Morgan Stanley 2000 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2000 Morgan Stanley annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

This past year was one of solid growth in our securities business despite a slowdown

in the second half. Net revenues increased by 22 percent, with both our institutional

and individual securities businesses reaching record levels. We increased the number

of financial advisors in our individual investor group to almost 14,000—the second

highest in the industry. We continued to expand our global presence, increasing

employees outside the United States by more than 30 percent. Our transaction vol-

ume in announced global M&A deals passed the $1 trillion mark for the second year

in a row, with a market share of 35 percent. We maintained market leadership in

other key categories such as equity and equity-related underwriting. In equity

research, Morgan Stanley Dean Witter ranked first in Institutional Investor’s Year

2000 Global Research Poll for the fourth straight year.

It also was an excellent year for our asset management business, with net income up

52 percent from last year. Two years ago, we began to reorganize our diverse asset

management capabilities, which serve a broad range of both individual and institu-

tional investors. In 2000, asset management reported record net income of

$683 million, and we continued to attract new money from investors despite steep

declines in the broad market indices. Our assets under management at year-end

stood at $502 billion—$30 billion more than a year earlier. One key to growth in

this business is the performance of our mutual funds. This past year, the number

of our funds rated four- or five-star by Morningstar rose from 51 to 65, and we have

the second highest number of U.S. domestic funds receiving Morningstar’s two

highest ratings.

Credit services’ record net income of $726 million reflected the continued growth

of the Discover® Card. Transaction volume climbed by 28 percent this past year to

$90 billion, on the heels of a 22 percent gain in 1999. Our brand is gaining significant

market share of total transaction volume, increasing from 6.6 percent in June 1999

to 7.1 percent in June 2000. In the past year, our growth in receivables also outpaced

most of our competitors, with an increase of 24 percent to a record $47 billion. We

continued to broaden the base of merchants accepting Discover Card by enrolling

670,000 new locations during the year, bringing the total merchant locations now

accepting our card to approximately 4 million.

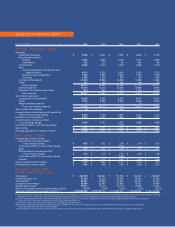

NET INCOME

(dollars in millions)

EARNINGS PER SHARE

(diluted)

RETURN ON COMMON EQUITY

(in percent)