Public Storage 2003 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2003 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

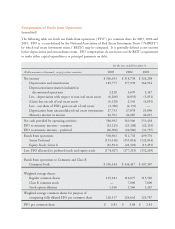

Investment Activities

We were busy allocating and generating capital in 2003. Our activities included:

Opening 14 self-storage properties at a cost of $107 million. These properties represent nearly one million

rentable square feet or about 10,300 units. Self-storage facilities typically generate operating losses

during their first year of operation. Net operating income from these facilities was only $219,000.

Adding 1,700 rentable units to our system by converting five facilities that included containerized

storage to self-storage at a cost of $6 million.

Selling five facilities for net proceeds of $13 million and producing financial statement gains of over

$5 million ($0.04 per share). We also disposed of approximately $6 million of excess land with a

nominal gain.

During 2003, our portfolio of development properties which have been in operation for two to four years were

a source of significant earnings growth. Net operating income before depreciation from the 63 self-storage

facilities developed since 1999 increased over $5 million to $15 million. The investment yield from these

properties, comprised of about 40,000 units, is still below 5%. Accordingly, these properties and those opened

in 2003 should be a source of meaningful earnings growth in 2004. During 2004, we expect to invest

$140 million and add 18,400 units to our system.

Our investment in PS Business Parks continues to perform above our expectations. At year-end, the market

value of our investment was approximately $525 million. During the year, PSB expanded its portfolio by

nearly four million square feet to 18.3 million rentable square feet. Accordingly, through our 44% equity

stake, we indirectly own 8.1 million square feet of office, industrial and flex space which is in addition to the

1.8 million square feet we own directly. Our investment continues to grow in value.

Other transactions and events impacting us in 2003 included:

The redemption of $88 million of 8.36% preferred stock.

The issuance of $252 million of 6.48% preferred stock in the fourth quarter of 2003 in anticipation of

redeeming $230 million of 8.25% preferred stock in the first quarter of 2004. Our earnings in 2004 will

be positively impacted by these refinancings, just as our 2003 earnings benefited from refinancings done

in 2002. We have an additional $86 million of 9% preferred stock to redeem in 2004 which has already

been funded with a $110 million 6.25% preferred stock issuance in March 2004. On March 22, 2004,

we restructured $200 million of preferred securities which were originally callable in 2005, reducing their

coupon from 9.5% to 6.4%. In 2005, we have an additional $200 million of 9.6% preferred securities

which can be redeemed. Depending on our outlook for interest rates, we may pre-fund these redemptions

in 2004. While extremely positive in the long run, this may cause some short-term earnings dilution in

2004.

We retired $40 million of debt in 2003 and expect to retire an additional $41 million in 2004. Our

total debt will then be below $36 million.

Our financial strength continues to improve, reflecting exceptional flexibility and liquidity. We are prepared

for opportunity.