Public Storage 2003 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2003 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9

Issuance of securities in exchange for property: The Company has issued common equity in exchange

for real estate and other investments in the last three years. Future issuances will be dependent upon market

conditions at the time, including the market prices of our equity securities.

Development Joint Venture Financing: The Company has entered into two separate development joint

venture partnerships since 1997 in order to provide development financing.

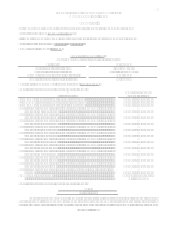

In November 1999, we formed PSAC Development Partners, L.P., (the Consolidated Development Joint

Venture) with a joint venture partner (PSAC Storage Investors, LLC) whose partners include a third party

institutional investor, owning approximately 35%, and Mr. Hughes, owning approximately 65%, to develop

approximately $100 million of storage facilities. At December 31, 2003, PSAC Development Partners, L.P. had

completed construction on 22 storage facilities with a total cost of approximately $108.6 million. We expect that

this second joint venture partnership will receive no additional capital funding to develop any additional facilities.

PSAC Development Partners, L.P. is funded solely with equity capital consisting of 51% from the

Company and 49% from PSAC Storage Investors, LLC. The term of the Consolidated Development Joint Venture

is 15 years; however, during the sixth year PSAC Storage Investors, LLC has the right to cause an early

termination of PSAC Development Partners, L.P. If PSAC Storage Investors, LLC exercises this right, we then

have the option, but not the obligation, to acquire their interest for an amount that will allow them to receive an

annual return of 10.75%. If the Company does not exercise its option to acquire PSAC Storage Investors, LLCs

interest, PSAC Development Partners, L.P.s assets will be sold to third parties and the proceeds distributed to the

Company and PSAC Storage Investors, LLC in accordance with the partnership agreement. If PSAC Storage

Investors, LLC does not exercise its right to early termination during the sixth year, the partnership will be

liquidated 15 years after its formation with the assets sold to third parties and the proceeds distributed to the

Company and PSAC Storage Investors, LLC in accordance with the partnership agreement.

PSAC Storage Investors, LLC provides Mr. Hughes with a fixed yield of approximately 8.0% per annum

on his preferred non-voting interest (representing an investment of approximately $64.1 million at December 31,

2003). In addition, Mr. Hughes can receive up to 1% of cash flow of the Partnership (estimated to be less than

$50,000 per year) if PSAC Storage Investors, LLC elects an early termination. If PSAC Storage Investors, LLC

does not elect to cause an early termination, Mr. Hughes 1% interest can increase to up to 10%.

Disposition of properties: During 2003, the Company sold certain self-storage facilities, which were

located in non-strategic markets and locations, for an aggregate of approximately $21.0 million. The Company

used the proceeds from these sales as a source of funding for developments and third-party acquisitions. The

Company continually reviews its portfolio for facilities that are not strategically located and determines the proper

method of disposition of these facilities.

See Managements Discussion and Analysis of Financial Condition and Results of Operations-Liquidity

and Capital Resources.

Investments in Real Estate and Real Estate Entities

Investment Policies and Practices with respect to our investments: Following are our investment

practices and policies which, though we do not anticipate any significant alteration, can be changed by the Board of

Directors without a shareholder vote:

• Our investments primarily consist of direct ownership of self-storage properties (the nature of our self-

storage properties is described in Item 2, Properties), as well as partial interests in entities that own

self-storage properties, which are located in the United States.

• Our investments are acquired both for income and for capital gain.