North Face 2000 Annual Report Download

Download and view the complete annual report

Please find the complete 2000 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Talking Business

Taking Action

VF Corporation 2000 Annual Report

Table of contents

-

Page 1

Talking Business Taking Action VF Corporation 2000 Annual Report -

Page 2

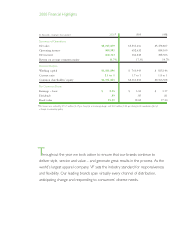

...In thousands, except per share amounts 2000* 1999 1998 Summary of Operations Net sales Operating income Net income Return on average common equity Financial Position Working capital Current ratio Common shareholders' equity Per Common Share Earnings - basic Dividends Book value $ 2.25 .89 19.52... -

Page 3

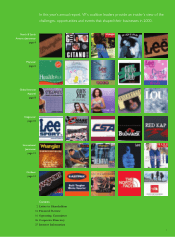

In this year's annual report, VF's coalition leaders provide an insider's view of the challenges, opportunities and events that shaped their businesses in 2000. North & South America Jeanswear page 4 Playwear page 6 Global Intimate Apparel page 8 Imagewear page 10 International Jeanswear page ... -

Page 4

... as Vanity Fair's Illumination® bras and the Lily of charge and the change in accounting policy, we France X-BraTM and Strappies bras. 2000 also reported earnings per share of $2.25 in 2000. marked the successful launch of a new line of Our core jeanswear, playwear, daypack, intimate apparel under... -

Page 5

... explorers. In addition to opening up new product categories and retail channels for VF, the extraordinary strength of The North Face brand offers excellent opportunities for future growth. Managing the business. Managing a portfolio of global brands is a dynamic process. In 2000 we made changes to... -

Page 6

...of products will best satisfy consumers and retailers, and then we use our brands and service capabilities to fulï¬ll their needs across different retail channels. For example, Lee products are sold to consumers shopping in middle tier stores, while Wrangler, Rustler, Riders and Brittania jeans are... -

Page 7

LEADERSHIP 5 -

Page 8

EXCITEMENT 6 -

Page 9

... our business, cut costs and got well-styled, great value products to market - all of which improved our proï¬tability. John Schamberger The market for children's apparel VP and Chairman - Playwear Coalition is very fragmented, with most brands having market shares in the low singledigits. Private... -

Page 10

... we work with department, chain, mass merchandise and specialty stores, with brands targeted to each. Our Vanity Fair, Lily of France, Vassarette and Bestform brands have strong market share positions in their respective channels, particularly in the bra category. In Europe, we distribute our brands... -

Page 11

EXCELLENCE Acquire a certain air. VFB0011-08 FT T h e A i r B r a 9 -

Page 12

POWERFUL 10 -

Page 13

... Service. We'll be launching a number of catalog web sites for our customers, giving more than 300,000 of their employees the convenience of shopping and paying for their career apparel via the Internet. What Lies Ahead *Licensed In 2000, our licensed sports division handled its biggest special... -

Page 14

... brand, acquired late in 2000. It's the number one female brand in Germany and is strong throughout eastern Europe. It's our goal to extend the H.I.S brand across Europe, where it will complement our more male-oriented Wrangler and Lee businesses. A mass market for branded jeans is still developing... -

Page 15

EXPANDING AUTHENTIC AMERICAN JEANS 13 -

Page 16

INNOVATIVE 14 -

Page 17

... In mid-2000, we acquired the Eastpak brand, a leader in mass merchandise stores in the U.S. and the number one brand in Europe as well. Capping the year was the acquisition of The North Face, the premium brand of technical outdoor apparel and products. The combination of these businesses gives us... -

Page 18

... Common Shareholders' Equity 27 Notes to Consolidated Financial Statements 34 Financial Summary 5,000 4,000 3,000 2,000 1,000 91 00 Net sales Gross profit Net income Operating Committee Top row, left to right: John Schamberger, VP and Chairman - North & South America Jeanswear and Playwear... -

Page 19

... over the last three years, sourcing has shifted from higher cost owned plants located primarily in western Europe to lower cost owned and contracted production in locations outside of western Europe. Marketing, administrative and general expenses were 23.5% of sales in 2000, compared with 22.2% in... -

Page 20

... the JanSport and Eastpak brands (backpacks and daypacks) and The North Face branded products (outerwear and equipment). Sales increased primarily from The North Face and Eastpak acquisitions in May 2000. Segment proï¬t, excluding $6.0 million of restructuring costs in 2000, advanced only slightly... -

Page 21

... slower expansion in offshore manufacturing capacity, primarily in jeanswear. During 2000, the Company purchased 4.0 million shares of its Common Stock in open market transactions at a cost of $105.7 million. During 1999, the Company purchased 4.0 million shares for $149.1 million. Under its current... -

Page 22

... support our domestic and European businesses are manufactured in Company-owned plants in foreign countries or by foreign contractors. The Company's primary net foreign currency market exposures relate to the euro, the Mexican peso, the British pound and the Canadian dollar. Management monitors net... -

