North Face 2000 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2000 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

awards entitle the participants to the right to receive shares of VF

Common Stock, with the number of shares to be earned based on

the three year total shareholder return of VF Common Stock com-

pared with a peer group of major apparel companies. Shares earned

at the end of each three year period are issued to participants in

the following year, unless they elect to defer receipt of the shares.

A total of 39,923 shares and 44,962 shares of VF Common Stock

were earned for the three year performance periods ended in 2000

and 1999, respectively. At the end of 2000, there are 33,875 stock

awards outstanding for the performance period ending in 2001 and

54,711 for the performance period ending in 2002. Compensation

expense equal to the market value of the shares to be issued is

recognized over each three year performance period. Expense of

$1.8 million and $2.0 million was recognized for this plan in 2000

and 1999, respectively. A total of 37,911 shares of Common Stock

are issuable in future years to participants who have elected to

defer receipt of their shares earned.

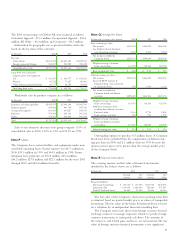

Note M Restructuring Costs

During the fourth quarter of 2000, the Company recorded pretax

charges totaling $119.9 million ($.67 per share) aimed at eliminating

certain underperforming businesses and reducing the Company’s

overall cost structure. These charges related to exiting certain busi-

nesses and product lines, closing higher cost manufacturing facilities,

consolidating distribution and administrative operations and writing

down assets.

As part of the above charge, the Company recorded costs

totaling $69.7 million to exit several underperforming businesses.

Effective December 27, 2000, the Company transferred its Wrangler

business in Japan to a licensee and recorded a pretax loss on disposi-

tion of $26.8 million, of which $23.8 million related to the write-

off of intangible assets. In the occupational apparel business units,

the Company discontinued its regional catalog and linens businesses

and exited other unprofitable product lines arising from certain of

the companies acquired in late 1998 and early 1999. Finally, the

Company decided to exit certain intimate apparel product lines

having limited profit and growth potential. Sales of these businesses

included in the consolidated operating results were $101 million in

2000, $138 million in 1999 and $92 million in 1998.

Also included are charges of $18.5 million to close certain higher

cost North American manufacturing facilities as part of the

ongoing strategy of moving toward lower cost, more flexible global

sourcing. In other actions, the Company recorded $31.7 million

of other restructuring costs relating to closing and consolidating

distribution centers and administrative offices and functions in the

U.S., Europe and Latin America.

The restructuring costs were recorded in the Consolidated

Statement of Income in Cost of Products Sold – $55.9 million;

Marketing, Administrative and General – $37.2 million; and Other

Operating Expense – $26.8 million. A total of $22.4 million of

the costs relate to personnel reductions, including severance and

related benefits. These actions affect approximately 2,700 of the

Company’s employees. As of December 30, 2000, 400 employees

have been terminated. The remainder of the employees, all of

whom have been notified, are generally located at manufacturing

facilities and will work through the plant closing transition periods

that end in 2001.

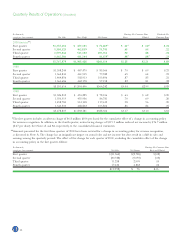

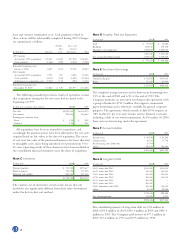

Activity in the restructuring accrual is summarized as follows:

Facilities Other Lease and

Exit Asset Contract

In thousands Severance Costs Write-downs Termination Total

Total restructuring costs $22,367 $ 21,850 $ 59,996 $15,695 $119,908

Noncash charges:

Intangible assets – – (23,819) – (23,819)

Inventories – – (22,392) – (22,392)

Other – (20,381) (13,785) – (34,166)

Cash payments (1,976) (8) – (154) (2,138)

Balance

December 30, 2000 $20,391 $ 1,461 $ 0 $15,541 $ 37,393

Remaining severance and other cash payments will be made

into 2002.

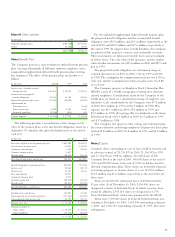

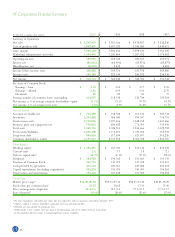

Note N Income Taxes

The provision for income taxes is computed based on the follow-

ing amounts of income before income taxes and cumulative effect

of change in accounting policy:

In thousands 2000 1999 1998

Domestic $429,453 $567,545 $582,128

Foreign 2,080 28,031 49,470

$431,533 $595,576 $631,598

The provision for income taxes consists of:

In thousands 2000 1999 1998

Current:

Federal $130,740 $175,052 $174,346

Foreign 23,957 14,113 35,082

State 17,753 19,607 14,757

172,450 208,772 224,185

Deferred, primarily federal (8,033) 20,562 19,107

$164,417 $229,334 $243,292

The reasons for the difference between income taxes computed

by applying the statutory federal income tax rate and income tax

expense in the financial statements are as follows:

In thousands 2000 1999 1998

Tax at federal statutory rate $151,037 $208,452 $221,059

State income taxes,

net of federal tax benefit 6,169 12,744 9,592

Amortization of intangible assets 8,812 8,241 7,916

Foreign operating losses

with no current benefit 20,613 13,871 8,988

Change in valuation allowance (4,951) (2,263) (4,273)

Other, net (17,263) (11,711) 10

$164,417 $229,334 $243,292