Quest Diagnostics 1998 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 1998 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

By most measures, 1998 was a year

in which your company made solid

progress. Even as we met the challenges

of growing competition and declining

clinical testing volume, we generated

strong cash flow, extended our strategic

partnerships in new and innovative

ways, aggressively managed costs, and

made significant progress toward

achieving our goal of becoming a unified,

customer-driven company with

common systems, practices and values

everywhere throughout the country.

At yearend, we were well positioned

to take a new strategic step to further

improve our prospects.

Perhaps most important for long-

term success, we reinforced in 1998

the commitment to our vision –

“dedicated people improvingthehealth

of patients through unsurpassed

diagnostic insights” – by pledging

ourselves to a set of ambitious and

clearly quantifiable goals for

instilling unsurpassed quality in

every aspect of the business.

As the information included in

this report demonstrates, Quest

Diagnostics has come a long, long

way from the difficult years of the

mid-1990s. Our turnaround is

succeeding. We are committed to

becoming the clear industry leader

by providing our patients and

customers with services and products

of exceptional quality. In a business

where the quality of what we do can

literally mean the difference between

life and death, we are absolutely

convinced that consistent, unsurpassed

quality will provide the ultimate

competitive edge.

SBCL Acquisition

We announced an agreement as this

report was going to press to acquire

the clinical laboratory business of

SmithKline Beecham plc. Quest

Diagnostics has agreed to purchase

SmithKline Beecham Clinical

Laboratories(SBCL) for approximately

$1.3 billion in cash and stock. This

important acquisition will enable us

to provide a higher level of service

for customers and patients in a cost-

constrained environment, thereby

increasing shareholder returns.

This transaction is highly strategic

and timely. We are confident we

have the discipline and the focus to

ensure successful integration of the

two companies. We are acquiring a

company that in many ways mirrors

our own business. Both companies

have strong reputations as well-

managed operations. We share a

common commitment to quality,

integrity andcompliance, and are

bothdedicated to improving

patient health. Combining the two

companies will improve the quality,

convenience and accessibility of our

services; accelerate innovation of

new tests and information products;

and enable continued reduction in

our costs by sharing the best practices

from each of our organizations. We

expect to complete the transaction

this summer, following shareholder

approval and regulatory clearance.

Upon completion, SmithKline

Beecham plc will become our largest

shareholder, owning approximately

29.5% of our shares.

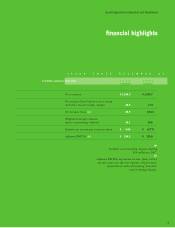

Performance Summary

We are pleased to report that in

1998, Quest Diagnostics reported

net income of $26.9 million, or $0.89

per diluted share, on revenues of

$1.46 billion, versus 1997 net income,

adjusted to exclude special charges, of

$17.6 million, or $0.60 per share, on

revenues of $1.53 billion.

As anticipated, requisition volume

declined 7% from 1997, although

the rate of decline did slow over

the course of the year. Given these

conditions, we are particularly

pleased with our ability to generate

substantial amounts of cash. We

ended the year with $203 million

of cash on hand, and generated

$141 million in cash from operations.

Strong cash generation reflects

significant improvements in

our billing, collection and cost

management processes.

There are many other indicators

of financial strength in our

1998 performance:

In addition to repaying $33 million

of scheduled bank debt, we prepaid

an additional $20 million of debt

ahead of schedule,while also buying

back $13 million of our stock.

We remained firmly on track to

meet the commitment made at the

time of our spinoff from Corning

Incorporated in early 1997 to reduce

the cost of running our business by

$180 million by the end of 2000.

Through the end of 1998, we

eliminated $100 million in costs

unrelated to the decline in requisition

volume, and we remain confident

that we will meet our goal. These

savings are allowing us to reinvest in

our business to assure long term

profitable growth.

We reduced bad debt expense from

7.4% of revenues in 1997 to 6.1% in

1998, steadily progressing toward

our goal of 4% by the end of 2000.

A major step was the conversion of

our Teterboro facility to a new

billing system, by far the largest and

most successful conversion to date.

4

Chairman’s Letter