Page 23

...statements, the Company changed its accounting policy for recognizing revenue in 2000. Mackey J. McDonald Chairman, President and Chief Executive Ofï¬cer PricewaterhouseCoopers LLP Greensboro, North Carolina February 1, 2001 Robert K. Shearer Vice President - Finance and Chief Financial Ofï¬cer... -

Page 24

... impact on annual sales and net income but does result in a shift in sales and earnings among the quarterly periods. The effect of this change for each quarter of 2000, excluding the cumulative effect of the change in accounting policy in the ï¬rst quarter, follows: Net Sales Net Income Earnings... -

Page 25

... 631,598 Cost of products sold Marketing, administrative and general expenses Other operating expense, net Operating Income Other Income (Expense) Interest income Interest expense Miscellaneous, net Income Before Income Taxes and Cumulative Effect of Change in Accounting Policy Income Taxes Income... -

Page 26

...and Shareholders' Equity Current Liabilities Short-term borrowings Current portion of long-term debt Accounts payable Accrued liabilities Total current liabilities Long-term Debt Other Liabilities Redeemable Preferred Stock Deferred Contributions to Employee Stock Ownership Plan Common Shareholders... -

Page 27

...115 12,337 3,397 (60,886) 124,094 $ 63,208 Capital expenditures Business acquisitions Other, net Cash invested Financing Increase (decrease) in short-term borrowings Proceeds from long-term debt Payment of long-term debt Purchase of Common Stock Cash dividends paid Proceeds from issuance of Common... -

Page 28

... Stock Tax beneï¬t from Preferred Stock dividends Redemption of Preferred Stock Purchase of treasury shares Stock compensation plans, net Common Stock held in trust for deferred compensation plans Foreign currency translation Unrealized gains on marketable securities Balance December 30, 2000... -

Page 29

... stock of The North Face, Inc. and acquired the Eastpak backpack and daypack business in May 2000. The Company also acquired the trademark rights to the Chic and Gitano brands and, in October 2000, acquired 85% of the common stock of H.I.S. Sportswear AG. The aggregate cost for these businesses... -

Page 30

... Income taxes Compensation Restructuring costs (Note M) Other 2000 1999 All acquisitions have been accounted for as purchases, and accordingly, the purchase prices have been allocated to the net assets acquired based on fair values at the dates of acquisition. The excess of cost over fair value of... -

Page 31

...based on a September 30 valuation date, plus the funded status at the end of each year: In thousands Fair value of plan assets, beginning of year Actual return on plan assets Company contributions Acquired company plan Beneï¬ts paid Fair value of plan assets, end of year 2000 1999 For the unfunded... -

Page 32

... employees' accounts. Note L Stock Option Plan The Company has granted nonqualiï¬ed stock options to ofï¬cers, directors and key employees under a stock compensation plan at prices not less than fair market value on the date of grant. Options become exercisable generally one year after the date... -

Page 33

... costs relating to closing and consolidating distribution centers and administrative ofï¬ces and functions in the U.S., Europe and Latin America. The restructuring costs were recorded in the Consolidated Statement of Income in Cost of Products Sold - $55.9 million; Marketing, Administrative... -

Page 34

... Segment Information The Company designs and manufactures apparel products marketed primarily under Company-owned brand names. Customers are primarily department, discount and specialty stores throughout the world. The Company manages its businesses through separate marketing companies that support... -

Page 35

... based on quoted market prices or values of comparable borrowings. The fair value of the Series B Preferred Stock is based on a valuation by an independent ï¬nancial consulting ï¬rm. The Company enters into short-term foreign currency forward exchange contracts to manage exposures related to speci... -

Page 36

...,226 1,866,769 835,558 2.1 22.5% 100,141 391,651 460,652 154,262 156,252 Summary of Operations Net sales Cost of products sold Gross margin Marketing, administrative and other Operating income Interest, net Miscellaneous, net Income before income taxes Income taxes Net income 260,334 2.25 2.21 .89... -

Page 37

1996 $ 5,137,178 3,458,166 1,679,012 1,121,729 557,283 (49,387) 512 508,408 208,884 $ $ 299,524 2.32 2.28 .73 127,292 16.2% 8.6% 592,942 730,823 1,706,326 721,524 3,449,535 766,267 519,058 1,973,739 940,059 2.2 21.4% 97,036 61,483 711,454 138,747 160,578 $ $ 1995 $ 5,062,299 3,577,555 1,484,744 1,... -

Page 38

...Co. New York, New York Managing Director Carousel Capital Company, LLC Charlotte, North Carolina (Investment banking and private equity ï¬rms) Director since 1999, age 55 Corporate Ofï¬cers George Fellows 2,5 Former President and Chief Executive Ofï¬cer Revlon, Inc. New York, New York (Cosmetics... -

Page 39

..., North Carolina 27408. Investor Relations Cindy Knoebel, CFA Vice President, Financial and Corporate Communications VF Services, Inc. 628 Green Valley Road, Suite 500 Greensboro, North Carolina 27408 Transfer Agent and Registrar First Chicago Trust Company of New York, a Division of EquiServe Mail... -

Page 40

VF Corporation 628 Green Valley Road Suite 500 Greensboro, North Carolina 27408 www.vfc.com