Morgan Stanley 2001 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2001 Morgan Stanley annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

demand across all our businesses. In a rapid reversal,

revenues declined 16 percent in 2001, presenting a real

challenge to manage costs to protect profits for share-

holders. Through a combination of reducing incentive

compensation, restructuring existing businesses and clos-

ing selected operations, we were able to reduce the

expense base in 2001 and create profit leverage for when

the economy turns.

Compensation was down 14 percent overall and was down

by a much larger percentage in selected businesses.

Headcount was down 4 percent from peak levels despite

a significant increase in headcount at Discover. Non-

compensation expenses came down throughout the year

and by the fourth quarter were 11 percent below fourth

quarter last year, excluding costs associated with our air-

craft leasing operations. Our focus on costs will continue

in 2002, and we expect to achieve further savings as we

get out of businesses with poor current economics. For

example, we closed our retail business in Japan and sev-

eral retail branches in the U.S., as well as our freestanding

retail Internet business, and temporarily halted further inter-

national expansion of our credit card business.

While reducing our cost structure, we have kept in mind that

the factors driving secular growth in financial services — an

aging population, globalization, privatization and produc-

tivity — remain in place and that growth will resume. We

therefore have balanced the need to reduce expenses with

the need to have talent in place to take full advantage of

future opportunities.

TO DO IN 2002

We continue to see the accelerated combination of firms

in pursuit of a global capital markets strategy. In the past

18 months, UBS acquired PaineWebber for $12 billion to

gain retail distribution and asset management in the U.S.,

and Chase completed its acquisition of J.P. Morgan to

strengthen its investment banking and equity business

globally. Also, Credit Suisse First Boston acquired DLJ for

$13.5 billion to strengthen its investment banking and

equity business in the U.S. As a result of these strategic

mergers, there now are about eight firms vying for leader-

ship in global investment banking and securities distribution,

some of them straining to carve out a viable market share

in a business where there is enough demand for no more

than three or four profitable competitors. This competitive

dynamic will put continued pressure on margins.

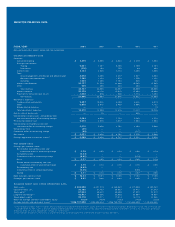

2001

2000

1999

1998

65

56

51

43

2001

2000

1999

1998

137

127

128

90

NUMBER OF FUNDS RANKED FOUR OR FIVE STARS

BY MORNINGSTAR

NUMBER OF TOP-RATED ANALYSTS WORLDWIDE

6MORGAN STANLEY ANNUAL REPORT 2001