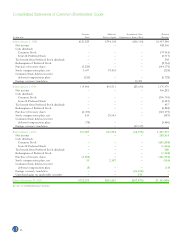

North Face 2000 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2000 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

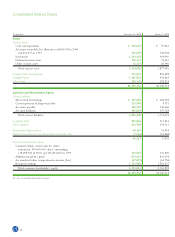

Total long-term debt increased through the

September 2000 issuance of $300.0 million of 8.10%

notes due in 2005 and $200.0 million of 8.50% notes

due in 2010. Proceeds from these debt obligations were

used to repay short-term borrowings. Current maturi-

ties of long-term debt increased as $114.0 million

becomes payable in 2001 and is expected to be funded

by cash flow from operations.

The accumulated other comprehensive loss compo-

nent of Common Shareholders’ Equity increased during

2000 due to foreign currency translation adjustments

resulting from the strengthening of the U.S. dollar in

relation to the currencies of most European countries

where the Company has operations.

Liquidity and Cash Flows

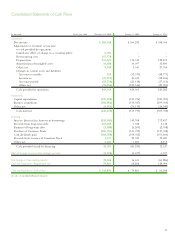

Working capital was $1,103.9 million and the current

ratio was 2.1 to 1 at the end of 2000, compared with

$763.9 million and 1.7 to 1 at the end of 1999. The

increase in 2000 was due to the increase in inventories

and repayment of short-term borrowings with the

proceeds of the long-term debt offering.

The primary source of liquidity is the Company’s

strong cash flow provided by operations, which was

$443.3 million in 2000, $423.4 million in 1999 and

$429.3 million in 1998.

Capital expenditures were $125.2 million in 2000,

compared with $150.1 million and $189.1 million in

1999 and 1998, respectively. Capital expenditures relate

to ongoing investments in information systems and

capital improvements in our worldwide manufacturing

and other facilities. Capital expenditures in 2001 are

expected to be slightly higher than the 2000 level, but

below historical levels, and will be funded by cash flow

from operations. Capital expenditures have declined

from the 1999/1998 levels due to slower expansion in

offshore manufacturing capacity, primarily in jeanswear.

During 2000, the Company purchased 4.0 million

shares of its Common Stock in open market transactions

at a cost of $105.7 million. During 1999, the Company

purchased 4.0 million shares for $149.1 million. Under

its current authorization from the Board of Directors,

the Company may purchase up to an additional 4.0 mil-

lion shares. Depending on other opportunities that may

arise, the Company intends to purchase approximately

one million shares per quarter during 2001.

Cash dividends totaled $.89 per common share in

2000, compared with $.85 in 1999 and $.81 in 1998.

The dividend payout rate increased to 40% due to

lower 2000 earnings (30% excluding the two unusual

items), compared with a payout rate of 28% in 1999

and 26% in 1998. The indicated annual dividend rate

for 2001 is $.92 per share. VF has paid dividends on its

Common Stock annually since 1941 and intends to

maintain a long-term payout rate of 30%.

Looking ahead to 2001, sales should rise slightly

above 2000 levels, with the sales increases from the

2000 acquisitions partially offset by the absence

of $101 million in sales related to the workwear,

Wrangler Japan and other businesses that we exited in

2000. Management believes that the benefits from the

restructuring initiatives described previously, as well as

increased profitability in the workwear businesses and

in the recently acquired companies, are necessary for

the Company to achieve its long-term earnings growth

target of 8% to 10%. For 2001, that implies a range in

earnings per share of $3.21 to $3.28. We expect cash

flow from operations to be approximately $450 million

to $500 million. With our strong financial position,

unused credit lines and additional borrowing capacity,

the Company has substantial liquidity and flexibility to

meet investment opportunities that may arise.

Euro Currency Conversion

Effective January 1, 1999, 11 of the 15 member coun-

tries of the European Union established fixed conver-

sion rates between their existing currencies and a single

new currency, the “euro.” During a transition period

through December 2001, business transactions can be

conducted in both the euro and the legacy currencies,

while cash transactions remain in the legacy currencies.

After that date, the euro will be the sole currency of

the participating countries for business transactions.

Beginning in January 2002, new euro-denominated

currency will be issued by the participating countries,

and their legacy currencies will cease to be legal tender

effective June 30, 2002. Approximately 9% of the

Company’s 2000 sales were generated in the participat-

ing countries of the European Union.

We have evaluated all information technology systems

and have concluded that they are euro compliant. We

are also evaluating the strategic implications of adopting

the euro, including pricing and distribution of the

Company’s products. Although this evaluation is ongo-

ing, it is likely that the euro will lead to more uniform

pricing in all European markets, including those that

have not adopted the euro as their common currency.

The financial impact of the conversion to the euro on

the Company’s operations will depend on the competi-

tive conditions that exist in the various regional markets.

However, management believes that the conversion

to the euro will not have a material effect on the

Company’s results of operations or financial position.

All costs relating to the conversion to the euro, which

are not significant, are being expensed as incurred.

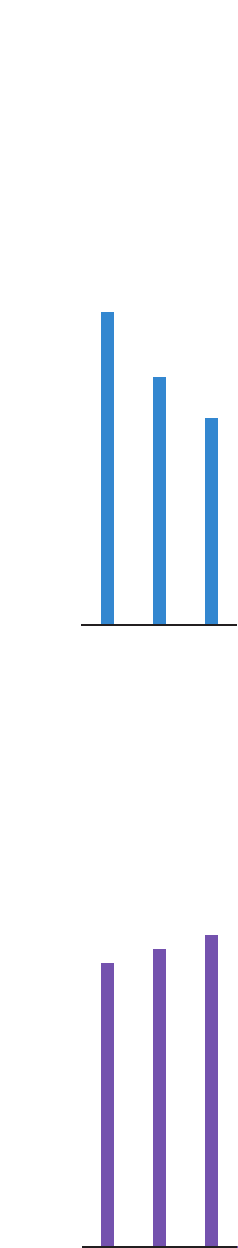

Capital Expenditures

Dollars in millions

189

150

125

98 99 00

Capital expenditures declined

in 2000, as the rate of

manufacturing expansion

has slowed.

Dividends per Share

Dollars

0.81

0.85

0.89

98 99 00

VF’s dividend payout rose

5% for 2000, with an

indicated payout of $.92 pe

r

share for 2001.