Morgan Stanley 1999 Annual Report Download

Download and view the complete annual report

Please find the complete 1999 Morgan Stanley annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MORGAN STANLEY DEAN WITTER 1999 annual report

see. serve. grow.

Table of contents

-

Page 1

see. serve. grow. MORGAN STANLEY DEAN WITTER 1999 annual report -

Page 2

-

Page 3

... turning possibilities into realities...through securities offerings, mergers and acquisitions advice, asset management, credit services and innovative investment tools. We grow our business by serving our clients...entering new markets, developing new products, attracting the most-talented people... -

Page 4

... extraordinary year for Morgan Stanley Dean Witter, our clients and our shareholders. The commitment and exceptional performance of our 55,000 employees around the globe led to increases in market share in several key businesses. We ended the year in the strongest position in our history, and we are... -

Page 5

P H I L I P J . P U R C E L L , Chairman & Chief Executive Ofï¬cer (left) J O H N J . M A C K , President & Chief Operating Ofï¬cer -

Page 6

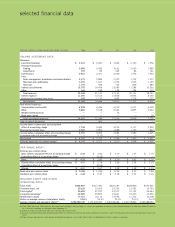

... ended November 30 with Dean Witter, Discover & Co.'s ï¬nancial statements for the years ended December 31. (2) Amounts shown are used to calculate basic earnings per common share. (3) Amounts have been retroactively adjusted to give effect for a two-for-one common stock split, effected in the form... -

Page 7

... are gaining power, transaction costs are being driven down, and more open and transparent markets and increased competition put a premium on products and services that are the best of breed. We know that such a new economy is emerging. And we believe that Morgan Stanley Dean Witter (MSDW), with its... -

Page 8

... our institutional securities business and distribution capabilities of our Private Client Group is illustrated by the large increases in new equity issue sales to individual investors over the past three years. In credit services, our Discover Card is a franchise of unique breadth that serves more... -

Page 9

... investors worldwide are gaining control of billions of dollars of pension investments - and shifting them from ï¬xed income to equity investments. MSDW is expanding its asset management business globally. MSDW was the market leader in 1999, raising $6 billion in technology IPOs for clients... -

Page 10

... 6,597 10,985 EUROPEAN M&A ANNOUNCED TRANSACTIONS MARKET SHARE* (volume in percent) *Thomson Financial Securities Data MSDW RETAIL MUTUAL FUNDS NET SALES MARKET SHARE* (in percent) *Includes MSDW Advisors and Van Kampen market share Based on top 50 competitors MSDW ONLINE AVERAGE TRADES PER DAY -

Page 11

... and become more competitive. More investors are demanding performance, and the equity markets are gaining in prominence. Morgan Stanley Dean Witter has been a leader in the growth, restructuring and consolidation of the European markets. Some of the prominent M&A transactions we advised on included... -

Page 12

... to date - the proposed merger of Time Warner and America Online. COMMITMENT TO ADDING VALUE Morgan Stanley Dean Witter has the resources, the commitment, the people and the technology to provide virtually any client in almost any country the combination of products, services and advice to ï¬nd... -

Page 13

..., investors can do business with us any way they choose. In November, MSDW was the lead-manager in the $5.5 billion initial public offering of United Parcel Service, the largest IPO in U.S. history. We have brought technical innovation to debt and equity markets in Europe and Asia, creating new... -

Page 14

...96 6.4 9.0 8.1 13.0 99 98 97 96 12,674 11,238 10,157 9,295 99 98 97 96 90 86 84 128 WORLDWIDE EQUITY AND EQUITY-RELATED UNDERWRITING MARKET SHARE* (in percent) *Thomson Financial Securities Data NUMBER OF FINANCIAL ADVISORS NUMBER OF MSDW TOP-RATED ANALYSTS WORLDWIDE* *Institutional Investor -

Page 15

... of advice, technology, research and originated product as Morgan Stanley Dean Witter. In our institutional securities business, the counterpart of the advanced i choice Internet platform is ClientLink, a robust global platform that provides customers with real-time price information on a wide... -

Page 16

...and equity issuance, 99 98 97 96 28 43 47 51 99 98 97 96 23.4 24.3 27.8 35.5 99 98 97 96 58 56 54 71 NUMBER OF MSDW FUNDS RANKED 4 AND 5 STARS BY MORNINGSTAR WORLDWIDE M&A ANNOUNCED TRANSACTIONS MARKET SHARE* (volume in percent) *Thomson Financial Securities Data GENERAL PURPOSE CREDIT CARD... -

