Qantas 2002 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2002 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

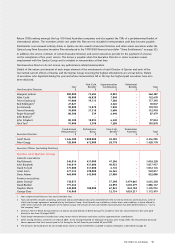

p26 2002 QANTAS ANNUAL REPORT

BOARD RESPONSIBILITIES

In preparing this Statement, the Qantas Board has focussed on

the structure and values which it has in place to ensure that the

Board protects and enhances shareholder value.

The Board maintains, and ensures that Qantas management

maintains, the highest level of corporate ethics. The Board

comprises a majority of independent Non-Executive Directors

who, together with the BA Directors and Executive Directors,

have extensive commercial experience and bring independence,

accountability and judgement to the Board’s deliberations to

ensure maximum benefit to shareholders, employees and the

wider community.

In particular, the Board:

•

ensures compliance with laws and all appropriate

accounting standards

•sets and reviews strategic direction

•monitors the operating and financial performance of the

Qantas Group

•monitors the performance of the Chief Executive Officer,

Chief Financial Officer and executive management

•monitors risk management

•ensures that the market and shareholders are fully informed

of material developments

BOARD STRUCTURE

•

11 Directors

•seven independent Non-Executive Directors elected by

shareholders other than British Airways – no substantial

shareholder/supplier/customer relationship nor previous

executive roles within Qantas

•Chairman is an independent Non-Executive Director

•maximum 12 year term for independent Non-Executive

Directors and six year term for the Chairman

•two Non-Executive Directors are appointed by British Airways

(a right acquired from the Australian Government in 1993

when British Airways purchased its shareholding)

•two Executive Directors – Chief Executive Officer and

Chief Financial Officer

•

new independent Non-Executive Directors are nominated by

the Chairman’s Committee, appointed by the other independent

Non-Executive Directors and elected by shareholders

•

details of the Directors and their qualifications are on page 25

•at the 2000 Annual General Meeting, shareholders approved

the entering of Director Protection Deeds with each Director

AUSTRALIAN PROVISIONS

•

the Constitution contains provisions to ensure the

independence of the Qantas Board and to protect the

airline’s position as the Australian flag carrier

•head office must be in Australia

•two-thirds of the Directors must be Australian citizens

•Chairman must be an Australian citizen

•British Airways cannot vote in any election of independent

Non-Executive Directors

•quorum for a Directors’ meeting must include a majority

of non-BA Directors who are Australian citizens and at least

one BA Director

•maximum 49 per cent aggregate foreign ownership

•maximum 35 per cent aggregate foreign airline ownership

•maximum 25 per cent ownership by one foreign person

BOARD MEETINGS

•

eight formal meetings a year

•additional meetings held as required (eg during the aviation

crisis resulting from the combination of the 11 September

2001 terrorist attacks and the 14 September 2001 collapse

of Ansett)

•two-day meeting held each year to review and approve the

strategy and financial plan for the next financial year

COMMITTEES

•

Board does not delegate major decisions to Committees

•Committees are responsible for considering detailed issues

and making recommendations to the Board

•Audit, Risk & Compliance Committee – assists the Board

in fulfilling its audit, accounting and reporting obligations,

monitors internal and external auditors (including the

independence of the external auditors), monitors business

risk management and compliance with legal and statutory

obligations

•Safety, Environment & Security Committee – receives detailed

reports on all safety (including occupational health and

safety), environment and security aspects of the airline and

ensures that the appropriate risk management procedures are

in place to protect the airline, its passengers, employees and

the community

•Chairman’s Committee – review Board’s performance and

remuneration, nomination of new Directors, recommends

remuneration for Chief Executive Officer and senior

executives and monitors succession planning

•Nominations Committee – approval of Chairman and any

Alternate Directors

•

the Audit, Risk & Compliance Committee, Safety, Environment

& Security Committee and Chairman’s Committee operate

under formal Terms of Reference which are updated regularly

•Non-Executive Directors are a majority on and hold the Chair

of all Committees

•Chairman of the Audit, Risk & Compliance Committee has

appropriate financial experience

•membership of and attendance at 2002 Board and

Committee meetings are detailed on page 30

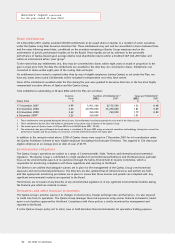

STANDARDS

•

annual formal review of Board performance

•active participation by all Directors at all meetings

•open access to information

•regular management presentations and visits to interstate/

offshore operations

•Chief Executive Officer and Chief Financial Officer certify the

accuracy and completeness of financial information provided

to the Board

•independent professional advice is available to the Directors

•formal Code of Conduct – including conflict of interest

•formal share trading policy

•formal Continuous Disclosure Policy – ensures compliance

with the Listing Rules and Corporations Act and that all

shareholders have equal access to material information

EXTERNAL AUDITOR INDEPENDENCE

•

the Board closely monitors the independence of the

external auditors

•

regularly reviews the independence safeguards put in place

by the external auditors

•

requires the rotation of the audit partner every seven years

•

policies to restrict the type of non-audit services which can

be provided by the external auditors

•

undertakes a detailed monthly review of non-audit fees paid

to the external auditor

•

imposes restrictions on the employment of ex-employees

of the external auditor

•

the Audit, Risk & Compliance Committee meets regularly

with management without the external auditors and with

the external auditors without management

corporate governance statement