North Face 2000 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2000 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

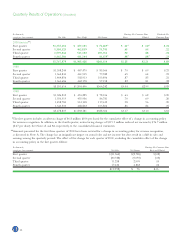

18

due to higher U.S. tax credits, taxes not provided on

permanently invested foreign earnings and lower state

income taxes.

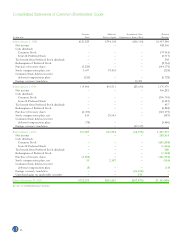

Reported net income was $260.3 million in 2000, or

$2.25 per share, compared with $366.2 million ($3.04

per share) in 1999 and $388.3 million ($3.17 per share)

in 1998. Excluding the effects of restructuring charges

and the cumulative effect of a change in accounting

policy, net income in 2000 was $343.8 million, or $2.98

per share. Net income declined by 6% from the 1999

level, while earnings per share declined by 2%, reflecting

the benefit of the Company’s share repurchase program.

The 2000 acquisitions had a $.06 negative impact on

2000 reported earnings per share, and the stronger U.S.

dollar in 2000 had a $.05 negative impact on earnings

per share compared with the prior year. Similarly, 1999

net income declined by 6% from 1998, while earnings

per share declined by 4%, again reflecting the benefit of

the Company’s share repurchase program.

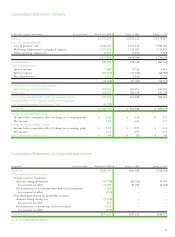

Information by Business Segment

The Consumer Apparel segment consists of jeanswear,

women’s intimate apparel, women’s swimwear, and the

children’s apparel businesses. Overall, segment sales

declined by 1% in each of the last two years. In 2000,

domestic jeanswear sales increased by 5%, with strength

across the mass, western and Lee marketing units.

European jeanswear sales declined due to the negative

effects of foreign currency translation. In other inter-

national markets, jeanswear sales increases in Latin

America were offset by a decline in the Wrangler busi-

ness in Japan. Domestic intimate apparel sales declined

9% in 2000, as increases in department store brands

were more than offset by the absence of new private

label programs and by a reduction in Vassarette brand

sales in the mass channel of distribution. Segment

profit in 2000, excluding $71.0 million of restructuring

charges, increased 7% over 1999, led by growth in sales

and profit margins in both domestic and international

jeanswear. In 1999, sales increases in mass market

domestic jeanswear and in the newly acquired Latin

American jeanswear businesses offset declines reported

in the Lee branded domestic business and in European

jeanswear businesses. The decline in Lee related to the

overall softness in retail sales in mid-tier department

stores in the U.S., and the decline in Europe was due

to a consumer shift away from basic jeans products to

alternative fabrics and styles. Segment profit in 1999

declined due to lower sales in Lee, lower sales in

Europe, operating difficulties resulting from European

jeanswear consolidation efforts, and a $6 million charge

to close the Jantzen women’s sportswear division.

The Occupational Apparel segment includes

the Company’s industrial, career and safety apparel

businesses. Sales increases in each of the last two years

were due to one acquisition in the latter part of 1998

and three acquisitions in early 1999. Segment profit in

2000 includes $34.6 million of restructuring costs.

Excluding these restructuring costs, segment profit still

declined significantly in 2000 due to manufacturing

and distribution inefficiencies related to integration of

the recently acquired companies. Segment profit in

1999 declined as a percent of sales from 1998 due to

the lower level of profitability of the acquired businesses

and to systems, distribution and other costs incurred

to integrate these new businesses into VF’s existing

infrastructure.

The All Other segment includes the Company’s

knitwear and outdoor-related businesses represented

by the JanSport and Eastpak brands (backpacks and

daypacks) and The North Face branded products

(outerwear and equipment). Sales increased primarily

from The North Face and Eastpak acquisitions in

May 2000. Segment profit, excluding $6.0 million

of restructuring costs in 2000, advanced only slightly

from the prior year level because of the low level of

profitability of the newly acquired businesses. Sales and

profit, excluding restructuring costs, in the Company’s

knitwear business increased in 2000 from the 1999

levels. With difficult market conditions and pricing

pressures, our knitwear profitability continues to be

below overall Company averages.

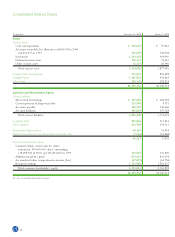

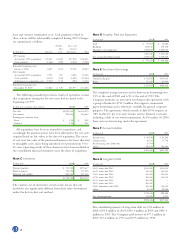

Analysis of Financial Condition

In managing its capital structure, it is management’s

goal to maintain a debt to capital ratio of less than

40%, while providing flexibility to pursue investment

opportunities that may become available. Our debt to

capital ratio remains within these guidelines: 34.7% at

the end of 2000 and 30.1% at the end of 1999.

Balance Sheets

Even with higher fourth quarter sales, accounts receiv-

able decreased in 2000 due to slightly lower day’s

sales outstanding. Inventories increased 17% in 2000.

Excluding businesses acquired in 2000, inventories

increased by 6%, primarily due to increases at domestic

jeanswear as their sales have grown. Management

has targeted an inventory reduction of as much as

$100 million during 2001.

Intangible assets increased during 2000 due to the

acquisitions completed during the year. This increase

was partially offset by the reduction in intangible assets

related to disposition of the Wrangler business in Japan.

The increase in other accrued liabilities results

from the restructuring charges recorded in the fourth

quarter of 2000.

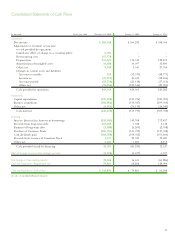

Debt to Capital Ratio

Percent

27.1

30.1

34.7

98 99 00

VF’s debt to capital ratio

remains well within our

target range, providing

f

lexibility to pursue a variet

y

o

f

investment o

pp

ortunities.

Cash Provided by

Operations

Dollars in millions

429 423

443

98 99 00

Cash provided by operations

remains strong, due in part

to VF’s conservative manage-

ment o

f

workin

g

ca

p

ital.