Morgan Stanley 2001 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2001 Morgan Stanley annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

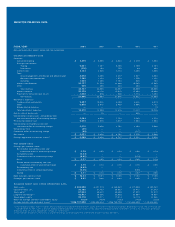

FINANCIAL RESULTS

>Our net income for fiscal year 2001 was $3.6 billion, a

decline of 34 percent from last year’s record $5.5 billion.

Earnings per share were $3.19, down 33 percent from

$4.73 a year ago.

>Return on equity (ROE) for the year was 19 percent, which

is very strong considering the difficult environment in the

securities industry. We believe the two principal reasons

for this strong ROE are our discipline in controlling

expenses and the breadth and diversity of our busi-

nesses, several of which had excellent results despite the

generally difficult environment.

>Net income in our securities segment was down 42 per-

cent from $4 billion in 2000 to $2.4 billion this past year.

Fixed income, however, was the exception within the

securities segment, with a record year in net revenues.

Our equities business also continued to deliver high

returns, even though volume was down from the peaks of

the first half of 2000. Both investment banking and the

individual investor group suffered significant decreases

in net revenues.

>Our investment management business was down 19 per-

cent in net income, but our investor base remained solid,

and the business continued to produce high returns.

>Credit services net income was roughly equal to last year

at $702 million, resulting in 19 percent ROE.

>We were pleased that our market share gains continued

in the equity and fixed income trading businesses, with

particularly strong gains in Europe.

>In equities, we achieved significant market share gains in

secondary trading for institutional clients in the U.S. and in

Europe, especially in listed stocks, over-the-counter (OTC)

stocks, convertible securities and listed options. Fixed

income showed similar gains in investment grade, asset-

backed, government securities and credit derivatives.

>In investment banking, we held our global position as #2

in completed mergers and acquisitions (M&A), #2 in initial

public offerings (IPO) and #3 in equity products. During

the year, we reorganized the division, repositioning our

resources to allow for more client coverage while reduc-

ing headcount by more than 10 percent. Despite

increased competitive pressure from commercial

banks, we were able to maintain our market position in

investment banking. We are intent on improving that

leadership position over the next several years as the

impact of our reoriented client coverage strategy begins

to take effect.

2001

2000

1999

1998

5,456

3,521

4,791

3,276

2001

2000

1999

1998

4.73

*3.19

4.10

2.67

NET INCOME

(Dollars in Millions)

EARNINGS PER SHARE

(Diluted)

*Excludes extraordinary item and cumulative effect of accounting change.

MORGAN STANLEY ANNUAL REPORT 2001 3