Quest Diagnostics 1998 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 1998 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We saw average revenue per requisition

increase for the second consecutive

year, following five straight years of

declines. Partly, this was a result

of replacing low-profit business with

higher-profit business as we demon-

strated our steadfast commitment

to provide services only to those

customers from whom we are

properly compensated, even if

that means a decline in volume.

We made substantial progress during

1998 toward addressing the Year 2000

computer-programming problem.

Although substantial work remains,

we are on track to complete the first

phase on schedule midway through

1999, which will leave the second half

of the year for testing and refine-

ments. Consequently, we fully expect

core systems to be Year 2000-ready

before the end of the year. Our Year

2000 work has provided the added

benefit of accelerating efforts to

standardize billing and laboratory

systems across the country.

Nevertheless, 1998 was not without

disappointments. Our progress

toward standardization of systems

and practices was significant, but

not as swift as we had hoped. Also,

the joint venture in Arizona, Sonora

Quest Laboratories, in which we hold

a minority interest, encountered

significant integration challenges

that hindered its first year of

operations. Also, Nichols Institute

Diagnostics, our medical products

subsidiary, encountered startup losses

associated with the introduction of

its state-of-the-art Nichols Advantage

instrument.

Finally, the decline in the volume of

test requisitions was disappointing.

Admittedly, the rate of decline

slowed in the second half; moreover,

of the 7% year-over-year decline in

volume, about half was directly

attributable to our own consolidation

of facilities and to our decision to

reduce unprofitable business. Still,

we do not intend to shrink our

way to success, and we continue to

pursue top line growth through the

strategic acquisition of SBCL and

the active development of new high

growth businesses.

Strategic Partnerships

Your company intensified efforts to

become the preferred partner with

large buyers of health care services.

We made important inroads within

the highly competitive field of

hospital testing, which accounts

for nearly 55% of the $30-plus

billion market in clinical testing.

In part, our success comes from

viewing traditional competitors

as potential partners, and providing

ways we can profitably work together

to reduce their lab testing costs while

simultaneously improving quality.

Over time, we have come to realize

there is no “one-size-fits-all” model of

collaboration; each situation is unique

and requires creative approaches,

ranging from outsourcing routine

testing to fully integrated joint

ventures. Some of the partnerships

successfully established in 1998

include:

Joint ventures with UPMC Health

System in western Pennsylvania

and Unity Health in St. Louis, both

leading hospital network and health

care providers in their respective

regions;

Partnerships through which we

provide multiple clinical services to

5

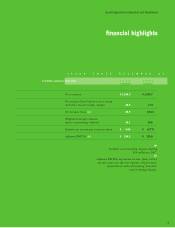

1996

1997

1998

1995

Adjusted EBITDA*

$177 million

$166 million

$154 million

$159 million

1996

1997

1998

1995

Cash and Cash Equivalents at End of Year

$ 36 million

$ 42 million

$162 million

$203 million

1996

1997

1998

1995

Debt at End of Year

$1,208 million

$ 536 million

$ 515 million

$ 465 million

1996

1997

1998

1995

Bad Debt as Percentage of Net Revenues

*Adjusted EBITDA; excludes restructuring charge

and other special charges

9.4%

6.9%

7.4%

6.1%