Mercury Insurance 2015 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2015 Mercury Insurance annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3

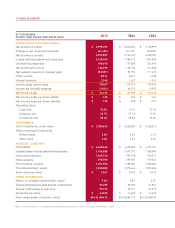

Mercury General conducts its business through the following subsidiaries:

Insurance Companies

Formed or

Acquired

A.M. Best

Rating Primary States

Mercury Casualty Company ("MCC")(1) 1961 A+ CA, AZ, NV, NY, VA

Mercury Insurance Company ("MIC")(1) 1972 A+ CA

California Automobile Insurance Company ("CAIC")(1) 1975 A+ CA

California General Underwriters Insurance Company,

Inc. ("CGU")(1) 1985 Non-rated CA

Mercury Insurance Company of Illinois 1989 A+ IL, PA

Mercury Insurance Company of Georgia 1989 A+ GA

Mercury Indemnity Company of Georgia 1991 A+ GA

Mercury National Insurance Company 1991 A+ IL, MI

American Mercury Insurance Company 1996 A- OK, GA, TX, VA

American Mercury Lloyds Insurance Company ("AML") 1996 A- TX

Mercury County Mutual Insurance Company 2000 A- TX

Mercury Insurance Company of Florida 2001 A+ FL, PA

Mercury Indemnity Company of America 2001 A+ FL, NJ

Workmen’s Auto Insurance Company ("WAIC")(2) 2015 Non-rated CA

Non-Insurance Companies

Formed or

Acquired Purpose

Mercury Select Management Company, Inc. 1997 AML’s attorney-in-fact

Mercury Insurance Services LLC 2000 Management services to subsidiaries

AIS Management LLC 2009 Parent company of AIS and PoliSeek

Auto Insurance Specialists LLC ("AIS") 2009 Insurance agent

PoliSeek AIS Insurance Solutions, Inc. ("PoliSeek") 2009 Insurance agent

Animas Funding LLC ("AFL") 2013 Special purpose investment vehicle

Fannette Funding LLC ("FFL") 2014 Special purpose investment vehicle

_____________

(1) The term "California Companies" refers to MCC, MIC, CAIC, and CGU.

(2) WAIC was acquired on January 2, 2015. For more detailed information, see Note 20. Acquisition, of the Notes to

Consolidated Financial Statements in "Item 8. Financial Statements and Supplementary Data."

Production and Servicing of Business

The Company sells its policies through approximately 9,700 independent agents, its 100% owned insurance agents, AIS

and Poliseek, and directly through internet sales portals. All of the independent agents collectively accounted for more than 87%

of the Company's direct premiums written in 2015, and no independent agent accounted for more than 1% of the Company’s direct

premiums written during the last three years. Approximately 1,900 of the independent agents are located in California and

approximately 1,500 are located in Florida. The independent agents are independent contractors selected and contracted by the

Company and generally also represent competing insurance companies. AIS and Poliseek represented the Company as independent

agents prior to their acquisition in 2009, and continue to act as independent agents selling policies for a number of other insurance

companies. Policies sold directly through the internet sales portals are assigned to and serviced by the Company's agents.

The Company believes that it compensates its agents above the industry average. Net commissions incurred in 2015 were

approximately 16% of net premiums written.

The Company’s advertising budget is allocated among television, radio, newspaper, internet, and direct mailing media with

the intent to provide the best coverage available within targeted media markets. While the majority of these advertising costs are

borne by the Company, a portion of these costs are reimbursed by the Company’s independent agents based upon the number of

account leads generated by the advertising. The Company believes that its advertising program is important to generate leads,

create brand awareness, and remain competitive in the current insurance climate. In 2015, the Company launched a national