North Face 1999 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 1999 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

[26]

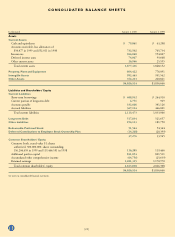

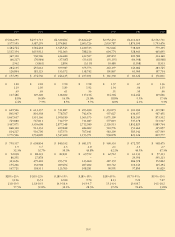

Note D Property, Plant and Equipment

In thousands 1999 1998

Land $ 46,626 $ 45,296

Buildings 478,372 443,619

Machinery and equipment 1,289,064 1,222,216

1,814,062 1,711,131

Less accumulated depreciation 1,009,640 935,040

$ 804,422 $ 776,091

Note E Short-term Borrowings

In thousands 1999 1998

Commercial paper $319,033 $ –

Banks 89,899 244,910

$408,932 $244,910

The weighted average interest rate for short-term borrowings was 6.5%

at the end of 1999 and 5.8% at the end of 1998. The Company main-

tains an unsecured revolving credit agreement with a group of banks for

$750.0 million that supports commercial paper borrowings and is oth-

erwise available for general corporate purposes. The agreement, which

extends to July 2004, requires an .08% facility fee per year and contains

various financial covenants, including a debt to net worth requirement.

At January 1, 2000, there were no borrowings under the agreement.

Note F Accrued Liabilities

In thousands 1999 1998

Income taxes $ 59,242 $ 70,112

Compensation 71,798 103,769

Other 236,084 272,120

$367,124 $446,001

Note G Long-term Debt

In thousands 1999 1998

9.50% notes, due 2001 $100,000 $100,000

6.63% notes, due 2003 100,000 100,000

7.60% notes, due 2004 100,000 100,000

6.75% notes, due 2005 100,000 100,000

9.25% debentures, due 2022 100,000 100,000

Other 22,585 22,626

522,585 522,626

Less current portion 4,751 969

$517,834 $521,657

The scheduled payments of long-term debt are $114.0 million in

2001, $.5 million in 2002, $100.4 million in 2003 and $100.4 mil-

lion in 2004. The Company paid interest of $73.4 million in 1999,

$59.5 million in 1998 and $48.0 million in 1997.

