North Face 2000 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2000 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

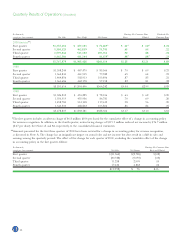

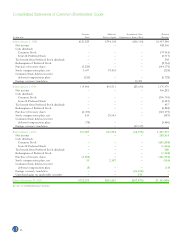

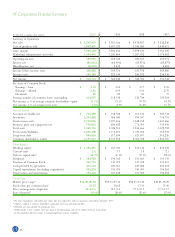

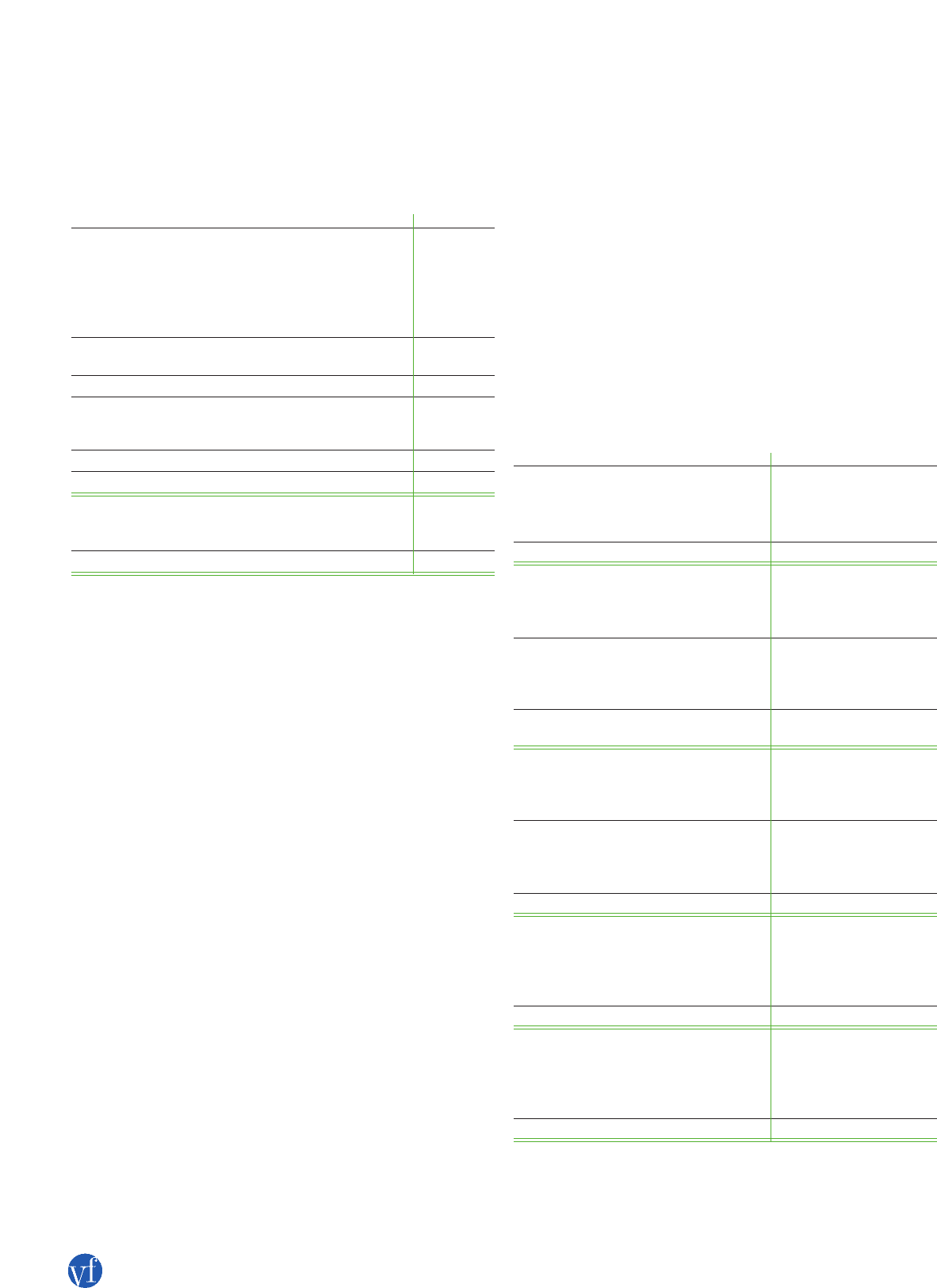

Deferred income tax assets and liabilities consist of the following:

In thousands 2000 1999

Deferred income tax assets:

Employee benefits $ 53,064 $ 51,582

Inventories 23,463 19,990

Other accrued expenses 117,511 79,767

Operating loss carryforwards 104,143 71,911

Foreign currency translation 46,372 34,869

344,553 258,119

Valuation allowance (57,033) (46,526)

Deferred income tax assets 287,520 211,593

Deferred income tax liabilities:

Depreciation 45,985 56,103

Other 32,124 25,244

Deferred income tax liabilities 78,109 81,347

Net deferred income tax assets $209,411 $130,246

Amount included in:

Current Assets $118,314 $ 74,067

Other Assets 91,097 56,179

$209,411 $130,246

As of the end of 2000, the Company has not provided deferred

U.S. income taxes on $18.7 million of undistributed earnings of

international subsidiaries where such earnings are considered to be

permanently invested. The Company has $185.1 million of foreign

operating loss carryforwards expiring at various dates; a valuation

allowance has been provided where it is more likely than not that

the deferred tax assets relating to certain of those loss carryforwards

will not be realized. Income taxes paid were $183.4 million in

2000, $228.0 million in 1999 and $215.2 million in 1998.

