Public Storage 2007 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2007 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

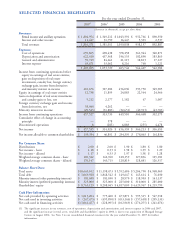

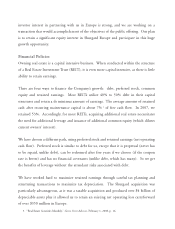

For the year ended December 31,

2007 12006 12005 2004 2003

(Amounts in thousands, except per share data)

Revenues:

Rental income and ancillary operations $ 1,804,954 $ 1,349,212 $ 1,043,391 $ 952,766 $ 890,350

Interest and other income 11,417 31,799 16,447 5,391 2,537

Total revenues 1,816,371 1,381,011 1,059,838 958,157 892,887

Expenses:

Cost of operations 659,865 498,438 378,258 361,944 340,871

Depreciation and amortization 622,410 437,568 196,153 182,890 183,863

General and administrative 59,749 84,661 21,115 18,813 17,127

Interest expense 63,671 33,062 8,216 760 1,121

1,405,695 1,053,729 603,742 564,407 542,982

Income from continuing operations before

equity in earnings of real estate entities,

gain on disposition of real estate

investments, casualty loss, foreign currency

exchange gain, income from derivatives

and minority interest in income 410,676 327,282 456,096 393,750 349,905

Equity in earnings of real estate entities 12,738 11,895 24,883 22,564 24,966

Gain on disposition of real estate investments

and casualty gain or loss, net 5,212 2,177 1,182 67 1,007

Foreign currency exchange gain and income

from derivatives, net 58,444 4,262 — — —

Minority interest in income (29,543) (31,883) (32,651) (49,913) (43,703)

Income from continuing operations 457,527 313,733 449,510 366,468 332,175

Cumulative effect of change in accounting

principle — 578 — — —

Discontinued operations 8 (285) 6,883 (255) 4,478

Net income $ 457,535 $ 314,026 $ 456,393 $ 366,213 $ 336,653

Net income allocable to common shareholders $ 199,354 $ 46,891 $ 254,395 $ 178,063 $ 161,836

Per Common Share:

Distributions $ 2.00 $ 2.00 $ 1.90 $ 1.80 $ 1.80

Net income - basic $ 1.18 $ 0.33 $ 1.98 $ 1.39 $ 1.29

Net income - diluted $ 1.17 $ 0.33 $ 1.97 $ 1.38 $ 1.28

Weighted average common shares - basic 169,342 142,760 128,159 127,836 125,181

Weighted average common shares - diluted 170,147 143,715 128,819 128,681 126,517

Balance Sheet Data:

Total assets $10,643,102 $11,198,473 $ 5,552,486 $ 5,204,790 $ 4,968,069

Total debt $ 1,069,928 $ 1,848,542 $ 149,647 $ 145,614 $ 76,030

Minority interest (other partnership interests) $ 181,688 $ 181,030 $ 28,970 $ 118,903 $ 141,137

Minority interest (preferred partnership interests) $ 325,000 $ 325,000 $ 225,000 $ 310,000 $ 285,000

Shareholders’ equity $ 8,763,129 $ 8,208,045 $ 4,817,009 $ 4,429,967 $ 4,219,799

Cash Flow Information:

Net cash provided by operating activities $ 1,013,204 $ 775,400 $ 673,871 $ 595,315 $ 547,918

Net cash used in investing activities $ (247,475) $ (495,890) $ (453,146) $ (157,638) $ (205,133)

Net cash used in financing activities $ (1,061,457) $ (228,095) $ (102,969) $ (276,255) $ (241,076)

SELECTED FINANCIAL HIGHLIGHTS

(1) The significant increase in our revenues, cost of operations, depreciation and amortization, and interest expense in 2006 and 2007,

and the significant increase in total assets, total debt and shareholders’ equity in 2006, is due to our acquisition of Shurgard Storage

Centers in August 2006. See Note 3 to our consolidated financial statements for the year ended December 31, 2007 for further

information.