Note H Other Liabilities

In thousands 1999 1998

Deferred compensation $179,321 $151,436

Deferred income taxes – 11,512

Other 14,792 18,802

$194,113 $181,750

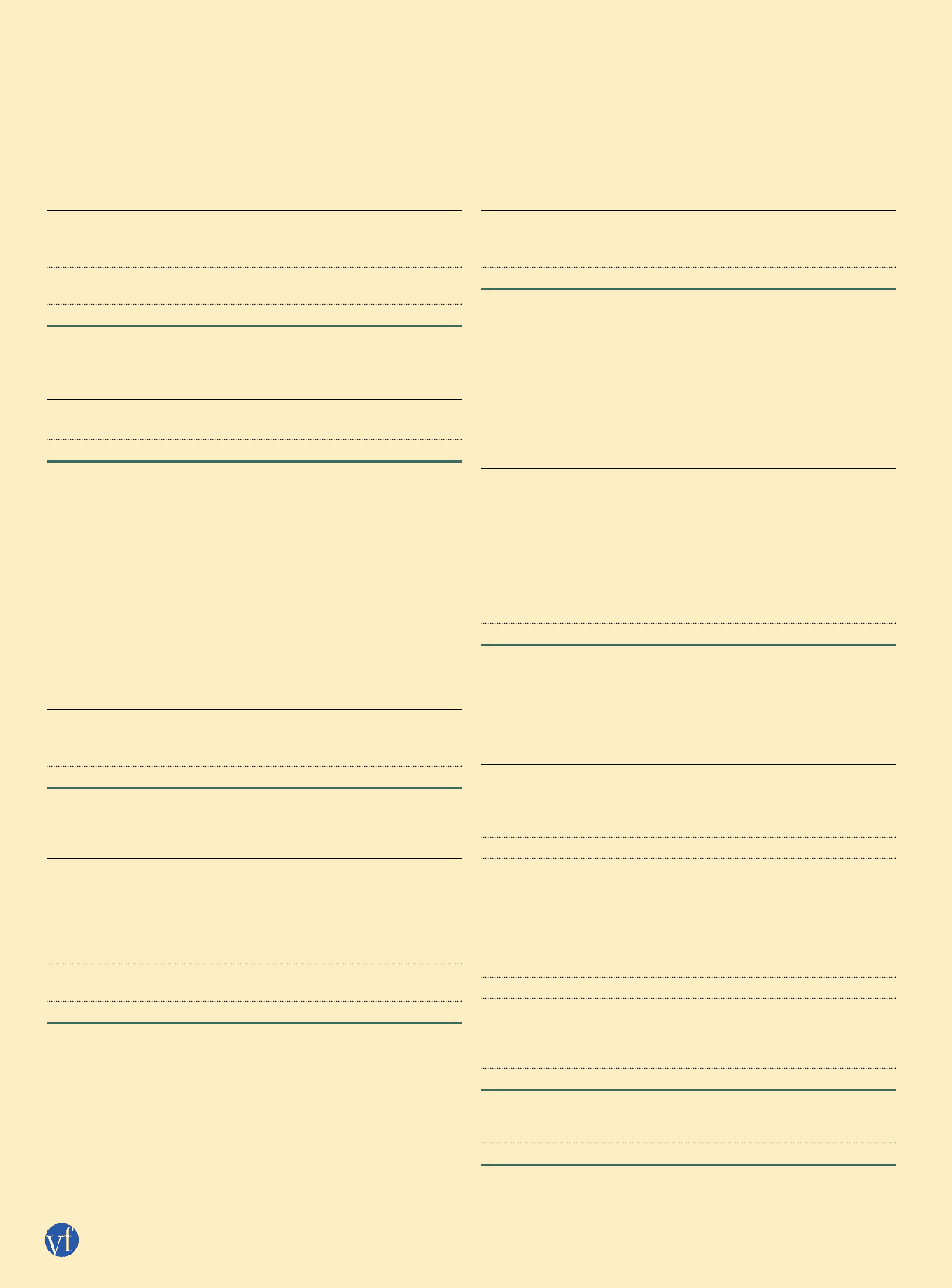

Note I Benefit Plans

The Company sponsors a noncontributory defined benefit pension

plan covering substantially all full-time domestic employees and a

nonqualified supplemental defined benefit pension plan covering

key employees. The effect of the defined benefit plans on income is

as follows:

In thousands 1999 1998 1997

Service cost – benefits earned

during the year $ 22,174 $ 20,391 $ 17,264

Interest cost on projected

benefit obligation 41,166 38,584 35,934

Expected return on plan assets (50,692) (45,270) (34,771)

Amortization of:

Transition asset – (3,068) (4,378)

Prior service cost 5,359 5,667 5,475

Actuarial (gain) loss (831) 610 391

Pension expense $ 17,176 $ 16,914 $ 19,915

The following provides a reconciliation of the changes in fair

value of the pension plans’ assets and benefit obligations, based on a

September 30 valuation date, plus the funded status at the end of

each year:

In thousands 1999 1998

Fair value of plan assets, beginning of year $553,591 $526,087

Actual return on plan assets 112,848 28,013

Company contributions 24,000 20,400

Benefits paid (23,144) (20,909)

Fair value of plan assets, end of year 667,295 553,591

Benefit obligations, beginning of year 591,726 503,340

Service cost 22,174 20,391

Interest cost 41,166 38,584

Plan amendments – 22,427

Actuarial (gain) loss (44,831) 29,019

Benefits paid (24,385) (22,035)

Benefit obligations, end of year 585,850 591,726

Funded status, end of year 81,445 (38,135)

Unrecognized net actuarial (gain) loss (88,095) 17,825

Unrecognized prior service cost 29,911 35,269

Pension asset, net $ 23,261 $ 14,959

Amount included in:

Other Assets $ 47,633 $ 35,164

Other Liabilities (24,372) (20,205)

$ 23,261 $ 14,959