Kenwood 2003 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2003 Kenwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

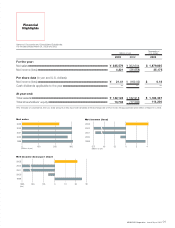

Total assets

Shareholders' equity

Equity ratio

142.1 billion yen

13.7 billion yen

9.6%

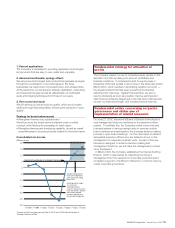

• The home electronics business effectively moved into the black,

despite a temporary loss attributable to restructuring overseas,

as the overall effects of restructuring began contributing to its

earnings in the latter half of the fiscal year under review.

• The car electronics business earned a large income, supported

by strong demand in the Americas and Europe.

• The wireless radio business registered steady earnings results

again just as for the preceding year.

• Some other businesses sustained losses. One is the cellular

phone business, whose production was phased out at the end

of October 2002. We think the loss from these businesses was

a one time phenomenon for the fiscal year ended March 2003.

Non-consolidated results

In the fiscal year ended March 2003, non-consolidated net sales

followed almost the same path as consolidated net sales. While

domestic sales fell due to Japan's stagnant economy and

withdrawal from the production of cell phone terminals, sales

overseas declined below the previous year's levels, due mainly to

the withdrawal from the home electronics business in Asia. As a

result, non-consolidated net sales at home and abroad dropped

by 65.2 billion yen, year on year, to 157.8 billion yen.

On the other hand, the Company improved operating balance

by a remarkable 5.7 billion yen from the previous fiscal year,

posting a net income of 5.3 billion yen, thanks to: strong demand

overseas for car electronics/wireless radio equipment, the effects

of restructuring of the home electronics business, and company-

wide reduction in fixed costs.

Ordinary balance improved by 6 billion yen, year on year, to

register an income of 4.7 billion yen, a turnaround from the loss in

the previous fiscal year, after non-operating loss, such as interest

expense, was deducted from operating income.

Although the Company booked evaluation loss on its

investment securities, it posted an extraordinary income related to

the return of provisions for losses on investments in sales units

overseas, whose earnings picked up. As a result, net balance

achieved a "V-shaped" recovery, with an income of 4.2 billion

yen, an improvement of 32.8 billion yen from a year earlier,

significantly exceeding the Company's earlier forecast.

Assets, liabilities, and shareholders' equity at the end of

fiscal year ended March 2003

At the end of March 2003, total assets of the Kenwood Group

decreased 40.8 billion yen from the previous fiscal year. Cash

and deposits increased by 6.5 billion yen. Meanwhile, trade notes

and accounts receivable were 23 billion yen lower and inventories

dropped by 11 billion yen, while tangible fixed assets were down

by 5.3 billion yen, due to restructuring of the home electronics

business and reduction in inventories at sales firms. Intangible

fixed assets were also 2.9 billion yen down, affected by the

withdrawal from the cellular phone business.

Total liabilities decreased by 71.4 billion yen. Trade notes and

accounts payable were 27.2 billion yen less, due to the overhaul

of the business structure and the fact that the final day of the

previous fiscal year fell on a Sunday. Short-term and long-term

debts reduced by 20.1 billion yen and 9.2 billion yen, respectively,

as a result of a debt-for-equity swap worth 25 billion yen.

Provision for losses on business restructuring worth 10 billion yen

was removed, in the wake of the completion of this restructuring.

Of the total proceeds from a debt-for-equity swap and third-

party allotment of shares, 13.5 billion yen was credited each to

common stock and additional paid-in capital. Retained earnings

increased by 4.3 billion yen, reflecting a net income of 4.2 billion

yen and others. As a result, retained earnings were in the red by

34.2 billion, compared with the negative 38.6 billion yen at the

end of the previous fiscal year, thus the undisposed losses

decreased.

Consequently, total shareholders' equity increased 30.7 billion

yen, while negative net worth totaling 17 billion yen was erased.

Consolidated Financial Position

11

KENWOOD Corporation Annual Report 2003