Qantas 2002 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2002 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

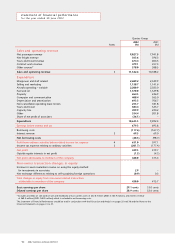

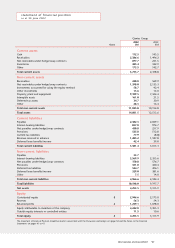

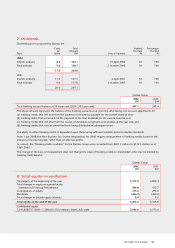

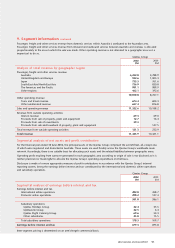

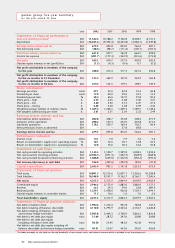

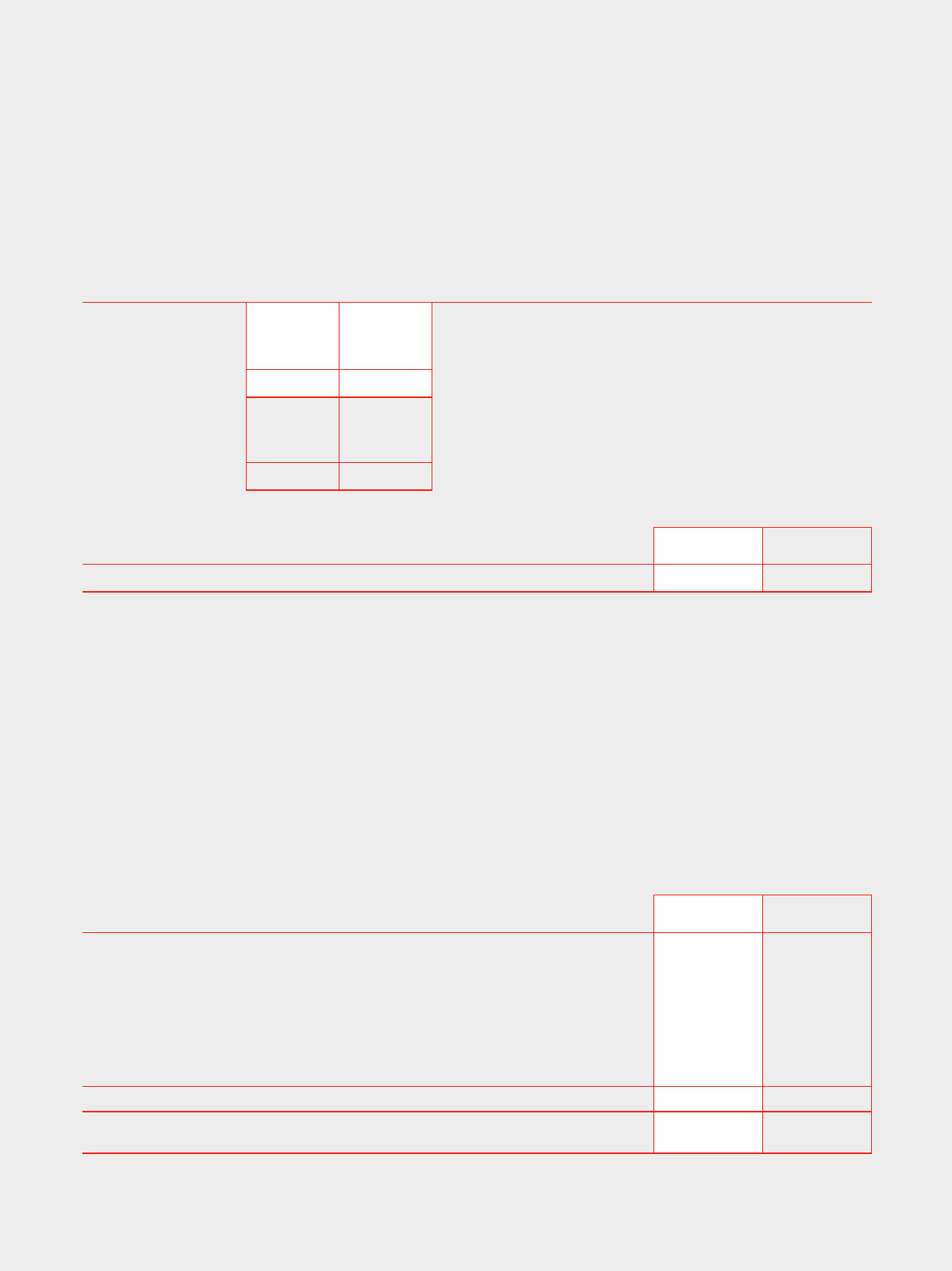

7. Dividends

Dividends paid or proposed by Qantas are:

Cents Total Franked Percentage

per Amount Tax Rate Franked

Type Share $M Date of Payment % %

2002

Interim ordinary 8.0 124.1 10 April 2002 30 100

Final ordinary 9.0 140.7 2 October 2002 30 100

17.0 264.8

2001

Interim ordinary 11.0 141.5 4 April 2001 34 100

Final ordinary 9.0 117.8 3 October 2001 30 100

20.0 259.3

Qantas Group

2002 2001

$M $M

Total franking account balance at 30.0 per cent (2001: 30.0 per cent) 407.1 241.4

The above amount represents the balance of the franking accounts as at year end, after taking into account adjustments for:

(a) franking credits that will arise from the payment of income tax payable for the current financial year;

(b) franking debits that will arise from the payment of the final dividends for the current financial year;

(c) franking credits that will arise from the receipt of dividends recognised as receivables at the year end; and

(d) franking credits that may be prevented from being distributed in subsequent years.

The ability to utilise franking credits is dependent upon there being sufficient available profits to declare dividends.

From 1 July 2002, the New Business Tax System (Imputation) Act 2002 requires measurement of franking credits based on the

amount of income tax paid, rather than on after tax profits.

As a result, the “franking credits available” for the Qantas Group were converted from $407.1 million to $174.5 million as at

1 July 2002.

This change in the basis of measurement does not change the value of franking credits to shareholders who may be entitled to

franking credit benefits.

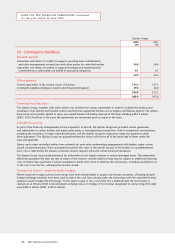

Qantas Group

2002 2001

$M $M

8. Total equity reconciliation

Total equity at the beginning of the year 3,315.9 2,864.4

Total changes in equity recognised in the

Statement of Financial Performance 430.0 415.7

Contributions of equity 773.6 291.0

Dividends (266.9) (264.2)

Total changes in outside equity interests 0.9 9.0

Total equity at the end of the year 4,253.5 3,315.9

Contributed equity

1,563,858,757 (2001: 1,308,612,512) ordinary shares, fully paid 2,946.6 2,173.0

THE SPIRIT OF AUSTRALIA p43