Page 17

... Spain and our cooperative agreement with Sanwa Bank in Japan are key steps in the global expansion of our securities and asset management businesses for individual investors. Cardmembers and vendors in the U.K. now leverage the power of the Discover Card through the Morgan Stanley Dean Witter card... -

Page 18

... diverse revenue streams in our three core businesses. SHAREHOLDER VALUE We repurchased 50 million shares of common stock to return capital to shareholders. MARKET LEADERSHIP We have increased market share in M&A, equity underwriting, IPOs and investment grade debt. LARGEST CAPITAL BASE We have... -

Page 19

The forces of technological change, deregulation and greater demands by customers are driving this growth. worldwide pension assets and U.S. mutual fund assets, New York Stock Exchange and NASDAQ average daily trading volumes, and credit card receivables all have shown strong growth. The long-term ... -

Page 20

... a new credit card in the United Kingdom featuring a Cashback Bonus award, attractive pricing and no annual fee. The results in card acceptance and receivables growth for the ï¬rst several months have been excellent. FINANCIAL STRENGTH Few ï¬rms can match Morgan Stanley Dean Witter's ï¬nancial... -

Page 21

... with the clear purpose of further expanding our business and pursuing opportunities for growth, we obviously are in a very strong position. We will continue to strive to create shareholder value and to manage the business for your beneï¬t. We are conï¬dent that Morgan Stanley Dean Witter will... -

Page 22

Morgan Stanley Dean Witter at a glance securities MSDW serves institutional investors, individual investors and investment banking clients, including corporations, governments and other entities around the globe. The ï¬rm provides clients with investment banking advice on mergers and acquisitions... -

Page 23

... 54 report of independent auditors 55 consolidated statements of financial condition 57 consolidated statements of income 58 consolidated statements of comprehensive income 59 consolidated statements of cash flows 60 consolidated statements of changes in shareholders' equity 62 notes to... -

Page 24

... money market, equity, fixed income or other investment alternatives which also could cause fluctuations to occur in the Company's Asset Management business. In the Company's Credit Services business, changes in economic variables, such as the number and size of personal bankruptcy filings, the rate... -

Page 25

... for employees from the financial services, insurance and management consulting industries. For a detailed discussion of the competitive factors in the Company's Securities, Asset Management and Credit Services businesses, see the Company's Annual Report on Form 10-K for the fiscal year ended... -

Page 26

...'s government to mitigate these conditions, including bank bailouts, emergency loans and stimulus packages, were beginning to have a favorable impact on the nation's economic performance. Certain financial markets elsewhere in the Far East, such as in Hong Kong, Singapore and Korea, also began to... -

Page 27

... proprietary mutual funds and other financial products. This acquisition reflects the Company's strategic initiative to build its international Securities and Asset Management businesses to serve the needs of individual investors. The Company's fiscal 1999 results include the operations of AB... -

Page 28

...accompanying business segment information includes the operating results of Morgan Stanley Dean Witter Online ("MSDW Online"), the Company's provider of electronic brokerage services, within the Securities segment. Previously, the Company had included MSDW Online's results within its Credit Services... -

Page 29

... of global high-yield and investment grade fixed income securities. The primary market for these securities benefited from relatively low nominal interest rates which page 27 | 99 AR Advisory fees from merger, acquisition and restructuring transactions Equity underwriting revenues Fixed income... -

Page 30

... from the Company's increased sales and research coverage of the region that began in mid-1997. European equity trading revenues also benefited from generally favorable market conditions and positive investor sentiment regarding EMU. Revenues from trading equity derivative products also increased in... -

Page 31

...and sales of mutual funds, futures, insurance products and options. Commissions also include revenues from customer securities transactions associated with MSDW Online. Commission revenues increased 27% in fiscal 1999, primarily reflecting higher revenues from equity cash products in markets located... -

Page 32

... Company's Investment Consulting Services ("ICS") business. The Company receives 12b-1 fees for services it provides in promoting and distributing certain open-ended mutual funds. These fees are based on either the average daily fund net asset balances or average daily aggregate net fund sales and... -

Page 33

... of 27 securities branch locations. Brokerage, clearing and exchange fees increased 11%, primarily reflecting increased expenses related to higher levels of trading volume in the global securities markets. Information processing and communications costs increased 15% due to higher data services and... -

