Qantas 2002 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2002 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

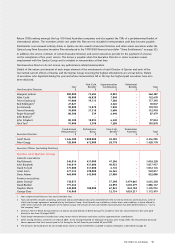

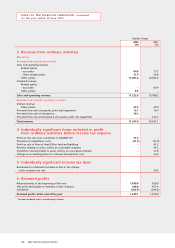

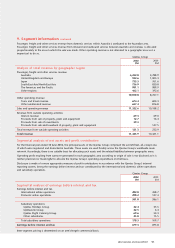

Review of expenditure

•Total expenditure increased by 12.1 per cent on capacity growth of 3.2 per cent and a higher proportion of more

expensive domestic flying.

– higher manpower and staff-related expenditure, of 5.5 per cent was due to the increase in full-time employees as a

result of greater activity and the provision of an incentive bonus to all staff, partially offset by efficiency gains;

– aircraft operating variable expenditure, which includes maintenance material costs, crew expenses, route navigation

and landing fees, increased by 8.8 per cent, primarily due to additional activity, the ageing of the aircraft fleet and the

adverse impact of foreign exchange rate movements;

– increases in fuel and oil expenditure, of 18.1 per cent were a direct result of additional flying, the weaker

Australian dollar relative to the US dollar and a reduction in fuel hedging benefits partially offset by the lower average

price of jet fuel;

– computer and communication costs increased by 11.9 per cent as a result of additional reservation fees driven by

increased passenger numbers;

– increased non-cancellable operating lease rentals of 40.6 per cent were mainly due to leasing of additional aircraft; and

– increased capacity hire of 127.0 per cent was due to short-term leases entered into to cover capacity requirements

following the collapse of Ansett.

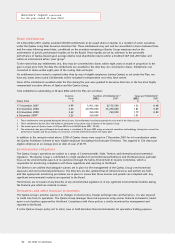

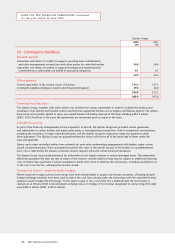

Review of other statement of financial performance items

•Net borrowing costs decreased by 51.1 per cent. Although average net debt was higher than the prior year, $77.0 million

of interest was capitalised into aircraft progress payments and other infrastructure projects.

•Income tax expense relating to ordinary activities increased by 13.7 per cent in line with increased profitability. The

effective tax rate increased by 2.3 percentage points to 32.0 per cent due to the impact of an individually significant tax

benefit recognised in the prior year partially offset by the favourable movement as a result of a reduction in the corporate

tax rate to 30 per cent in the current financial year.

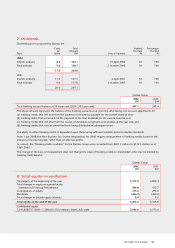

Impact of exchange rates on the statement of financial performance

The Qantas Group is exposed to foreign exchange rate fluctuations on the Australian dollar value of foreign currency

dominated revenue and expenditure. The Qantas Group earns revenue in approximately 80 different countries, reflecting

its route structure and location of ticket sales. The Qantas Group’s foreign currency costs are primarily denominated in United

States dollars and relate largely to fuel, engineering and maintenance materials, and lease rentals.

The Qantas Group manages its foreign currency exposures by using a variety of long-term and short-term financial

instruments, in accordance with its risk management policies. The overall economic impact of exchange rate movements

on the profit result in comparison to last year was $51.0 million adverse.

discussion and analysis of the statement of financial performance continued

for the year ended 30 June 2002

p36 THE SPIRIT OF AUSTRALIA