Morgan Stanley 1999 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 1999 Morgan Stanley annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

99 AR |page 10 transactions for Pemex, the Mexican oil company. In Japan, we lead-managed an innovative

$5.6 billion equity offering for East Japan Railway and arranged for the first-ever securitiza-

tion of non-performing real estate loans.

The dot-com phenomenon in the United States was another major trend in 1999. More than

300 technology companies went public this past year, raising more than $33 billion in capital.

MSDW played a central role as the number one underwriter of technology IPOs in the United States

and worldwide, working with leaders such as Amazon.com, eBay and Priceline.com. We were

the lead-manager in the $2.2 billion IPO for Agilent Technologies, a subsidiary of Hewlett-Packard,

and the $2.8 billion secondary offering for Nextel Communications. In an active market for

technology mergers and acquisitions, we were the advisor in a number of prominent transactions,

including the sale of Broadcast.com to Yahoo! and the acquisition of Netscape by America Online.

In addition, as the year 2000 began, we became an advisor in what is perhaps the most widely

heralded “new economy” combination to date — the proposed merger of Time Warner and

America Online.

COMMITMENT TO ADDING VALUE

Morgan Stanley Dean Witter has the resources, the commitment, the people and

the technology to provide virtually any client in almost any country the combination

of products, services and advice to find the best solution for that client’s financial

needs. Our future growth is linked to this basic value proposition.

There are countless examples of how this past year Morgan Stanley Dean Witter brought the

firm’s broad resources to bear to meet the particular needs of our clients. One notable example,

with far-reaching implications, was the launch in October of ichoice for individual investors.

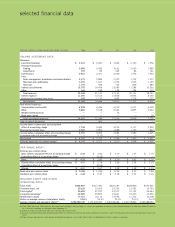

99

98

97

96

5.5

2.5

3.3

4.7

NEW ACCOUNTS OPENED IN

DISCOVER FINANCIAL SERVICES

(in millions)

99

98

97

96

8.1

6.7

5.7

6.9

WORLDWIDE INVESTMENT GRADE

DEBT UNDERWRITING MARKET SHARE*

(in percent)

*Thomson Financial Securities Data

99

98

97

96

425

376

338

278

ASSETS UNDER MANAGEMENT

OR SUPERVISION

(in billions of U.S. dollars)