North Face 1999 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 1999 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Marketing, administrative and general expenses were 22.2% of

sales in 1999, compared with 21.9% and 22.5% in 1998 and

1997, respectively. Expenses as a percent of sales increased in 1999

primarily due to fixed short-term expenses on a lower sales level in

European jeanswear. This increase was partially offset by lower

advertising spending.

Other operating income and expense includes goodwill amortiza-

tion expense, offset by net royalty income. In each of the last two years,

amortization of goodwill increased from acquisitions completed during

those years, and net royalty income declined from the conversion of

certain formerly licensed businesses to owned operations.

Net interest expense increased in each of the last two years due to

higher short-term borrowings related to the business acquisitions.

Interest income includes $3.0 million in 1999 and $10.5 million in

1997 related to settlements of prior years’ tax examinations.

The effective income tax rate was 38.5% in 1999 and 1998

and 40.1% in 1997. The effective rate declined in 1998 due to a

reduction in foreign operating losses with no current tax benefit,

lower state income taxes and higher tax-free income attributable to

investments that fund certain deferred compensation plans.

Information by Business Segment The Consumer Apparel seg-

ment consists of jeanswear, women’s intimate apparel and swimwear,

and children’s apparel businesses. Overall, segment sales were rela-

tively flat in 1999. Record sales in mass market domestic jeanswear

sold in the discount channel and sales in the newly acquired Latin

American jeanswear businesses offset declines reported in the Lee

branded domestic business and in European jeanswear businesses. The

decline in Lee was due to softness in retail sales in mid-tier depart-

ment stores in the U.S., and the decline in Europe was due

to a consumer shift away from basic jeans products to alternative

fabrics and stylings. Segment profit in 1999 declined due to lower

Analysis of Operations

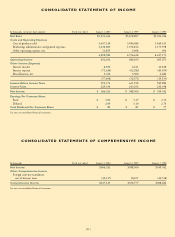

Consolidated sales rose 1% to a record $5,551 million in 1999.

The sales increase in 1999 was primarily due to the acquisitions

of occupational apparel businesses in late 1998/early 1999 and

jeanswear businesses in South America, offset in part by a slowdown

of jeanswear sales in Europe and in the mid-tier channel in the

U.S. Sales in 1998 rose 5% over the 1997 level, due primarily to

the acquisition of Bestform Group, Inc., a major manufacturer and

marketer of women’s intimate apparel.

Gross margins were 34.1% of sales in 1999, compared with

34.5% in 1998 and 34.1% in 1997. Margins were favorably impact-

ed during the last two years from the continuing shift to lower cost

sourcing, lower raw material costs and increased operating efficien-

cies. However, in 1999 this was offset by lower gross margins in the

domestic Lee jeanswear, European jeanswear and workwear businesses.

In jeanswear, these reductions resulted from lower than anticipated

volume and the resulting impact in expense absorption, as well the

need to reduce inventory levels closer to demand. In workwear, lower

margins resulted from the newly acquired companies.

For the United States market, VF manufactures its products in

owned domestic plants and offshore plants, primarily in Mexico.

In addition, VF contracts production from independent contractors

mostly located outside of the U.S. There has been a shift over the

last three years toward a more balanced sourcing mix, with more

products being manufactured in and contracted from lower cost

facilities in Mexico and the Caribbean Basin. The amount of domes-

tic sales derived from products sewn outside the United States has

increased each year so that now 65% is sourced from international

locations. Similarly, in foreign markets, sourcing is being shifted

from higher cost owned plants located primarily in Western Europe

to lower cost owned and contracted production in locations outside

of Western Europe.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF OPERATIONS AND FINANCIAL CONDITION

Sales

Dollars in millions

Sales reached record levels

in 1999.

5,222

5,479 5,552

97 98 99

Gross Margin

Percent to sales

More balanced manufacturing,

lower raw material costs and

increased operating efficiencies are

enabling VF to maintain strong

gross margins.

34.1 34.5 34.1

97 98 99

[16]