North Face 2006 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2006 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUMMARY ANNUALREPORT 2006

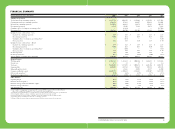

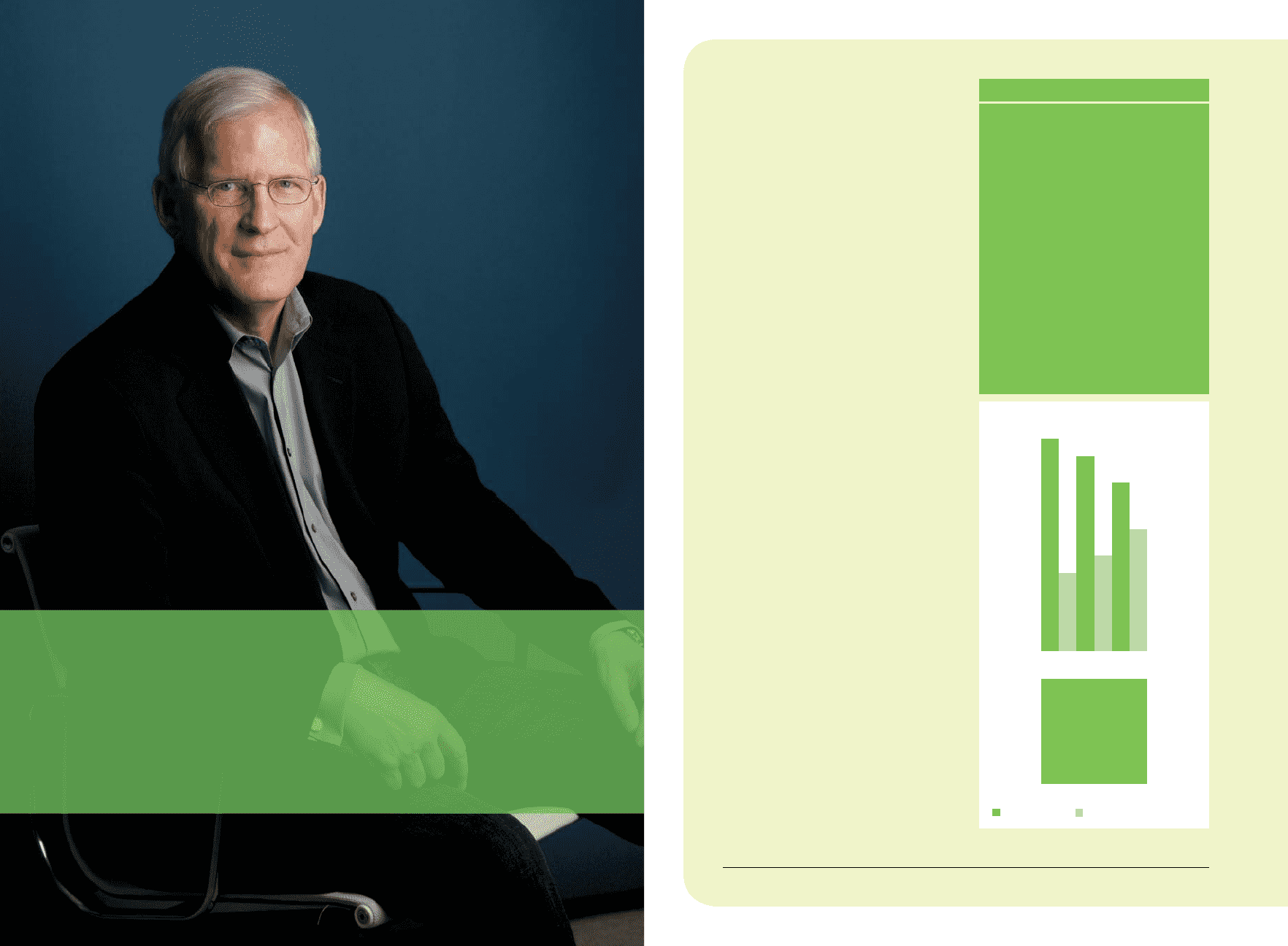

I am pleased to report that 2006

marked another year of record financial

performance, great progress in our efforts

to transform VF and excellent returns

for our shareholders. We enter 2007

looking forward to a fifth consecutive

year of record revenues and earnings,

bolstered by a newly rebalanced business

portfolio designed to drive strong growth

and profitability.

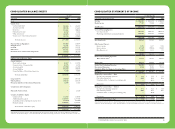

We began 2007 with a historic announce-

ment — the planned sale of our global

Intimates business. This important step is

part of our ongoing transformation toward

becoming a higher-growth, higher-margin

lifestyle brand company. Contributing

revenues of over $800 million and operating

income of approximately $50 million in

2006, Intimates has played an important

and positive role in our success over our

100-plus-year history. However, the

time has come to rebalance our portfolio

strategically and focus our energies and

resources on the many growth opportunities

within our Jeanswear, Outdoor, Imagewear

and Sportswear businesses instead. The

main implications of this sale are threefold.

The first relates to our business mix.

When we launched our Growth Plan

in 2004, over 70 percent of our revenues

came from our heritage businesses —

Jeanswear, Imagewear and Intimates —

and nearly 30 percent came from our

lifestyle segments — Outdoor and Sports-

wear. The Plan established a target of

60 percent of revenues from our lifestyle

businesses. As a result of the sale of our

Intimates business, and the continued

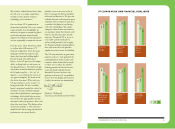

Growth in revenues

and earnings per

share from continuing

operations of

10%

and 12%, respectively.

A 90% increase in our

quarterly cash dividend

to an annual rate of

$2.20 per share.

A 48% increase in

VF’s stock price.