Kenwood 2003 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2003 Kenwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Net sales 225.6 billion yen 185 billion yen

Annual 12.2% rises in the fiscal year ending March 2004 onward

233 billion yen

Operating income 12.3 billion yen 15.5 billion yen

Double that of fiscal year ended March 2003

24 billion yen

Operating income margin 5.4% 8.4%

Double that of fiscal year ended March 2003

10.3%

Inventories 32.2 billion yen 23 billion yen

Half that of fiscal year ended March 2003

17.5 billion yen

Net interest-bearing debt 50.1 billion yen 30 billion yen Zero net-debt 0 billion yen

Interest-bearing debt 80.9 billion yen 68 billion yen 33 billion yen

ROE (Note) − (Note) − 20% 20% or more

Shareholders' equity 13.7 billion yen 24 billion yen 58 billion yen

'Excellent Kenwood Plan'

Consolidated

performance

Results in

the fiscal year

ended March 2003

Targets for

the fiscal year

ending March 2004

Targets for

the fiscal year

ending March 2006

Targets

(Note) ROE

ROE is excluded because the resultant percentage becomes an extremely large figure due to a large sum of loss carryforwards. If loss carryforwards are subtracted

from net shareholders' equity, ROE would be 7.4% in the fiscal year ended March 2003, when net income was 4.2 billion yen.

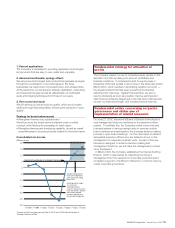

Plan for initial year (the fiscal year ending March 2004)

• Net sales

Net sales are expected to decline in the first year after the

corporate rebuilding.

• Operating income

Operating income is predicted to rise sharply as a result of

restructuring of the home electronics business. This,

coupled with the withdrawal from the cellular phone business

and liquidation of unprofitable operations, will likely increase

operating income by a steep 26% over the previous fiscal

year.

• Inventories

In the initial year of the Production Revolution campaign, the

Company aims to reduce inventories by one-third of the

previous fiscal year's levels.

• Interest-bearing debt (Net interest-bearing debt =

Interest-bearing debt – Cash and cash equivalents)

The Company had completely redeemed its corporate bonds

worth 5 billion yen in April, and agreed on a repayment

schedule with the lenders.

Targets for final year (the fiscal year ending March 2006)

• Net sales

The Company aims to increase net sales by annual 12.2%

for the fiscal year ending March 2004 onward.

• Operating income

The Company is hoping that operating income will be double

that of fiscal year ended March 2003. For this purpose, it will

make the home electronics business profitable as well as

maintain or enhance the high profitability of the car

electronics and communications businesses, by reinvesting

in product development and these businesses.

• Inventories

The Company will halve its inventories from the level of fiscal

year ended March 2003, through Production Revolution

efforts.

• Net interest-bearing debt

The Company, which requires credit for approximately 20

billion yen of its operating funds, intends to achieve a zero

net-debt management, by keeping debts below the level of

cash and cash equivalents.

• ROE

Assuming loss carryforwards are eliminated by the end of the

plan's final year, the Company will achieve an ROE of 20% —

the threshold for becoming a company of global excellence in

our core business domains backed by sufficient

shareholders' equity.

• Resumption of dividends

In anticipation of the disposal of loss carryforwards by the

end of the plan's final year, the Company hopes to resume

dividend payments.

06 KENWOOD Corporation Annual Report 2003