief Financial

Officer

David M. Zewe(4) 2003 $ 415,569 $ 237,964 $ 0 $ 0 78,000 $0 $ 30,137

Senior Vice 2002 375,000 277,650 0 0 38,000 0 27,097

President,

Diagnostic Testing

Operations

Gerald C. Marrone(5) 2003 $ 357,672 $ 174,687 $125,000 $ 0 71,617 $0 $ 26,982

Senior Vice 2002 345,800 256,030 125,000 0 31,496 0 27,367

President, 2001 345,535 218,700 125,000 0 35,055 0 35,262

Administration

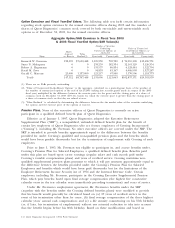

(1) Includes $36,913 in tax gross-up payments on forgiven loan amounts for Dr. Mohapatra. The loan was provided in

connection with the relocation of Dr. Mohapatra, bears no interest and is forgiven over a five-year period. The

principal balance of the loan to Dr. Mohapatra was $50,000 at January 1, 2003 and $0 at December 31, 2003. The loan

pre-dates the Sarbanes-Oxley Act and has not been modified since its passage. Also includes Information Technology

bonus of $125,000 for Mr. Marrone.

(2) Represents the value of the 100,000 shares of restricted stock awarded to Mr. Freeman in accordance with the terms of

his Employment Agreement. The value of the award is based on the closing stock price of $48.90 on February 13,

2003, when the agreement was approved by the Board of Directors. The stock award provides for monthly vesting over

a three-year period beginning January 1, 2003 and vests immediately in full if Mr. Freeman’s employment is terminated

by reason of death. Upon Mr. Freeman relinquishing his position as Chief Executive Officer, there will be no further

monthly vesting from the relinquishment date except that Mr. Freeman will vest in an additional 12/36 of the stock

award if he remains as Chairman of the Board until the first anniversary of the relinquishment date or if prior to such

date his employment is terminated by the Company without “cause’’ or by Mr. Freeman for “good reason’’ (provided

that the stock award will vest in full if such termination by the Company without “cause’’ or by Mr. Freeman for “good

reason’’ occurs within six months of the date he ceases to be Chief Executive Officer). The term “good reason’’ is

described below under “Employment Agreement of Mr. Freeman’’. As of December 31, 2003, 66,667 restricted shares

subject to the grant remained unvested, having a value of $4,874,024, based on the closing price of a share of common

stock on December 31, 2003 ($73.11). The restricted stock awards receive the same dividends as all other shares of the

Company’s common stock.

(3) Includes forgiven principal on relocation loans of $50,000 for Dr. Mohapatra. This loan pre-dates the Sarbanes-Oxley

Act and has not been modified since its passage. Includes a payment of $70,853 to Mr. Freeman to compensate him

for the loss of certain benefits under Corning’s employee benefit plans consistent with the treatment of all other

participants in the Executive Retirement Supplemental Plan, which is described below under “Pension Plans.’’ Includes

$12,000, $11,103, $11,337, $10,409 and $7,300 contributed to the Company’s Profit Sharing Plan for Mr. Freeman, Dr.

Mohapatra, Mr. Hagemann, Mr. Zewe, and Mr. Marrone, respectively. Includes $36,123, $17,548, $19,728 and $19,682

contributed to the Company’s Supplemental Deferred Compensation Plan for Dr. Mohapatra, Mr. Hagemann, Mr.

Zewe, and Mr. Marrone, respectively. The Company’s Supplemental Deferred Compensation Plan provides credits to

make up for certain limitations imposed under the Company’s tax-qualified Profit Sharing Plan.

(4) Mr. Zewe became an executive officer in December 2002.

(5) Mr. Marrone has announced that he will retire in April 2004.

12 ?Quest Diagnostics Incorporated ?2004 Proxy Statement