Morgan Stanley 2001 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2001 Morgan Stanley annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

>Our market share in retail securities increased in terms

of number of financial advisors, but our percentage of

industry-wide revenues decreased.

>In 2001, Discover®Card again increased market share

measured by percentage of total receivables.

In summary, we increased market shares in our trading

businesses and maintained market shares in most of our

other major businesses.

CHALLENGES OF 2001

The year was not an easy one in which to achieve a 19 per-

cent ROE. Most markets were down significantly from 2000.

>M&A activity declined by 51 percent.

>IPOs globally were down 57 percent.

>Retail securities activity in the U.S. was off at least

25 percent.

>Equity prices in the U.S. were down 13 percent for S&P

500 and 21 percent for the NASDAQ Composite.

European markets suffered from similar declines.

>The U.S. officially slipped into a recession, leading the

Federal Reserve to reduce interest rates 11 times during

the year. In Europe, gross domestic product (GDP) annual

growth fell from 3.3 percent to 1.6 percent.

>Technology and telecom stocks and bonds were partic-

ularly hard hit with stocks off over 50 percent, sharp

declines in most bonds and many bankruptcies.

The impact of a difficult economic environment in 2001

reaffirmed the wisdom of focusing on our clients as well

as our strategy of diversification by both products and

markets. In general, certain businesses in which we car-

ried “proprietary positions,” such as high yield and private

equity, experienced write-downs. Through sales and write-

downs, however, we significantly reduced the size of both

our high-yield and private equity portfolios in 2001. Our

restructured high-yield business focuses on servicing

client flows, and private equity is concentrated on the fund

business where we invest alongside our clients in vehi-

cles that we manage. While it represents a small part of

our business currently, we also continue to invest in our

commercial lending business. Disciplined underwriting,

advantageous collateral arrangements, increased diversi-

fication and an increased investment in distribution

infrastructure will help us to better manage these portfolios

in the future.

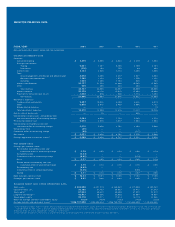

2001

2000

1999

1998

30.9

18.5

32.6

24.5

2001

2000

1999

1998

4.40

5.36

5.42

6.76

RETURN ON COMMON EQUITY

(In Percent)

DISCOVER FINANCIAL SERVICES NET CHARGE-OFF RATE

(In Percent)

4MORGAN STANLEY ANNUAL REPORT 2001