Page 34

.... Morgan Stanley Dean Witter Investment Management and Miller Anderson & Sherrerd serve the specialized needs of global institutional and high net worth investors. Asset Management's product breadth includes mutual funds, closed-end funds, managed accounts, managed futures funds, pooled vehicles... -

Page 35

... custody and correspondent clearing services. Asset management, distribution and administration fees were as follows: (dollars in millions) FISCAL 1999 FISCAL 1998 FISCAL 1997 Products offered primarily to individuals Products offered primarily to institutional clients Total assets under management... -

Page 36

... as additional office space and higher occupancy costs at certain locations. Brokerage, clearing and exchange fees increased 39%, primarily reflecting commissions paid in connection with the Company's launch of the Van Kampen Senior Income Trust mutual fund, higher closed-end fund sales through the... -

Page 37

... Services business unit, which also operates the Discover/ NOVUS Network, a proprietary network of merchant and cash access locations. The credit cards offered by the Company include the Discover Card, the Discover Platinum Card, the Morgan Stanley Dean Witter Card and other proprietary general... -

Page 38

... growth of general purpose credit card transaction volume related to the Discover Card, offset by lower revenues due to the sale of the operations of SPS in October 1998. In addition, merchant and cardmember fees benefited from higher overlimit and late fees attributable to a fee increase introduced... -

Page 39

... in credit losses from securitized consumer loans resulting from a lower level of charge-offs related to the Discover Card portfolio and the positive impact of the sale of the operations of SPS, partially offset by an increase in the level of average securitized loans. The increase in servicing fees... -

Page 40

... loans and the sale of the Prime Option and SPS portfolios. The lower yield on general purpose credit card loans in fiscal 1998 was due to a larger number of cardmembers taking advantage of promotional rates. In both years, the Company believes that the effect of changes in market interest rates... -

Page 41

... of charge-offs related to the Discover Card portfolio and the positive impact of the sale of the operations of SPS, the sale of Prime Option and the discontinuance of the BRAVO Card. This decrease was reflective of the Company's continuing efforts to improve the credit quality of its portfolio. The... -

Page 42

.... Marketing and business development expense increased in fiscal 1999 due to direct mailing and other promotional activities related to the launch and continued promotion of the Discover Platinum and Morgan Stanley Dean Witter Cards, higher cardmember rewards expense and a new advertising campaign... -

Page 43

... of annual purchases. The increase in fiscal 1998 was attributable to higher advertising and promotional expenses associated with increased direct mail and other promotional activities related to the Discover Card, Private Issue Card and partnership programs, as well as higher cardmember rewards... -

Page 44

... Company's Credit Services business) are used to finance the Company's consumer loan portfolio. Consumer loan financing is targeted to match the repricing and duration characteristics of the loans financed. The Company uses derivative products (primarily interest rate, currency and equity swaps) to... -

Page 45

... equity and long-term debt; repurchase agreements; U.S., Canadian, Euro and Japanese commercial paper; letters of credit; unsecured bond borrows; securities lending; buy/sell agreements; municipal reinvestments; master notes; and committed and uncommitted lines of credit. Repurchase agreement... -

Page 46

... an effort to enhance its ongoing stock repurchase program, the Company may sell put options on shares of its common stock to third parties. These put options entitle the holder to sell shares of the Company's common stock to the Company on certain dates at specified prices. As of November 30, 1999... -

Page 47

... economic conditions. In addition, the market for non-investment grade securities and emerging market loans and securitized instruments has been, and may in the future be, characterized by periods of volatility and illiquidity. The Company has in place credit and other risk policies and procedures... -

Page 48

...'s exposure to market risk relates to changes in interest rates, foreign currency exchange rates, or the fair value of the underlying financial instruments or commodities. The Company's exposure to credit risk at any point in time is represented by the fair value of such contracts reported as assets... -

Page 49

... and remains committed to providing its clients with innovative financial products. The Company established Morgan Stanley Derivative Products Inc. to offer derivative products to clients who will enter into derivative transactions only with triple-A rated counterparties. In addition, the Company... -

Page 50

... risk arising from changes in the level or volatility of interest rates, the timing of mortgage prepayments, the shape of the yield curve and credit spreads for corporate bonds and emerging market debt). The Company is exposed to equity price risk as a result of making markets in equity securities... -

