Morgan Stanley 1999 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 1999 Morgan Stanley annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

page 5|99 AR

change that is creating new companies, driving consolidation and globalization, and bringing

about the restructuring of entire industries and economies.

In this “new economy,” customers are gaining power, transaction costs are being driven down,

and more open and transparent markets and increased competition put a premium on products

and services that are the best of breed. We know that such a new economy is emerging. And we

believe that Morgan Stanley Dean Witter (MSDW), with its tradition of putting customer interests

first, its financial strength and its ability to provide customers with access to efficient markets,

stands at the fulcrum of change.

BREADTH AND DEPTH

One theme, which we never tire of repeating, is the great breadth and depth of

our firm, which gives us a diverse stream of revenues and the capabilities to

offer a wide range of opportunities to our customers.

We have three core businesses — securities, asset management and credit services — each

requiring different expertise, each meeting particular customer needs and each offering

significant opportunities for growth. We achieved record results and market share gains this

past year in both our securities and credit services businesses; and in the third, asset manage-

ment, we improved our results substantially from a year earlier and took steps to capitalize

on some strategic long-term growth opportunities.

Within each of our core businesses, we have established strong brands and broad market

presence as well as considerable diversity in products and services. Our capabilities for

institutional customers include products and services in mergers and acquisitions, equities,

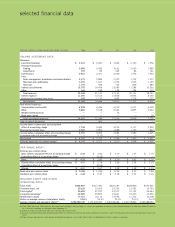

99

98

97

96

22,009

14,833

16,444

12,023

99

98

97

96

4.10

2.67

2.08

1.58

EARNINGS PER SHARE

(diluted, in U.S. dollars)

99

98

97

96

32.6

22.0

24.5

20.0

RETURN ON AVERAGE COMMON EQUITY

(in percent)