Morgan Stanley 2000 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2000 Morgan Stanley annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Another advantage of incumbency results from the importance of advice, or client-

tailored excellence. As the sheer flow of information increases, the need to filter,

analyze and decide how to act on the information also increases. Even as the cost of

information decreases, investors and businesses are still willing to pay for the advice

they need in order to use the information profitably. At our firm, we are committed

to providing our clients with the very best online technology, but we also are con-

tinuing to build resources such as our team of nearly 14,000 financial advisors. Sound

advice, whether based on the knowledge of financial advisors, investment bankers,

research analysts or traders, is a value-added resource that cannot be built overnight.

The most powerful and far-reaching trend in financial services in our time is global-

ization, which is now being accelerated by the Internet. The spread of more open

political systems and market economies throughout the world, and the closer links

among markets, has created greater opportunities for financial services companies—

with clear advantages for those with an established global presence. We believe that

there is significant value for our clients in the global network we have worked hard

to create. In 2000, more than 40 percent of our institutional securities revenues came

from outside the United States. Major transactions included some of the largest

IPOs ever in China (Sinopec, China Unicom); the offering for Alcatel Optronics—the

first-ever tracking stock in Europe; and the acquisition of EDC (Venezuela) by AES

(United States)—the first successful unsolicited acquisition in Latin America. We also

continued to build on our initiative to establish a global retail securities and asset

management capability with the recently proposed acquisition of Quilter Holdings

Limited, a leading U.K.-based private client investment management business. In

addition, our entry into the credit card market in the United Kingdom is well under

way, and we plan to enter additional international markets this year.

BUILDING A NEW COMPANY

We clearly are benefiting from certain advantages of incumbency in a changing

world and continue to take steps that will place us in an even stronger position to

meet the challenges that lie ahead.

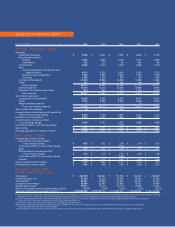

WORLDWIDE M&A

ANNOUNCED TRANSACTIONS*

(market share in percent)

*Thomson Financial Securities Data

WORLDWIDE INITIAL

PUBLIC OFFERINGS*

(market share in percent)

*Thomson Financial Securities Data

NUMBER OF TOP-RATED

ANALYSTS WORLDWIDE