Page 51

...or sale of positions in related securities and financial instruments, including a variety of derivative products (e.g., swaps, options, futures and forwards). The Company manages the market risk associated with its trading activities on a Company-wide basis, on a trading division level worldwide and... -

Page 52

... more than once in 100 trading days. 99%/ONE-DAY VaR AT NOVEMBER 30, 1999 1998(1) PRIMARY MARKET RISK CATEGORY (dollars in millions, pre-tax) Interest rate Equity price Foreign exchange rate Commodity price Subtotal Less diversification benefit(2) Aggregate Value-at-Risk (1) $33 32 3 16 84 33... -

Page 53

...the trading businesses) in its institutional trading business in excess of the 99%/one-day VaR which incorporates the enhancements to the Company's VaR model made during fiscal 1999. PRIMARY MARKET RISK CATEGORY (dollars in millions, pre-tax) HIGH Interest rate Equity price Foreign exchange rate... -

Page 54

... includes certain credit card loans which may be offered at below-market rates for an introductory period, such as for balance transfers and special promotional programs, after which the loans will contractually reprice in accordance with the Company's normal market-based pricing structure. For... -

Page 55

... loan request. With respect to its consumer lending activities, potential credit card holders undergo credit reviews by the Credit Department of Discover Financial Services to establish that they meet standards of ability and willingness to pay. Credit card applications are evaluated using scoring... -

Page 56

..., 1999, in conformity with generally accepted accounting principles. As discussed in Note 2 to the consolidated financial statements, in fiscal 1998, Morgan Stanley Dean Witter & Co. changed its method of accounting for certain offering costs of closed-end funds. New York, New York January 21, 2000 -

Page 57

... debt Corporate equities Derivative contracts Physical commodities Securities purchased under agreements to resell Receivable for securities provided as collateral Securities borrowed Receivables: Consumer loans (net of allowances of $769 at November 30, 1999 and $787 at November 30, 1998) Customers... -

Page 58

... Corporate and other debt Corporate equities Derivative contracts Physical commodities Securities sold under agreements to repurchase Obligation to return securities received as collateral Securities loaned Payables: Customers Brokers, dealers and clearing organizations Interest and dividends... -

Page 59

..., clearing and exchange fees Information processing and communications Marketing and business development Professional services Other Merger-related expenses Total non-interest expenses Gain on sale of businesses Income before income taxes and cumulative effect of accounting change Provision... -

Page 60

... of comprehensive income 99 AR | page 58 fiscal year (dollars in millions) 1999 1998 1997 Net income Other comprehensive income, net of tax: Foreign currency translation adjustment Comprehensive income See Notes to Consolidated Financial Statements. $4,791 (15) $4,776 $3,276 (3) $3,273... -

Page 61

... of long-term borrowings Redemption of cumulative preferred stock Redemption of Capital Units Repurchases of common stock Cash dividends Net cash provided by (used for) financing activities Dean Witter, Discover & Co.'s net cash activity for the month of December 1996 Net (decrease) increase in cash... -

Page 62

... statements of changes in shareholders' equity 99 AR | page 60 EMPLOYEE CUMULATIVE STOCK TRANSLATION TRUST ADJUSTMENTS (dollars in millions) PREFERRED STOCK COMMON STOCK(1) PAID-IN CAPITAL(1) RETAINED EARNINGS NOTE RECEIVABLE RELATED TO SALE OF PREFERRED STOCK TO ESOP COMMON STOCK HELD IN... -

Page 63

... NOTE RECEIVABLE RELATED TO SALE OF PREFERRED STOCK TO ESOP COMMON STOCK HELD IN TREASURY, AT COST COMMON STOCK ISSUED TO EMPLOYEE TRUST TOTAL BALANCE AT NOVEMBER 30, 1998 $674 Net income Dividends Conversion of ESOP Preferred Stock Issuance of common stock Repurchases of common stock... -

Page 64

..., rates and indices; securities lending; and private equity activities. The Company's Asset Management business provides global asset management advice and services to investors through a variety of product lines and brand names, including Morgan Stanley Dean Witter Advisors, Van Kampen Investments... -

Page 65

... are reported at their principal amounts outstanding, less applicable allowances. Interest on consumer loans is credited to income as earned. Interest is accrued on credit card loans until the date of charge-off, which generally occurs at the end of the month during which an account becomes 180 days... -

