Kenwood 2003 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2003 Kenwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

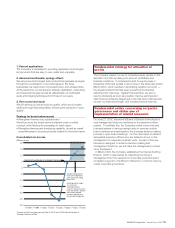

FY1998

-30

-25

-20

20

-15

15

-10

10

-5

5

0

FY1999 FY2000 FY2001 FY2002 FY2003 FY2004 FY2006

*Figures for the fiscal years ending March 2004 and 2006 indicate targets of

'Excellent Kenwood Plan'.

(Billions of yen)

Net income achieves a "V-shaped" recovery

'Excellent Kenwood Plan'

Fiscal year ending March

2004 to fiscal year ending

March 2006

Operating income margin:

10%; ROE: 20%

Toward becoming a

company of global excellence

in our core business domains

that resumes dividend

payments and achieves a

zero net-debt management

1. Desired applications

The Company is dedicated to providing application technologies

and products that are easy to use, useful and enjoyable.

2. Advanced multimedia; synergy effects

We will pursue technologies and products that generate synergies

through the combination of core techniques in the three

businesses: car electronics, home electronics, and wireless radio.

At the same time, we will develop strategic digitization, networking

and visual technologies as well as differentiate our multimedia

audio and imaging techniques from those of our peers.

3. Pure sound and visual

We will develop sound and picture quality, which would create

exciting through Surprising Ideas, following the principle of "pure

quality".

Strategy for brand enhancement

• Strengthen Kenwood as a global brand

We will promote the brand name worldwide under a unified

concept, while tailoring the campaign to each region.

• Strengthen planning and developing capability, as well as overall

competitiveness to propose products suitable for the brand name.

Consolidated net income

The Company makes it a rule to comprehensively decide on the

allocation of profits by taking into account profitability and

financial conditions. It completed a debt-for-equity swap in

December 2002 and posted a net income in the fiscal year ended

March 2003, which resulted in eliminating negative net worth —

the largest problem that had been preventing the financial

standing from improving. Against this backdrop, we aim to

resume dividends as soon as possible, improve earnings and

cash flows by achieving targets set in the mid-term business plan,

recover our financial strength, and increase internal reserves.

On June 27, 2002, Kenwood's Board of Directors introduced a

new management structure centering on the executive officer

system. To facilitate this, the Company invited community and

business leaders of varying backgrounds to serve as outside

board members and participate in the business decision-making

process in open board meetings. On the other hand, the Board

designated executive officers who are tasked to focus on the

management of respective business units. As part of this new

framework designed to enhance decision-making and

management functions, we will make the management process

more transparent.

In March 2003, the Company established the Internal Auditing

Division, which is responsible for inspecting the Group's

management from the viewpoint of corporate governance and

compliance reports to the Board of Directors, in a bid to improve

overall corporate governance.

Fundamental strategy for allocation of

profits

Fundamental notion concerning corporate

governance and status quo of

implementation of related measures

09

KENWOOD Corporation Annual Report 2003