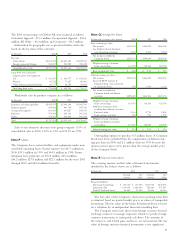

Note O Business Segment Information

The Company designs and manufactures apparel products marketed

primarily under Company-owned brand names. Customers are

primarily department, discount and specialty stores throughout

the world.

The Company manages its businesses through separate market-

ing companies that support specific brands. Manufacturing and

product sourcing needs are met by groups that support individual

or in some cases several different product types. These operations

have been aggregated into three reportable segments. The

“Consumer Apparel” segment includes jeanswear and related

products, women’s intimate apparel and swimwear, and children’s

apparel, all having similar characteristics of economic performance,

product type, production process, method of distribution and class

of customer. The “Occupational Apparel” segment is distinguished

from the Consumer Apparel segment because of a different class

of customer. The “All Other” segment consists of the Company’s

knitwear, outdoor apparel and equipment, and daypack operations,

which have different product or economic characteristics than

those in the other segments.

Management evaluates the operating performance of each of

its marketing companies based on their income from operations.

Accounting policies used for segment reporting are consistent with

those stated in Note A, except that inventories are valued on a

first-in, first-out basis and that interest income and expense and

amortization of intangible assets are not allocated to individual

segments. Corporate and other expenses include expenses incurred

in and directed by the Corporate offices that are not allocated to

specific business units. Segment assets are those used directly in

the operations of each business unit, such as accounts receivable,

inventories and property, plant and equipment. Corporate assets

include investments and deferred income taxes. Financial informa-

tion for the Company’s reportable segments is as follows:

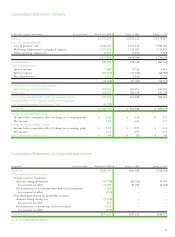

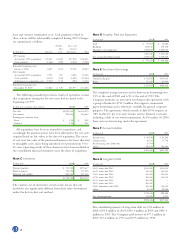

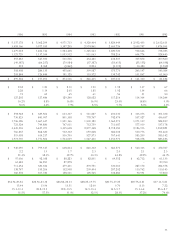

In thousands 2000 1999 1998

Net sales:

Consumer Apparel $4,227,997 $4,276,809 $4,313,082

Occupational Apparel 661,635 640,227 482,931

All Other 858,247 634,580 682,794

Consolidated net sales $5,747,879 $5,551,616 $5,478,807

Segment profit:

Consumer Apparel $ 605,197 $ 629,127 $ 693,638

Occupational Apparel 3,050 79,164 80,988

All Other 54,897 57,715 38,686

Total segment profit 663,144 766,006 813,312

Interest, net (81,032) (62,490) (55,871)

Amortization of intangible assets (36,400) (33,097) (32,890)

Corporate and other expenses (114,179) (74,843) (92,953)

Consolidated income before

income taxes $ 431,533 $ 595,576 $ 631,598

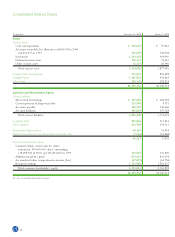

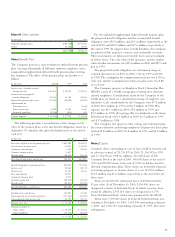

Segment assets:

Consumer Apparel $1,780,493 $1,783,225 $1,858,873

Occupational Apparel 348,134 379,004 247,734

All Other 457,195 332,850 377,155

Total segment assets 2,585,822 2,495,079 2,483,762

Cash and equivalents 118,891 79,861 63,208

Intangible assets 1,101,876 992,463 951,562

Corporate assets 551,567 459,111 338,134

Consolidated assets $4,358,156 $4,026,514 $3,836,666

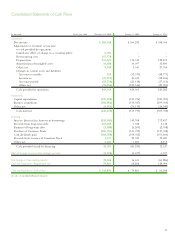

Capital expenditures:

Consumer Apparel $ 68,115 $ 97,196 $ 129,532

Occupational Apparel 11,072 20,845 19,362

All Other 14,920 8,358 11,480

Corporate 31,117 23,677 28,685

Consolidated capital expenditures $ 125,224 $ 150,076 $ 189,059

Depreciation expense:

Consumer Apparel $ 83,260 $ 89,313 $ 83,382

Occupational Apparel 15,515 14,958 11,769

All Other 24,295 23,555 26,165

Corporate 13,952 6,509 7,179

Consolidated depreciation expense $ 137,022 $ 134,335 $ 128,495