Morgan Stanley 2001 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2001 Morgan Stanley annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FOCUS ON CLIENTS

A major accomplishment in 2001 was the continued move

closer to true client centricity in every business. Each busi-

ness has restructured to focus on and better serve our

clients. It is no coincidence that those businesses that

enjoyed the biggest market share gains — institutional

equities, for example — are the ones that have made the

most progress in reorganizing around the client.

As 2002 begins, we are confident the changes made in

2001 will make us more valuable to our clients in every

business. Several examples of excellent client focus

deserve highlighting:

>In the individual investor group, virtually all of our 4 mil-

lion individual clients received a call soon after

September 11 from their financial advisor, many of whom

worked around the clock to stay in touch, provide reas-

surance and continue business.

>Our investment bankers worked with Comcast

Corporation for more than a year designing a successful

plan to complete a merger with AT&T’s cable subsidiary

in a $72 billion transaction.

>Our investment bankers and equity and fixed income cap-

ital markets specialists helped raise $16.4 billion in debt,

$7.3 billion in convertible securities and $5.8 billion in

equity from the IPO of Orange Wireless on behalf of

France Telecom despite the extremely challenging mar-

kets for the telecommunications industry.

>In investment management, our portfolio professionals

achieved superior performance for clients in spite of an

extremely difficult market environment. With 56 of our funds

receiving four or five stars at the close of November 2001,

we had more funds receiving Morningstar’s two highest

ratings than any other full-service firm.

>In credit services, when U.S. mail delivery of payments

was delayed immediately after September 11, Discover

was the only large credit card issuer to suspend cus-

tomer late fees during the disruption of service.

CONTROLLING COSTS

In the three years ending in 2000, our net revenues grew

27 percent per year. Incremental investments and opera-

tions above capacity allowed us to fulfill the extraordinary

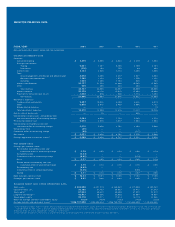

2001

2000

1999

1998

35.0

27.3

35.5

27.8

2001

2000

1999

1998

12.0

14.6

12.2

9.7

WORLDWIDE M&A ANNOUNCED TRANSACTIONS*

(Market Share in Percent)

*Thomson Financial

WORLDWIDE INITIAL PUBLIC OFFERINGS*

(Market Share in Percent)

*Thomson Financial

MORGAN STANLEY ANNUAL REPORT 2001 5