Page 66

...exchange forward contracts to manage the currency exposure relating to its net monetary investment in non-U.S. dollar functional currency operations. The gain or loss from revaluing these contracts is deferred and reported within cumulative translation adjustments in shareholders' equity, net of tax... -

Page 67

... dilution from common stock equivalents and other dilutive securities based on the average price per share of the Company's com- TRANSLATION OF FOREIGN CURRENCIES Assets and liabilities of operations having non-U.S. dollar functional currencies are translated at year-end rates of exchange, and the... -

Page 68

... would not have been material. NEW ACCOUNTING PRONOUNCEMENTS stock issued to employee trust. Both employee stock trust and common stock issued to employee trust are components of shareholders' equity. The adoption of EITF 97-14 did not result in any change to the Company's consolidated statements... -

Page 69

... The Company uses interest rate exchange agreements to hedge the risk from changes in interest rates on servicing fee revenues (which are derived from loans sold through asset securitizations). Gains and losses from these agreements are recognized as adjustments to servicing fees. The estimated fair... -

Page 70

... of the Company's deposits, including the effect of interest rate exchange agreements, was 5.9%. At November 30, 1999, certificate accounts maturing over the next five years were as follows: (dollars in millions) 2000 2001 2002 2003 2004 maintains a secured committed credit agreement with a group... -

Page 71

... interest based on a variety of money market indices, including London Interbank Offered Rates ("LIBOR") and Federal Funds rates. Non-U.S. dollar contractual floating rate borrowings bear interest based on euro floating rates. MEDIUM-TERM NOTES STRUCTURED BORROWINGS Included in the table above... -

Page 72

... page 70 equity swap contracts and purchased options which effectively convert the borrowing costs into floating rates based upon LIBOR. These instruments are included in the preceding table at their redemption values based on the performance of the underlying indices, baskets of stocks or specific... -

Page 73

.... Such changes may be substantial. Variable rates presented generally are based on LIBOR or Treasury bill rates. The above table does not include interest rate floor agreements that are utilized by the Company to manage interest rate risk. At November 30, 1999, interest rate floor agreements with... -

Page 74

... processing, data networking and related services. Under the terms of the agreement, the Company has an aggregate minimum annual commitment of $120 million subject to annual cost-of-living adjustments. The Company has contracted to develop a one millionsquare-foot office tower in New York City... -

Page 75

...as related derivative products (e.g., options, swaps, futures, forwards and other contracts with respect to such underlying instruments or commodities). Revenues related to principal trading are summarized below by trading division: DILUTED EPS: Income before cumulative effect of accounting change... -

Page 76

... bonds, money market instruments, mediumterm notes and Eurobonds, high-yield securities, emerging market securities, mortgage- and other asset-backed securities, preferred stock and tax-exempt securities. In addition, the Company is a dealer in interest rate and currency swaps and other related... -

Page 77

...limits its market risk by using a variety of hedging strategies, including the buying and selling of the currencies underlying the options based upon the options' delta equivalent. Foreign exchange option contracts give the purchaser of the contract the right to buy (call) or sell (put) the currency... -

Page 78

.... Stress testing, which measures the impact on the value of existing portfolios of specified changes in market factors, for certain products is performed periodically and is reviewed by trading division risk managers, desk risk managers and the Firm Risk Management Department. CREDIT RISK The... -

Page 79

... it to offbalance sheet credit risk. The Company may have to purchase or sell financial instruments at prevailing market prices in the event of the failure of a customer to settle a trade on its original terms or in the event cash and securities in customer margin accounts are not sufficient to... -

Page 80

... 107 91 40 Interest rate and currency swaps and options (including caps, floors and swap options) and other fixed income securities contracts $ 9.5 Foreign exchange forward and futures contracts and options 3.7 Equity security contracts (including equity swaps, futures contracts, and warrants and... -

Page 81

... Interest rate and currency swaps and options (including caps, floors and swap options) and other fixed income securities contracts Foreign exchange forward and futures contracts and options Equity securities contracts (including equity swaps, futures contracts, and warrants and options) Commodity... -

Page 82

... Interest rate and currency swaps and options (including caps, floors and swap options) and other fixed income securities contracts Foreign exchange forward contracts and options Equity securities contracts (including equity swaps, warrants and options) Commodity forwards, options and swaps Mortgage... -

