Public Storage 2007 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2007 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156

|

|

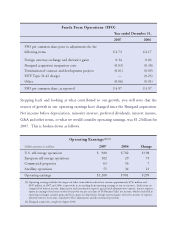

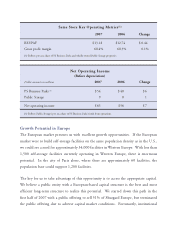

Same Store Key Operating Metrics(1)

2007 2006 Change

REVPAF $13.18 $12.74 $ 0.44

Gross profit margin 68.4% 68.3% 0.1%

(1) Reflects pro rata share of PS Business Parks and wholly-owned Public Storage properties.

Net Operating Income

(Before depreciation)

Dollar amounts in millions 2007 2006 Change

PS Business Parks (1) $54 $ 48 $6

Public Storage 9 8 1

Net operating income $63 $56 $7

(1) Reflects Public Storage’s pro rata share of PS Business Parks’ funds from operations.

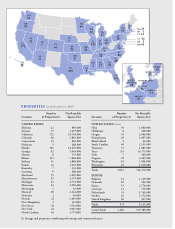

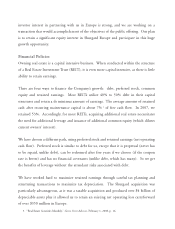

Growth Potential in Europe

The European market presents us with excellent growth opportunities. If the European

market were to build self-storage facilities on the same population density as in the U.S.,

we could see a need for approximately 34,000 facilities in Western Europe. With less than

1,500 self-storage facilities currently operating in Western Europe, there is enormous

potential. In the city of Paris alone, where there are approximately 60 facilities, the

population base could support 1,200 facilities.

The key for us to take advantage of this opportunity is to access the appropriate capital.

We believe a public entity with a European-based capital structure is the best and most

efficient long-term structure to realize this potential. We started down this path in the

first half of 2007 with a public offering to sell 51% of Shurgard Europe, but terminated

the public offering due to adverse capital market conditions. Fortunately, institutional