NVIDIA 2009 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2009 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

Recently Issued Accounting Pronouncements

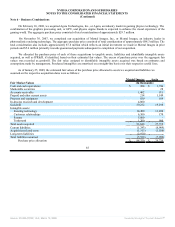

In December 2007, the FASB issued Statement of Financial Accounting Standards No. 141 (revised 2007), or SFAS No.

141(R), Business Combinations. Under SFAS No. 141(R), an entity is required to recognize the assets acquired, liabilities assumed,

contractual contingencies, and contingent consideration at their fair value on the acquisition date. It further requires that

acquisition-related costs be recognized separately from the acquisition and expensed as incurred, restructuring costs generally be

expensed in periods subsequent to the acquisition date, and changes in accounting for deferred tax asset valuation allowances and

acquired income tax uncertainties after the measurement period impact income tax expense. In addition, acquired in-process research

and development, or IPR&D, is capitalized as an intangible asset and amortized over its estimated useful life. We are required to

adopt the provisions of SFAS No. 141(R) beginning with our fiscal quarter ending April 26, 2009. The adoption of SFAS No. 141(R)

is expected to change our accounting treatment for business combinations on a prospective basis beginning in the period it is adopted.

In April 2008, the FASB issued FASB Staff Position No. FAS No.142-3, or FSP No. 142-3, Determination of Useful Life of

Intangible Assets. FSP No. 142-3 amends the factors that should be considered in developing the renewal or extension assumptions

used to determine the useful life of a recognized intangible asset under Statement of Financial Accounting Standards No. 142, or

SFAS No. 142, Goodwill and Other Intangible Assets. FSP No. 142-3 also requires expanded disclosure regarding the determination

of intangible asset useful lives. FSP No. 142-3 is effective for fiscal years beginning after December 15, 2008. Earlier adoption is not

permitted. We are currently evaluating the potential impact the adoption of FSP No. 142-3 will have on our consolidated financial

position, results of operations and cash flows.

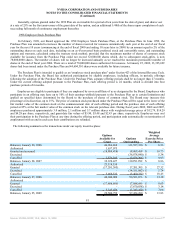

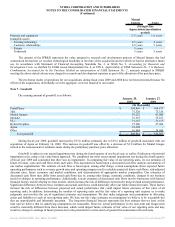

Note 2 - Stock-Based Compensation

The statement of operations includes stock-based compensation expense and the amortization of amounts capitalized as

inventory, as follows:

Year Ended

January 25, January 27, January 28,

2009 2008 2007

(In thousands)

Cost of revenue $ 11,939 $ 10,886 $ 8,200

Research and development 98,007 76,617 70,077

Sales, general and administrative 52,760 45,862 38,458

Total $ 162,706 $ 133,365 $ 116,735

Impact of the adoption of SFAS No. 123(R)

We elected to adopt the modified prospective application method beginning January 30, 2006 as provided by SFAS No.

123(R). Accordingly, during fiscal year 2007, we recorded stock-based compensation expense for awards granted prior to, but not yet

vested, as of January 29, 2006, equal to the amount that would have been recognized if the fair value method required for pro forma

disclosure under SFAS No. 123 had been in effect for expense recognition purposes, adjusted for estimated forfeitures. Previously

reported amounts have not been restated.

Our adoption of SFAS No. 123(R) resulted in a cumulative benefit from the accounting change of $0.7 million during fiscal year

2007, which reflects the net cumulative impact of estimating forfeitures in the determination of period expense by reversing the

previously recognized cumulative compensation expense related to those forfeitures, rather than recording forfeitures when they occur

as previously permitted.

Stock-based compensation expense that would have been recorded under APB No. 25 during the year ended January 28, 2007

was approximately $3.0 million. Upon our adoption of SFAS No. 123(R), at January 30, 2006, we reclassified the unearned

stock-based compensation expense balance of approximately $3.6 million that would have been recorded under APB No. 25 to

additional paid-in capital in our Consolidated Balance Sheet. The adoption of SFAS No. 123(R) reduced our basic and diluted

earnings per share by $0.19 and $0.17, respectively, and reduced our net income by $102.7 million for the year ended January 28,

2007.

Prior to adopting SFAS No. 123(R), we presented all tax benefits resulting from the exercise of stock options as operating cash

flows in our Consolidated Statement of Cash Flows. However, as required by our adoption of SFAS No. 123(R), since fiscal year

2007, we began classifying cash flows resulting from gross tax benefits as a part of cash flows from financing activities. Gross tax

benefits are realized tax benefits from tax deductions for exercised options in excess of cumulative compensation cost for those

instruments recognized in our consolidated financial statements. The effect of this change in classification on our Consolidated

Statement of Cash Flows resulted in cash used from operations of $0.9 million and $0.2 million and cash provided by financing

activities of $0.9 million and $0.2 million for the years ended January 25, 2009 and January 27, 2008, respectively. During year ended

January 28, 2007, cash used from operations and cash provided by financing activities was $0.2 million each.

Source: NVIDIA CORP, 10-K, March 13, 2009 Powered by Morningstar® Document Research℠