North Face 2000 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2000 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

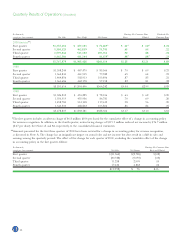

of $55.9 million in 2000, gross margins were flat with

1999 at 34.1%. Gross margins benefited from higher

than average margins in the companies acquired in

2000. In addition, margins were favorably impacted

during the last two years from the continuing shift to

lower cost sourcing, lower raw material costs and

increased operating efficiencies. Offsetting these

increases in 2000 were lower gross margins in occupa-

tional apparel. In 1999, lower gross margins in the

domestic Lee jeanswear and European jeanswear

businesses reduced overall ratios from the prior year.

For the U.S. market, VF manufactures its products

in owned domestic plants and offshore plants, primarily

in Mexico, and contracts production from independent

contractors mostly located outside of the U.S. The

amount of domestic sales derived from products manu-

factured in lower cost locations outside the U.S. has

increased each year over the last three years to where

now 67% is sourced from international locations.

Similarly, in foreign markets over the last three years,

sourcing has shifted from higher cost owned plants

located primarily in western Europe to lower cost

owned and contracted production in locations outside

of western Europe.

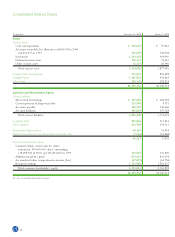

Marketing, administrative and general expenses were

23.5% of sales in 2000, compared with 22.2% in 1999

and 21.9% in 1998, respectively. Excluding restructuring

charges of $37.2 million in 2000, expenses were 22.9%

of sales. Expenses as a percent of sales increased in

2000 due to the higher than average expense levels of

the 2000 acquisitions. Expenses as a percent of sales

increased in 1999 primarily due to fixed short-term

expenses on a lower sales level in European jeanswear,

partially offset by lower advertising spending.

Other operating income and expense includes

amortization of intangible assets, net royalty income

and, in 2000, the $26.8 million loss on disposal of

the Wrangler business in Japan representing primarily

the write-off of intangible assets. In each of the last

two years, amortization of intangible assets increased

because of acquisitions completed during those years.

Net royalty income in 2000 was flat with 1999 but

declined from 1998 due to the conversion of certain

formerly licensed businesses to owned operations.

Net interest expense increased in each of the last

two years due to higher borrowings related to the

business acquisitions and, to a lesser extent, higher

interest rates.

The effective income tax rate was 38.1% (before

cumulative effect of a change in accounting policy) in

2000 and 38.5% in 1999 and 1998. Excluding the

effect of the restructuring charges, the effective tax rate

was 37.7% in 2000. The effective rate declined in 2000

Analysis of Operations

Restructuring Actions

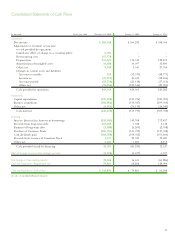

During the fourth quarter of 2000, management

announced that it intended to exit several underper-

forming businesses and to aggressively reduce its overall

cost structure to get the Company on track to achieve

our long-term earnings growth target of 8% to 10%

per year. Accordingly, we recorded pretax charges

of $119.9 million ($.67 per share) to implement these

initiatives.

As part of these restructuring charges, the Company

recorded costs of $69.7 million to exit several under-

performing businesses. The Company transferred its

Wrangler business in Japan to a licensee and incurred

a loss on disposition of $26.8 million, of which

$23.8 million related to the write-off of intangible

assets. In the occupational apparel business units, the

Company eliminated several product lines that were

part of the acquisitions made in late 1998 and early

1999 and decided to exit certain intimate apparel lines

determined to have limited potential. During 2000,

these businesses or product lines had sales of $101 mil-

lion and incurred $20 million of operating losses.

Also included in the restructuring charges was

$18.5 million to close higher cost manufacturing facilities

as part of our ongoing strategy of moving toward

lower cost, more flexible global sourcing. In addition,

the Company recorded $31.7 million of costs to close

or consolidate distribution centers and administrative

offices and functions.

The elimination of operating losses of the closed

businesses and savings from the manufacturing, distri-

bution and administrative cost reduction initiatives

should result in an annualized benefit to pretax earn-

ings of $45 million. See Note M to the consolidated

financial statements for more information on the

restructuring charges.

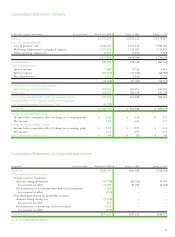

Consolidated Statements of Income

Consolidated sales rose 4% to a record $5,748 million

in 2000. The sales increase was primarily due to the

acquisitions completed in 2000, plus increases in our

domestic jeanswear, knitwear and playwear businesses,

offset by declines in our international businesses pri-

marily due to foreign currency translation. In translat-

ing foreign currencies into the U.S. dollar, the stronger

U.S. dollar reduced 2000 sales comparisons by $73

million. Sales in 1999 rose 1% over the 1998 level. This

was primarily due to the 1999 acquisitions, offset in

part by a slowdown in the jeanswear market in Europe

and in the mid-tier channel of distribution in the U.S.

Gross margins were 33.2% of sales in 2000, compared

with 34.1% in 1999 and 34.5% in 1998. Excluding

restructuring charges included in cost of products sold

Management’s Discussion and Analysis of

Operations and Financial Condition

Sales

D

ollars

in

millions

5

,

47

9

5,552

5

,

74

8

98

99

00

S

ales reached record level

s

in 2000.

Gross Margin

P

ercent

to

sales

34.

5

3

4.

1

33.2

98

99

00

Excludin

g

the e

ff

ects o

f

restructuring charges in 2000,

g

ross margins would have

been even with 1999 levels.