Public Storage 2003 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2003 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

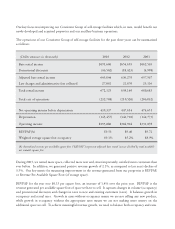

historical trends. We do not expect any meaningful reduction in this number in the near term. We

recognize a significant opportunity to improve profitability by reducing our customer acquisition costs.

The positive trends in revenue growth in 2003 and into 2004 have been, and will continue to be,

moderated by expense growth. Costs of operations in our Consistent Group increased about 11% for the

year. Expense increases were across the board, but primarily concentrated in customer acquisition costs,

personnel and repairs and maintenance. We expanded our hiring, training and retention programs to

improve the caliber of our operating personnel, retaining and motivating our best and brightest and to

improve customer service levels through proper staffing. Total hours increased approximately 5%. We also

initiated a restricted stock incentive program for field management personnel. Our repairs and

maintenance, as well as maintenance capital expenditures, increased in 2003 and will continue to increase

in 2004. On average, our portfolio is about 20 years old and is in need of some cosmetic improvements.

We are striving to have a competitive product, in rent ready condition at all times, which provides good

value to our customers.

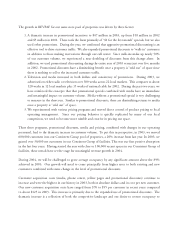

Ancillary Business Operations

Our ancillary businesses continue to make positive and growing contributions to earnings. While not of

great magnitude individually, collectively, the containerized moving and storage, merchandise sales,

consumer truck rental and tenant insurance businesses made a positive and measurable impact on our

operating results during the year. Most of these positive results were driven by increased customer traffic

flow from our primary business, self-storage.

With respect to the continuing operations of our containerized storage business, revenues were over 14%

higher due to higher rates. During the year, we have focused on segmenting the containerized storage

business away from the self-storage business, trying to attract different customers and pricing the product

according to its service and value. Operating expenses were down significantly compared to last year,

resulting in a year-over-year increase in net income of $5 million. Taking the results of our discontinued

operations into account, net income was over $2 million versus a loss of $10 million for 2002. We decided

to close an additional nine facilities during 2003, which followed the closure of 22 facilities in 2002.

Our ancillary operations also include tenant insurance, truck rental (both our own and as an agent of

Penske) and retail sales (locks and boxes). These businesses all grew as a result of increased customer

volume, better pricing and expense controls.

Revenues of our continuing ancillary operations increased 13% to $90 million. Net income from these

continuing operations improved by almost $7 million. These businesses continue to provide important

complimentary products to our self-storage customers, enabling them to one-stop shop for their moving

and storage needs.