Morgan Stanley 2000 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2000 Morgan Stanley annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANTAGES OF INCUMBENCY

As a major worldwide provider of financial services across a broad spectrum, we

expect to continue to benefit from the vibrant secular growth in our industry.

This growth is driven by deregulation and restructuring of major industries

in the global economy; demands of investors for superior performance; greater

transparency of financial markets as a result of more and better information;

increased connectivity among markets; and continued innovation and technological

change. These trends have driven growth in financial services over the past 25 years

and now are being reinforced by the transformational impact of technology in

virtually every industry.

As we write this letter, there is not quite the euphoria over the New Economy that

existed a year ago. The 40 percent decline in the NASDAQ has been painful. It has

become clear that there is more to building a successful business than simply adding

“dot-com” at the end of a company’s name. One of the lessons of the past year is

that there is still no substitute for a sound business model based on creating and

delivering value for which customers are willing to pay and generating revenues

that exceed the costs of the business. At the same time, there is little question that

the New Economy has created tools and opportunities that no company, in any

industry, can afford to ignore. When it comes to the impact of rapidly changing

technology on financial services, we believe the advantages accrue, not to the start-

ups or the specialized firms, but to the experienced, broad-based incumbents.

It begins with the advantages of scale. With more power in the hands of customers,

their transaction costs continue to fall dramatically, placing a premium on the ability

to provide broad product offerings, add value through innovation and achieve

increasing returns to scale. Advantage accrues to financial services companies that

can make required investments to expand and innovate and readily bring together

market knowledge and expertise to meet client needs in a time of rapid change. We

believe very few firms have the breadth and depth of skills to help lead transactions

such as the $182 billion merger of Time Warner and America Online or the

$14.6 billion Deutsche Telekom multi-currency global bond offering.

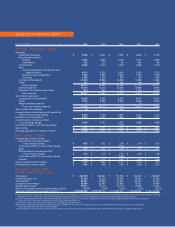

DISCOVER FINANCIAL SERVICES

TRANSACTION VOLUME

(in billions of dollars)

NUMBER OF FUNDS RANKED

FOUR OR FIVE STARS

BY MORNINGSTAR