Morgan Stanley 1999 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 1999 Morgan Stanley annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

99 AR |page 6

fixed income securities, commodities and foreign exchange — in markets throughout the

world. This past year we achieved record revenues and net income in our institutional

business, with substantial growth in nearly every category. It also was a record year for our

Private Client Group, which serves more than 4 million individual investor accounts. The

breadth of this business is reflected in 475 branch offices and more than 12,000 financial

advisors. The synergy between the origination capabilities of our institutional securities

business and distribution capabilities of our Private Client Group is illustrated by the large

increases in new equity issue sales to individual investors over the past three years.

In credit services, our Discover Card is a franchise of unique breadth that serves more than

48 million cardmembers and over 3.5 million merchant outlets. One of Discover’s key growth

initiatives this past year was a concerted marketing campaign to expand its merchant network

by emphasizing its cost and services advantage. This resulted in the enrollment of more

than 615,000 new merchant locations, the highest yearly increase in our history. Discover

also added to its cardholder base 5.5 million new accounts and grew transaction volume by

22 percent and managed consumer loans by 17 percent, to $38 billion.

In asset management, our strategy is to offer a full range of funds, international expertise

and asset allocation skills — the “best of our best” — to both our institutional clients and

our retail clients. The scope of this business now includes more than 400 funds and three

well-established distribution channels: relationships with our individual clients through our

financial advisors; relationships with corporations, governments and other institutions through

MSDW Investment Management and Miller Anderson & Sherrerd; and relationships with

millions of investors who purchase our Van Kampen funds through brokers, banks, financial

planners or other financial intermediaries.

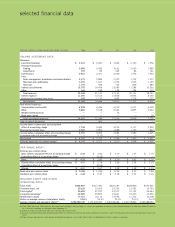

99

98

97

96

12.5

9.7

5.5

7.4

WORLDWIDE INITIAL PUBLIC

OFFERINGS MARKET SHARE*

(in percent)

*Thomson Financial Securities Data

99

98

97

96

1,118

950

705

614

NEW ACCOUNTS OPENED IN

PRIVATE CLIENT GROUP

(in thousands)

DISCOVER/NOVUS INCREASE

IN MERCHANT LOCATIONS

(in thousands)

99

98

97

96

615

394

405

419