Mercury Insurance 2015 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2015 Mercury Insurance annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LETTER TO SHAREHOLDERS

However, our Homeowners combined ratio deteriorated to 99.0%

in 2015 from 95.6% in 2014, primarily the result of our California

Homeowners business. Our California Homeowners combined

ratio was 102.0% in 2015 compared to 99.4% in 2014. Adverse

development, Catastrophe losses and an increase in severity

negatively impacted our results in 2015. In addition to seeking a

rate increase, we plan on implementing new claims procedures

to improve our profitability in our California Homeowners line.

Historically, our Commercial lines have been a profitable line

of business for Mercury. In 2015 we grew our Commercial

Automobile line 13% to $154.5 million, but our combined ratio

deteriorated to 105% from 93% in 2014. The deterioration in the

combined ratio was primarily due to our Florida business as we

experienced an increase in severity and recorded $5.9 million of

adverse development. In 2015 our California Commercial Property

line posted a 12.6% increase in premiums written to $65.9 million

with a 93.9% combined ratio. We expect the profitability of our

Commercial lines to improve in 2016 as we implement necessary

rate changes. We plan on continuing to focus on growing our

Homeowners and Commercial lines of business as long as we

believe we can do so in a prudent manner.

Companywide net premiums written grew 5.6% to $3.0 billion in

2015. California continued to experience positive premium growth

as rate increases more than offset lower policy sales. In California,

we posted net premiums written growth of 5.4% in 2015. Outside

of California and excluding our Mechanical Breakdown product,

net premiums written increased 5.5% in 2015. For 2016, we

expect to grow our business in the low single digit range as our

primary focus will be improving our profitability.

We have taken several steps the past few years to improve our

cost structure outside of California. In 2013, we implemented the

consolidation of our claims and underwriting operations located

outside of California into hub locations in Florida, New Jersey

and Texas. In addition, other expense reduction measures were

taken, including a new commission structure. Although these

changes have positively impacted our cost structure and scale

outside of California, there is more work to do. Simply put, our

loss adjustment expense (LAE) and expense ratios are too high.

Accordingly, we expect to implement further changes in 2016

to drive down our LAE and expense ratios outside of California

to acceptable levels.

In 2015, we launched our first-ever national advertising campaign

and nearly doubled our advertising spend to $44 million from

$23 million in 2014. We continue to learn from our advertising

efforts and in 2015 we nearly reached our targeted cost per sale.

In 2016, our plan is to spend $42 million in advertising and reach

our overall targeted cost per sale. Although we cannot compete

with the much larger advertising budgets of some of our larger

competitors, we will continue to advertise if the economics work

for us. In addition, as a result of our increased advertising efforts,

our brand awareness increased significantly in 2015 as measured

by an independent media organization.

Last year we were hit with an unanticipated $27.6 million fine

by the California Insurance Commissioner. The fine was based

on a 2004 Notice of Non-Compliance matter and is related to

the Krumme v. Mercury lawsuit that was decided in 2003. It is

our strong belief that this decision is contrary to California’s rate

laws, due process, and basic notions of fairness. Accordingly,

we filed a Writ of Administrative Mandamus and Complaint for

Declaratory Relief in Superior Court seeking, among other things,

to require the California Insurance Commissioner to vacate the

Order and refund the penalty, with interest. A hearing on this

matter is scheduled for June 2016.

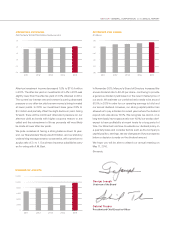

NET PREMIUMS WRITTEN

(in millions of dollars)

3,500

3,000

2,000

1,500

1,000

0

2014 20151996 1997 1998 1999 2000 2001 2002 2003

2,500

500

2004 2005 2006 2007 2008 2009 2010 2011 2012 2013