Pitney Bowes 2003 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2003 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

We achieved solid financial results in 2003. We met

our revenue, earnings and cash flow objectives,

and we substantially increased the company’s

financial flexibility in support of our growth

strategies. We also delivered a total return to

our shareholders of 28 percent, which consisted

of a stock price increase of 25 percent and our

dividend yield of 3 percent.

We grew our revenue by 4 percent to a total of

$4.6 billion. Favorable currency rates contributed

about 3 percent to our growth and were largely

responsible for strong growth in our international

operations (15 percent growth rate for non-U.S.

operations, compared with 1 percent in the U.S.).

Our revenue growth also was affected positively

by the acquisitions of PSI Group and DDD

Company, and negatively by our decision to

reduce our exposure to non-core financing.

On an “organic” basis (without the effects due

to currency and strategic actions), our revenue

growth rate was slightly positive for the year.

We met our earnings per share guidance

each quarter. Excluding “special items”

(e.g. restructuring charges, one-time write-offs)

our adjusted earnings per share from continuing

operations was $2.41 in 2003, compared with

$2.37 in 2002. If we exclude the impact of

non-core financing, our adjusted earnings grew

by 6 percent (from $2.13 to $2.25 per share).

On a GAAP basis, our earnings per share was

$2.11 in 2003, which compares with $1.97

in 2002. On page 29, we provide a reconciliation

between these GAAP numbers and our adjusted

results. The most significant special item during

2003 was an after-tax restructuring charge of

$75 million, which primarily reflects our actions

to outsource manufacturing and streamline

our infrastructure.

We generated over $850 million of cash from

operations and exceeded our target for “free

cash flow” (cash from operations less capital

expenditures). We also obtained over $300 million

of cash from our reduced investment in non-core

financing. As a result, we were able to increase

our dividend rate, repurchase $200 million of

common stock and reduce our total debt

outstanding by about $400 million.

We also restructured our debt to lengthen the

average maturity and to reduce our exposure to

potentially higher interest rates. As of the end of

2003, about 80 percent of our debt was long-term

and about 70 percent had a fixed interest rate.

As we look to 2004, we are optimistic about the

prospects for an improving global economy.

However, because of our relatively high percentage

of recurring revenue (about 77 percent in 2003),

we tend to lag the overall economy, and it generally

takes four quarters before we see the full effects

of an economic upturn in our results. In addition,

we will experience another year-over-year decline

in earnings from non-core financing, and we will

incur higher benefits and other non-controllable

expenses. However, while these factors will

constrain our earnings growth in 2004, we project

that they will have a lesser impact in future years.

We remain steadfastly committed to delivering

shareholder value and are confident that we

have the business model, growth strategies

and financial flexibility to make Pitney Bowes a

compelling investment for the foreseeable future.

Bruce Nolop

Executive Vice President and

Chief Financial Officer

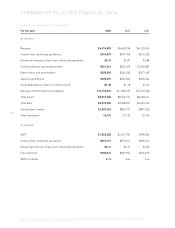

FINANCIAL HIGHLIGHTS FROM OUR CFO