Page 83

... common shares of the Company (see Note 12). 11 SHAREHOLDERS' EQUITY MS&Co. and DWR are registered broker-dealers and registered futures commission merchants and, accordingly, are subject to the minimum net capital requirements of the Securities and Exchange Commission, the New York Stock Exchange... -

Page 84

... an effort to enhance its ongoing stock repurchase program, the Company may sell put options on shares of its common stock to third parties. These put options entitle the holder to sell shares of the Company's common stock to the Company on certain dates at specified prices. As of November 30, 1999... -

Page 85

... Holders of vested Restricted Stock generally will forfeit ownership in certain limited situations, including termination for cause during the restriction period. Employee Stock Purchase Plan Under the Employee Stock Purchase Plan, eligible employees may purchase shares of the Company's common stock... -

Page 86

... is held by the ESOP trust, is convertible into 6.6 shares of the Company's common stock and is entitled to annual dividends of $2.78 per preferred share. The ESOP trust funded its stock purchase through a loan of $140 million from the Company. The ESOP trust note, due September 19, 2005 (extendible... -

Page 87

... 1997 Risk-free interest rate Expected option life in years Expected stock price volatility Expected dividend yield 5.9% 5.6 38.6% 1.1% 4.9% 4.8 33.2% 1.3% 6.0% 6.0 28.0% 1.3% 13 EMPLOYEE BENEFIT PLANS The Company sponsors various pension plans for the majority of its worldwide employees. The... -

Page 88

... 86 The following table provides a reconciliation of the changes in the U.S. Plans' benefit obligation and fair value of plan assets for fiscal 1999 and fiscal 1998, as well as a summary of the U.S. Plans' funded status at November 30, 1999 and 1998: (dollars in millions) FISCAL 1999 FISCAL 1998... -

Page 89

..., rates and indices; securities lending; and private equity activities. The Company's Asset Management business provides global asset management advice and services to investors through a variety of product lines and brand names, including Morgan Stanley Dean Witter Advisors, Van Kampen Investments... -

Page 90

... 1998 (dollars in millions) SECURITIES ASSET MANAGEMENT CREDIT SERVICES TOTAL All other revenues Net interest Net revenues Gain on sale of businesses Income before taxes and cumulative effect of accounting change Provision for income taxes Cumulative effect of accounting change Net income... -

Page 91

... investors proprietary mutual funds and other financial products. This acquisition reflects the Company's strategic initiative to build international Securities and Asset Management businesses to serve the needs of individual investors. The Company's fiscal 1999 results include the operations of AB... -

Page 92

...Summation of the quarters' earnings per common share may not equal the annual amounts due to the averaging effect of the number of shares and share equivalents throughout the year. (4) Closing prices represent the range of sales per share on the New York Stock Exchange for the periods indicated. The... -

Page 93

...S. PANDIT Dean, Walter A. Haas School of Business University of California at Berkeley Institutional Equities JOSEPH R. PERELLA Investment Banking JOHN H. SCHAEFER Chief Strategic & Administrative Officer ROBERT G. SCOTT Chief Financial Ofï¬cer SIR DAVID A. WALKER Morgan Stanley International... -

Page 94

international locations 99 AR | page 92 WORLDWIDE HEADQUARTERS - NEW YORK HONG KONG 1585 Broadway New York, NY 10036 Telephone: (212) 761-4000 Fax: (212) 761-0086 AMSTERDAM 30th Floor, Three Exchange Square Central, Hong Kong Telephone: (852) 2848-5200 Fax: (852) 2845-1012 JOHANNESBURG ... -

Page 95

... Place, 181 Bay Street Suite 3700, P.O. Box 776 Toronto, Ontario, Canada M5J 2T3 Telephone: (416) 943-8400 Fax: (416) 943-8444 ZURICH Suite 700B, 7th Floor, West Wing Shanghai Center 1376 Nanjing Xi Lu Shanghai 200040, People's Republic of China Telephone: (86 21) 6279-7150 Fax: (86 21) 6279-7157... -

Page 96

... with address changes, lost stock certificates and share ownership, contact: Morgan Stanley Dean Witter Trust FSB Harborside Financial Center, Plaza Two Jersey City, NJ 07311-3977 800-622-2393 Private Client Group Branch Office Locator MSDW Online AAA Client Services MSDW Client Services Asset... -

Page 97

MORGAN STANLEY DEAN WITTER 1585 Broadway, New York, NY 10036 www.msdw.com