Nikon 2012 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2012 Nikon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

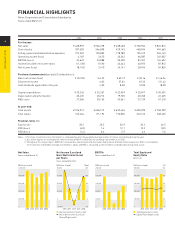

201020092008 2011 2012

100,000

50,000

0

-50,000

-100,000

150,000

201020092008 2011 2012

1,000,000

800,000

600,000

400,000

200,000

0

■ Precision Equipment ■ Imaging Products ■ Instruments ■ Other

Notes:

1. The “Other” segment comprises businesses not included in reportable

segments, such as the glass-related business and customized

products business.

2. Beginning with the fiscal year ended March 2012, we have revised our

method of allocating expenses. For purposes of comparison, operating

income for the fiscal year ended March 2011 has been revised using the

new standard. The year-on-year change for the fiscal year ended March

2012 has been calculated based on the revised figure for the previous

fiscal year. For the three fiscal years between April 1, 2007 and March 31,

2010, operating income (loss) was based on the old method.

(Millions of yen) (Millions of yen)

Sales by Business Segment Operating Income (Loss)

by Business Segment

9

NIKON CORPORATION ANNUAL REPORT 2012

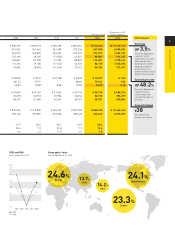

Nikon’s net sales and operating income rose

despite the Thai floods and appreciating yen.

Please provide an overview of operating

results for the fiscal year ended March 2012.

The tremendous efforts of the Precision Equipment

Company greatly contributed to our results. In IC

steppers and scanners, we expanded sales of ArF

immersion scanners, and in LCD steppers and

scanners, sales of equipment for small to medium-

sized high-definition panels performed well, leading

to increases in unit sales. To improve our earnings

structure, we implemented measures such as

reducing production lead times and trimming costs,

thereby enabling the Precision Equipment Company

to record substantial increases in segment sales

and operating income.

In the Imaging Company, although the first half

of the fiscal year saw a robust performance, in the

second half the flooding in Thailand meant production

was halted for many digital SLR cameras and

interchangeable lenses. However, the impact of this

disruption was minimized by strong sales of the new

Nikon 1 interchangeable lens-type advanced digital

camera, and the increased market share achieved by

the COOLPIX series compact digital cameras.

In the Instruments Company, within a severe

environment characterized by shrinking public

expenditure and restrained capital investment

by semiconductor and electronic-component

manufacturers, we worked to develop business in

the emerging markets of Asia and other regions,

and to expand sales of super-resolution microscope

systems and non-contact 3D measurement systems.

What is your outlook for the operating

environment in the fiscal year ending March

2013 and what are the key points to realizing

the Group’s next phase of growth?

The first key point is how far the Imaging Company

can bolster its performance following suspension

of digital SLR camera and interchangeable

lens production owing to the Thai floods in the

previous fiscal year. The second is how resistant

the Precision Equipment Company will be to the

unavoidable impact of a contracting market.

The third key point is whether the Instruments

Company’s results can outperform the pace of

recovery in the market. These are the three points

we will be focusing on.

The Imaging Company’s performance hinges

on how much lost ground it can regain in digital

SLR cameras and interchangeable lenses after

recovering from the Thai floods. In the non-reflex

camera market—which continues to grow—we

anticipate expanded sales of the Nikon 1. We are

also looking to increase our market share amid a

shrinking compact digital camera market. Bringing

our production of digital SLR cameras back

into good shape, we are forecasting substantial

increases in segment sales and operating income

compared with the previous fiscal year.

In the Precision Equipment Company, we

anticipate deterioration in the markets for both IC

and LCD steppers and scanners in the fiscal year

ending March 2013. Within that overall situation,

for IC steppers and scanners, we expect sales of

both the new NSR-S621D ArF immersion scanner

and the NSR-S320F ArF scanner to move into