North Face 1999 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 1999 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

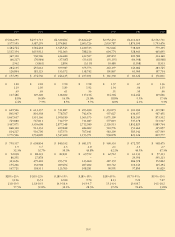

[28]

Stock options outstanding at January 1, 2000 are summarized

as follows:

Weighted

Average Weighted

Range of Remaining Average

Exercise Number Contractual Exercise

Prices Outstanding Life Price

$ 6– 10 8,900 .9 years $ 8.09

16– 20 44,220 1.9 years 17.95

21– 25 641,616 4.6 years 23.49

26– 30 1,179,510 4.7 years 27.01

31– 35 1,127,900 6.9 years 34.48

40– 45 3,629,350 8.6 years 43.25

$ 6– 45 6,631,496 7.2 years $36.74

All above options are exercisable, except for those granted in

1999. There are 4,646,983 shares available for future grants of stock

options and stock awards, of which no more than 1,030,053 may be

grants of restricted stock awards.

Since all stock options are granted at market value, compensation

expense is not required. However, had compensation expense been

determined based on the fair value of the options on the grant dates,

the Company’s net income would have been reduced by $11.9 mil-

lion ($.10 per share) in 1999, $9.7 million ($.08 per share) in 1998

and $9.0 million ($.07 per share) in 1997.

The fair value of options granted during 1999 was $9.97 per

share and of options granted during 1998 was $8.78 per share. Fair

value is estimated based on the Black-Scholes option-pricing model

with the following assumptions for grants in 1999 and 1998: divi-

dend yield of 2.0%; expected volatility of 26% in 1999 and 20% in

1998; risk-free interest rates of 4.8% in 1999 and 5.4% in 1998;

and expected lives of 4 years.

The Company has granted to key employees 67,367 shares of

restricted stock that vest in the year 2005. Compensation equal to

the market value of shares at the date of grant is amortized to expense

over the vesting period. Expense for these shares was $.3 million in

1999 and $.2 million in 1998 and 1997.

In 1999, the Company granted stock awards to certain key

employees under a new stock award plan, which replaced a portion of

the cash incentive compensation for those employees. The stock

awards entitle the participants to the right to receive shares of VF

Common Stock, with the number of shares to be earned based on the

three year total shareholder return of VF Common Stock compared

with a peer group of other major apparel companies. Shares earned at

the end of each three year period are issued to participants in the fol-

lowing year, unless they elect to defer receipt of the shares. A total of

44,962 shares of VF Common Stock were earned for the three year

performance period ended in 1999. At the end of 1999, there are

34,062 stock awards outstanding for the performance period ending

in 2000 and 34,062 for the performance period ending in 2001.

Compensation expense equal to the market value of the shares to be

issued is recognized ratably over each three year performance period.

In 1999, expense of $2.0 million was recognized for this plan.

Note M Income Taxes

The provision for income taxes is computed based on the following

amounts of income before income taxes:

In thousands 1999 1998 1997

Domestic $567,545 $582,128 $514,028

Foreign 28,031 49,470 71,852

$595,576 $631,598 $585,880

The provision for income taxes consists of:

In thousands 1999 1998 1997

Current:

Federal $175,052 $174,346 $201,924

Foreign 14,113 35,082 46,466

State 19,607 14,757 19,553

208,772 224,185 267,943

Deferred, primarily federal 20,562 19,107 (33,005)

$229,334 $243,292 $234,938

The reasons for the difference between income taxes computed by

applying the statutory federal income tax rate and income tax expense

in the financial statements are as follows:

In thousands 1999 1998 1997

Tax at federal statutory rate $208,452 $221,059 $205,058

State income taxes,

net of federal tax benefit 12,744 9,592 12,709

Amortization of intangible assets 8,241 7,916 7,084

Foreign operating losses

with no current benefit 11,608 4,715 4,033

Other, net (11,711) 10 6,054

$229,334 $243,292 $234,938

Deferred income tax assets and liabilities consist of the following:

In thousands 1999 1998

Deferred income tax assets:

Employee benefits $ 51,582 $ 62,564

Inventories 19,990 16,780

Other accrued expenses 79,767 103,811

Operating loss carryforwards 71,911 38,083

Foreign currency translation 34,869 13,806

258,119 235,044

Valuation allowance (46,526) (34,249)

Deferred income tax assets 211,593 200,795

Deferred income tax liabilities:

Depreciation 56,103 59,288

Other 25,244 39,857

Deferred income tax liabilities 81,347 99,145

Net deferred income tax assets $130,246 $101,650

Amount included in:

Current Assets $ 74,067 $ 99,608

Other Assets 56,179 13,554

Other Liabilities – (11,512)

$130,246 $101,650